Table of Contents

ToggleFor many Amercians, the dream of real estate investment often collides with the harsh realities of high upfront costs, the need for substantial renovation budgets, and the challenge of securing financing with less-than-perfect credit. Traditional investment strategies can be daunting, particularly for new investors.

However, what if there was a strategy that could generate an impressive cash flow from that investment? That is where the BRRRR method comes in – it is a practical approach to amassing wealth using real estate. But let’s dive deeper into how the BRRRR approach can be even more effective and how DSCR loans can help make it more accessible for those wanting to invest in real estate.

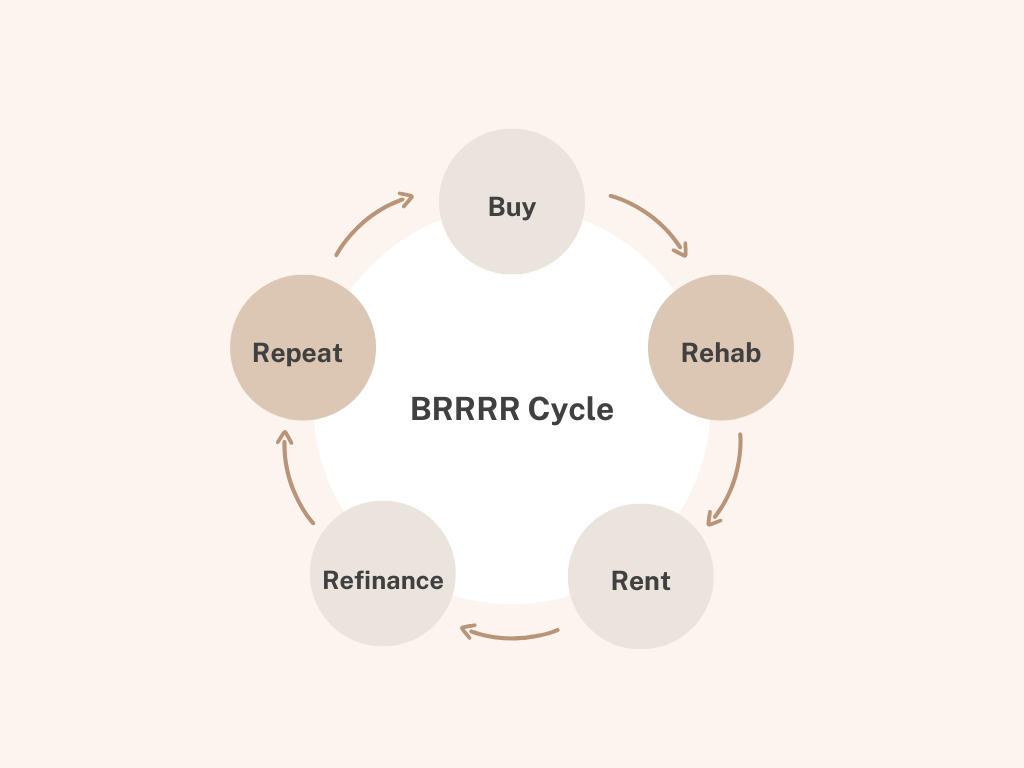

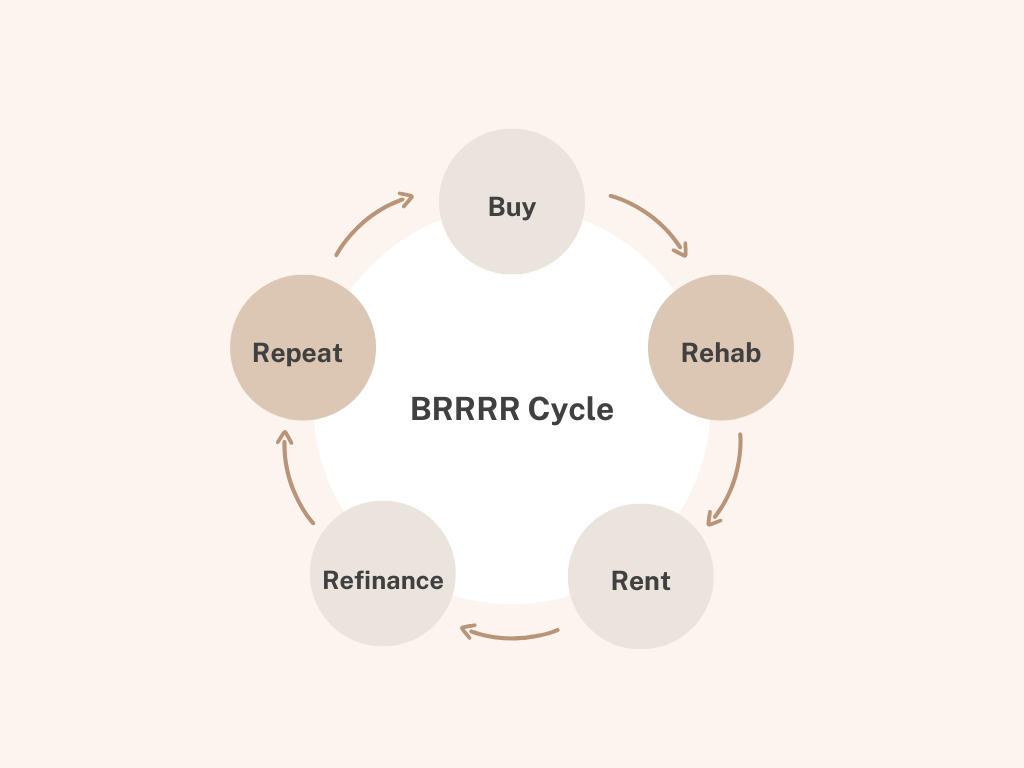

The BRRRR Cycle: Building Wealth Through Renovation

The BRRRR method is a cyclical strategy that enables an individual to amass wealth over time by using the investment property to create passive income. The following are the four stages and what they entail;

Buy: Find properties that retain their value in the market but are not priced well. Take time and look for those places that are in the up-and-coming areas and, hence, need a fixer-upper.

Rehab: Renovate the property to make it appealing to clients and potential renters, as well as update outdated features. The objective should be adaptations that raise or sustain the property’s rental value and select the best candidate tenants.

Rent: Find good tenants who are willing to make premium payments on the newly improved property. This produces a continual stream of rental revenues that sustain the approach.

Refinance: After the property gets appraised to show a higher value because of the upgrades and consistent rental income, then one should consider refinancing the mortgage. This releases the equity that you have created thus allowing you to access more capital for your next investment.

