Finding the perfect investment property requires quick action, and traditional lenders can be slow. Amish's understanding of Hard Money Loans was a game-changer for my business. He efficiently navigated the financing process, securing the funds I needed to close the deal fast and secure a profitable investment opportunity. Amish's expertise in Hard Money Loans gave me the competitive edge I needed to succeed in today's fast-paced real estate market.

Real Estate Investor

Flipping houses requires readily available financing, something traditional lenders often struggle to provide. Amish, however, presented hard money loans as a viable option for my property rehabilitation projects. He explained the benefits and drawbacks of hard money loans in detail, allowing me to make informed decisions. Amish's knowledge and responsiveness were invaluable throughout the process, ensuring my projects stayed on track and on budget. Hard money loans, secured with Amish's guidance, have become a cornerstone of my successful flipping business.

Property Flipper

I saw a fantastic opportunity to invest in a short-term rental property, but traditional financing wouldn't work due to the time constraints. Amish, however, presented hard money loans as an option to secure the funding quickly. He explained the exit strategy considerations and helped me calculate the potential returns on investment. Amish's understanding of hard money loans and his commitment to my success allowed me to capitalize on this time-sensitive opportunity, generating significant rental income.

Short-Term Investor

A hard money loan is a type of short-term real estate loan secured by the property itself, rather than the borrower’s credit history. Unlike traditional mortgages that require stringent credit checks, hard money lenders focus on the value and potential of the property. This makes hard money loans an attractive option for those who need quick financing or have non-traditional income sources.

Hard money loans are a versatile financing option designed to meet the needs of various real estate investors and borrowers.

Our goal is to deliver property-based financing solutions that align with your real estate investment strategies.

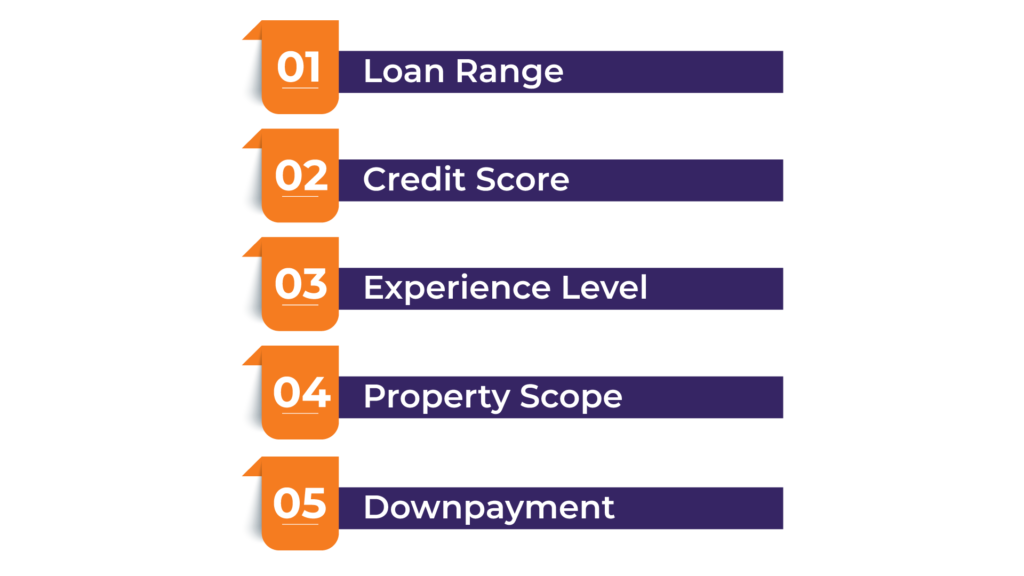

Loan amounts can range from $50,000 to $5,000, catering to different types of real estate investments, including land and construction loans.

While your credit score isn’t the primary focus, a score of 600+ can help secure better terms. For those with lower credit scores, understanding how to qualify for a hard money loan is key to improving approval chances.

