Table of Contents

ToggleJumbo loans are given to borrowers who want to purchase property that has high property value, and having high value comes with complex legal and tax procedures that a borrower must understand. If you have a jumbo loan or are planning to apply, it is important to understand what tax and legal aspects you need to focus on and what your rights as a borrower are. Let’s understand the various angles in this blog.

What are the Legal Implications of Jumbo Loans?

Jumbo Loans have various legal implications as they exceed the limit set by FHA and are not eligible to be purchased by Fannie Mae or Freddie Mac. Listed below are a few important legal implications that the borrower should consider:

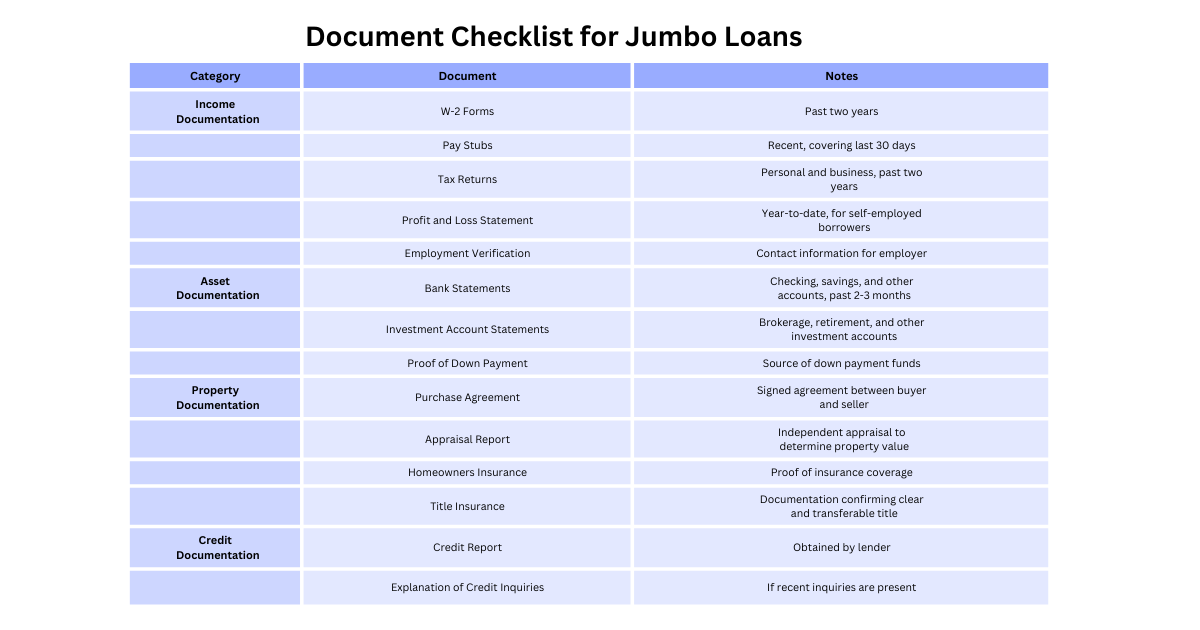

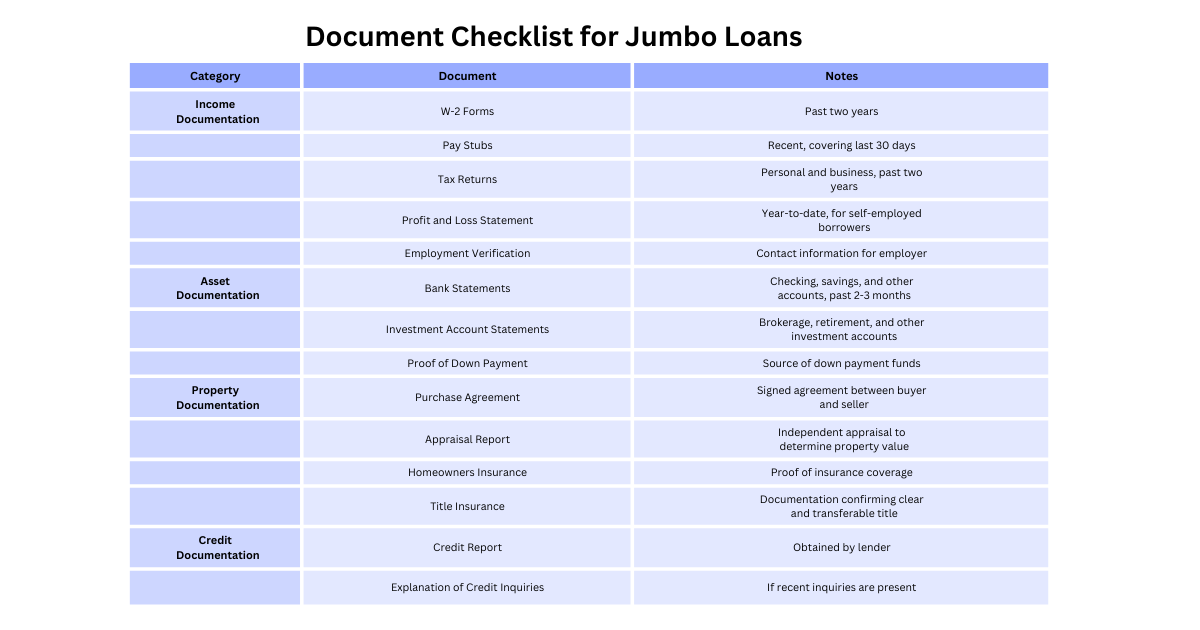

- The documentation process for jumbo loans is very extensive due to the high number of loans, and lenders require legal fact-checks on every aspect related to income, assets owned, previous loans, and more. In the table below in the document checklist, borrowers can look for the following:

Note: This is a general document checklist, the requirements may vary as per the lender.

- The jumbo loans, as mentioned, are not under legal rules set by Fannie Mae or Freddie Mac, resulting in stringent legal implications set by the lenders such as higher credit scores, lower debt-to-income ratio, 20%-30% down payments, higher interest rates, etc. But despite these stringent requirements, borrowers have the added advantage of financial scrutiny and flexible underwriting standards, which means that borrowers who have a large value of assets but lack a regular source of income can have tailored jumbo loans.

- Jumbo loans fall under TILA (Truth in Lending Act) and RESPA (Real Estate Settlement Procedures Act), which means borrowers are entitled to have clear legal disclosures from lenders in terms of cost, loan terms, loan process, etc., to ensure safety.

- Due to state-specific rules and loan agreements, the foreclosure procedures for jumbo loans differ, which adds to their complexity. To manage rights and evaluate alternatives such as loan modifications or refinancing, borrowers need to be aware of their respective state’s foreclosure laws.

In the chart below are the legal rights that jumbo borrowers can have:

What are the Tax Implications of Jumbo Real Estate Loans?