Repeat: Rinse and repeat! Invest in another property using the funds obtained from the refinance, and begin the BRRRR cycle again by growing your portfolio and raising your overall income.

The Power of DSCR Loans in the BRRRR Strategy

Conventional loans at mortgage firms mostly depend on your personal income when approving loan requests. This can be a problem for start-up investors who have low personal cash flow or multinational creditworthiness. Nevertheless, there is something known as DSCR loans, which stands out as a game changer.

Focus on Property, Not You: DSCR loans are all about the property and its ability to produce income. The lender evaluates such factors as the likelihood of the property generating enough cash to pay debt interest, known as the Debt Service Coverage Ratio (DSCR). This ratio is defined as the relationship between the property’s net operating income (NOI) and the total amount of debt service. A high DSCR tells us that the property can meet or service its debt and still make a profit.

Unlock Financing with Lower Credit Scores: Dependence on good credit is still desired, but, DSCR loans are usually less rigid compared to mortgage loans concerning credit score. This creates opportunities for persons who have damaged credit scores to engage in investment.

Lower Monthly Payments & Improved Cash Flow: DSCR loans usually come with longer terms that would mean lower payments per month are made. This allows for loan repayments to be made while focusing on upgrades and other property-related expenditures and, in turn, future acquisitions.

Example Of Using A DSCR Loan In The BRRRR Strategy

Let’s illustrate how a DSCR loan can be utilized in the BRRRR strategy with hypothetical numbers to showcase the financial benefits.

Scenario:

-

- Property Purchase Price: $200,000

-

- Rehabilitation Costs: $50,000

-

- Total Initial Investment: $250,000

-

- After-Repair Value (ARV): $350,000

-

- Monthly Rental Income Post-Rehab: $3,500

Step 1: Buy

-

- You purchase a distressed property for $200,000. You plan to invest $50,000 in renovations, making the total initial investment $250,000.

