Table of Contents

ToggleIntroduction

A hard money loan with a low credit score is a viable alternative for many real estate investors who want to improve their long-term investments’ profitability. In this blog, we will explore practical tactics to help low credit borrowers increase their chances of loan acceptance through understanding key factors, step-by-step loan application process, legal consideration, and more.

Understanding Hard Money Loans and Why Consider It?

Hard money loans are for real estate investors who require fast access to funds or who might not be eligible for conventional bank loans because of their credit history or the state of their properties. The key features include short-term and quick funding, asset-based loans, and flexible terms, which make them distinguishable from conventional loans.

Why Consider Hard Money When Having a Low Credit Score?

- Hard money loans are asset-backed loans, so the focus is on property value rather than the credit score, which reduces the need for a good credit score. The minimum credit score required is 600, whereas, for conventional loans, the minimum score is between 620-640 and can go above 740.

- Such loans require minimal documentation, which helps speed up the loan approval process compared to traditional loans.

- Borrowers with low credit scores can take up hard money loans as a short-term financing solution to refinance into conventional loans, resulting in an overall improved credit score.

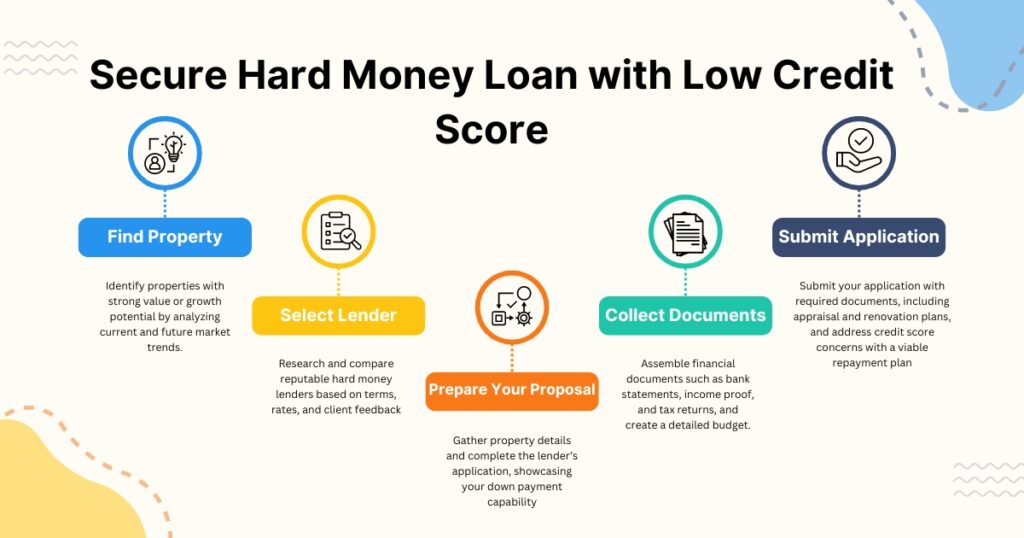

Step-By-Step Guide to Secure a Hard Money with a Low Credit Score

STEP 1: Evaluate your financial situation and focus on presenting a good credit score that reflects your capacity to handle down payments and other fees involved.

STEP 2: Look for local hard money lenders with experience in providing low-credit-score customers with hard money loans; additionally, make sure that your income and future financial prospects meet the requirements of the lenders.

STEP 3: Provide detailed information about your financial statements, savings, proof of income, and exit strategy to have an easy approval process.

STEP 4: Showcase your investment plan, valid reasons for low credit score, emphasize on the property’s value, and share similar real estate investment experiences to assure the lender that it is a secure investment.

STEP 5: Negotiate the interest rate, repayment terms, and other fees involved, and once approved, close the deal.

Expert Tips To Secure A Hard Money With A Low Credit Score

- Emphasis on Future Return on Investment: Provide financial projections through ROI and an extensive cash flow analysis to showcase the profitability of the investment.

- Focus on cross-collateralization: To secure a hard money loan for a bad credit score, you can submit your asset portfolio to a lender, which consists of bonds, stocks, and personal property.

- Build Strong Credit Score: The borrower can improve their credit score by reducing existing debts, resolving errors in their credit report, ensuring timely payments to build a positive credit history, and strengthening the credit utilization ratio.

Legal and Regulatory Considerations for Low Credit Borrowers with Hard Money Loans

Securing hard money loans involves certain regulatory aspects that are essential to consider, especially for low-credit borrowers:

- Borrowers should look for lenders with a license and expertise in hard money loans to ensure a safe and smooth loan process. The license status can be checked through your state regulatory body.

- The lender should always have a transparent disclosure process as per the Truth in Lending Act (TILA), disclosing annual percentages, repayment terms, and other fees/costs involved.

- The lender should provide an assessment of the property’s fair market value that adheres to the Uniform Standards of Professional Appraisal Practice (USPAP).

Conclusion

Securing a hard money loan with a low credit score looks difficult, but with the right approach and guidance, it is achievable for interested borrowers. They must emphasize building good relationships with potential lenders along with presenting a strong investment portfolio to enhance your credibility.

Also, hard money lending focuses on the quality of the collateral provided rather than on the credit score, which plays a key role in kickstarting the application of borrowers with low credit scores.

The loan application process can be complex, including finding the right lenders, negotiating lender terms and interest rates, submitting financial documentation, etc., to streamline the process, you can connect with us and improve your long-term financing position, resulting in an improved investment portfolio.

Read More: Ground-Up Construction Financing: How Hard Money Loans Can Help

Frequently Asked Questions

- What are the other financing options for people with low credit scores?

Other options include seller financing, private lenders, partnerships, and lease-to-own arrangements.

- If I am applying for a hard money loan, what score is considered low?

Hard money lenders usually view a credit score of less than 600 as substandard for loans; however, each lender has different requirements.

- Given a poor credit score, what further documentation would I need to submit?

A complete property appraisal, evidence of income, a clear exit plan, and any conforming real estate investment expertise would be required.

- What are the factors hard money loan lenders examine if my credit score is low?

Factors such as Loan-to-Value (LTV ratio), Property value and equity, borrowers’ experience, credit history details, and more are examined by hard money lenders for bad credit scores.

- How does a down payment impact my application for a hard money loan if my credit score is low?

A higher down payment percentage balances out your low credit score by reducing the lender’s risk. Aim for between 30 to 50 percent of the property’s worth to improve your application.