Whether you’re new to real estate investing or an experienced developer, hard money lenders consider your project’s potential and your real estate experience.

Property Scope

From residential to commercial properties, hard money financing is available across most U.S. states.

Typically, a down payment of 10% to 20% is required, depending on the property and the lender. Some hard money lenders may require a down payment that reflects the loan-to-value (LTV) ratio, usually around 70% to 80%.

Hard money loans are a practical solution for real estate investors who need quick access to funds. However, these loans typically come with higher interest rates compared to traditional mortgages.

While both hard money loans and traditional mortgages can help finance real estate purchases, they cater to very different needs.

Traditional financing might fall short of your unique real estate ambitions. That’s where we come in! We offer hard money loans across a wide range of locations within California, Texas, and Minnesota, empowering you to seize opportunities and navigate diverse projects.

Hard Money Loan Houston

Hard Money Loan Los Angeles

Our experienced loan specialists will work closely with you to understand your specific needs and determine if a hard money loan is the right fit for your project. Let’s turn your vision into reality, no matter where you are!

We ensure your investment will be profitable and affordable because we provide some of the most competitive rates available.

Embracing technology and automation, we streamline loan processes for efficiency and ease, saving you time and hassle.

Our commitment to outstanding service ensures a smooth, supportive, and transparent loan experience from start to finish.

Catering to various real estate strategies, from fix and flips to ground-up projects, we provide tailored solutions to fit your specific needs.

We value honesty and clarity, ensuring you have all the information you need to make informed decisions.

Servicing a broad geographical area, we offer opportunities for investors across most states in the U.S.

Our loan terms vary, and any prepayment penalties would be clearly outlined in your loan agreement. Transparency is key in our operations.

Typically, you’ll need to provide property details, your financial information, and plans for the investment. Exact requirements can vary based on the loan type

Interest rates are based on factors like loan amount, property type, and borrower’s experience and financial standing.

Yes, we offer refinancing options that allow you to transition to longer-term financing solutions as needed.

Hard money imposes several risks involving higher interest rates and a shorter time to repay the amount. In cases of loan default, the lender has the right to take ownership and control of property as collateral. Hard-money loans come with faster approvals and disbursals, which may involve hefty charges and lower LTV ratios, causing financial burdens.

Yes, definitely. You can leverage hard money to finance rental properties, such as residential spaces for singles or multi-family. These are highly useful for investors who deal with credit issues or need the process to be a bit faster. You should secure a foolproof strategy involving taking an older mortgage after rental property stabilization.

Securing a hard-money loan comes with a more flexible approach in comparison to older ways of loan financing. Lenders mainly evaluate the property rather than focusing on the borrower’s credit score. Some of the parameters to qualify for a hard money loan may involve a sufficient down payment (usually 20% to 40% of the property’s value), property appraisal, and proper coverage. Although some lenders may raise concerns about evaluating a basic credit score or proof of income, these are less complex for hard-money loans as compared to other traditional loans.

Hard money loans are applicable for financing residential, commercial, industrial, and empty spaces. These are highly preferable for fix-or-flip real estate projects, bridge loans, and developments requiring too much capital investment.

The usual ranges for interest rates on hard-money loans are between 8% and 15%. These lead to higher mortgage rates than traditional ones because of the lender’s risk. Loan terms are normally shorter, between 6 months and 3 years, or variable as per the project or lender’s policies. Two essential factors, such as shorter terms and higher rates, force the borrowers to have a proper exit strategy. These can involve selling the property or re-loaning with traditional financing.

One of the main advantages of hard money loans is the speed of funding. These loans can be approved and funded in as little as 5 to 12 days, making them ideal for time-sensitive real estate transactions. The expedited process is possible because hard money lenders focus on the value of the property rather than the borrower’s financial situation.

If you default on a hard money loan, the lender has the legal right to foreclose on the property. Because the loan is secured by the property, the lender will take ownership and may sell the property to recoup their investment. This risk underscores the importance of having a clear repayment plan and exit strategy before taking out a hard money loan.