Step 2: Rehab

-

- You renovate the property, spending $50,000. The property’s market value increases to $350,000 post-renovation.

Step 3: Rent

-

- After completing the renovations, you find tenants who rent the property for $3,500 per month.

Step 4: Refinance Using a DSCR Loan

-

- Gross Rental Income: Monthly rental income of $3,500 x 12 months = $42,000 annually.

-

- Debt Service Coverage Ratio (DSCR): Most lenders require a DSCR of at least 1.25. Assuming this ratio:

-

- Maximum Annual Debt Service: $42,000 / 1.25 = $33,600

-

- Monthly Debt Service: $33,600 / 12 = $2,800

-

- Debt Service Coverage Ratio (DSCR): Most lenders require a DSCR of at least 1.25. Assuming this ratio:

-

- Loan Amount Calculation:

-

- Assuming an interest rate of 8% on the DSCR loan with a 30-year term, the monthly principal and interest payment for a $400,000 loan would be approximately $2,935.

-

- Loan Amount Calculation:

-

- Equity Release:

-

- With the property now valued at $350,000 and assuming an 80% loan-to-value (LTV) ratio for refinancing, the maximum loan amount you could secure is $280,000 (80% of $350,000).

-

- You owe $250,000 on the initial investment (purchase and rehab costs).

-

- Refinancing at $280,000, you pay off the initial $250,000, leaving you with $30,000 in cash-out equity.

-

- Equity Release:

Step 5: Repeat

-

- Use the $30,000 cash-out equity to invest in your next property, repeating the BRRRR cycle.

Financial Benefits:

-

- Increased Equity: The renovation increased the property value from $200,000 to $350,000.

-

- Cash Flow: Monthly rental income of $3,500, covering the monthly debt service of $2,800, leaving you with a positive cash flow.

-

- Recycling Capital: The $30,000 cash-out refinance allows you to invest in another property without needing additional capital.

By using a DSCR loan, you leverage the property’s income potential to secure financing, allowing you to grow your real estate portfolio systematically and efficiently. This approach demonstrates the power of combining DSCR loans with the BRRRR strategy to maximize investment returns and scale your real estate business.

BRRRR With DSCR Loans: A Winning Combination

Let’s see how DSCR loans can enhance each stage of the BRRRR strategy:

Accessible Financing: DSCR loans help the BRRRR strategy to be more accessible to several investors.

Focus on Property Potential: Buy houses in areas that generate high rental income and less inbound personal income.

Build Wealth Through Equity: Every time the refinance is completed, there is new equity available to be used for other investments.

Passive Income Stream: Achieve healthy rental returns throughout your property investment portfolio.

Considerations Before You BRRRR

This goes a long way in explaining why BRRRR with DSCR loans is such a compelling strategy for achieving financial freedom, but it’s only possible with meticulous planning. Here are some factors to consider:

Market Analysis: Recommended that you seek more information concerning the local real estate market and find out which property is cheap but has high rental prospects.

Renovation Expertise: Plan your renovation clearly and have a realistic budget. It may be recommended to do business with established contractors to avoid getting a low-quality service or paying more than you have to.

Tenancy Management: Selecting good tenants and continuously managing the property is crucial to ensure that the landlord has a steady flow of income.

Conclusion: BRRRR Is Your Way to Success

The BRRRR approach, which makes use of DSCR loans, provides a practical means of building wealth through the purchase of real estate. Looking at underrated locations, thoughtful repairs, and refinancing with DSCR loans that take into consideration the potential of the building, the circle of constantly growing passive income and a successful real estate business can be launched. Just always ensure before you start your BRRRR strategy you have done your research and your financial part correctly enough and also stay committed to making the right decisions when it comes to investment.

The BRRRR strategy with DSCR loans can be a powerful tool to build wealth and create passive income through real estate. However, it’s important to do your research and plan carefully.

Munshi Capital can help you handle the BRRRR process. Our team of experts can answer your questions about DSCR loans, property analysis, and renovation. We can also connect you with qualified real estate agents and contractors.

Don’t wait! Contact Munshi Capital today for a free consultation and learn how the BRRRR strategy can help you achieve your financial goals. Visit our website or call us to speak with a DSCR loan specialist. We’ll help you get started on the path to building a successful real estate portfolio!