- The mortgage interest deduction has tax implications for both jumbo and non-jumbo loans. Considering both pre-2018 and post-TCJA ( Tax Cuts and Jobs Act ) 2017, if your jumbo loan amount exceeds the limits given in the chart below, then you can deduct interest only on the first $750,000 value of your loan. That means if your jumbo loan amount is for the $1 million, you are eligible to write off interest on the first $750,000 of the $1 million loan, as for federal income tax purposes, the interest paid on the remaining $250,000 would not be deductible.

- When it comes to property tax, TCJA has put a cap on property tax; earlier, there was no limit on federal tax returns. Now, you can deduct up to $10,000 and $5,000 if you are married and filing returns separately.

For example, you pay $7,000 in state income taxes and $12,000 in property taxes for your house, which is $19,000. Even though your actual taxes may be higher, you are only allowed to deduct a maximum of $10,000 from your federal taxes.

Conclusion

Jumbo loans give access to people who want to apply for high-value properties and consolidate their existing debts into one single loan which may have better loan terms. Along with these advantages, the loan comes with complex legal and tax considerations that require borrowers to have efficient financial planning which can be a daunting process. Don’t worry now you can get expert advice on navigating the intricacies of tax and legal aspects of jumbo loans so you gain maximum long-term benefits on your investment. Contact us Today !!

Read More: Building a Strong Credit Profile to Qualify for a Jumbo Loan: A Step-by-Step Guide

FAQs

1. What are the qualification criteria for loans by jumbo mortgage lenders?

To qualify for jumbo loans, lenders usually require a credit score of 700 or above, a low debt-to-income ratio, and up to 20%-30% down payment; the requirements differ based on the lender.

2. What kind of tax benefits are given to jumbo loan borrowers?

As per the Tax Cuts and Jobs Act of 2017, if the mortgage process was done after 15th Dec 2017, then the mortgage interest can be deducted from the initial $750,000 portion of the loan.

3. What is the limit for jumbo mortgages in California?

The general limit for jumbo mortgages in California differs based on the area you want to buy a home. According to Bank of America currently, the limit is $766,550.

4. Does property tax have implications on jumbo loan mortgages?

Yes, borrowers with jumbo loans usually pay high taxes because of the high property value