Table of Contents

ToggleWho are Private Money Lenders? An Overview

Private money lenders offer asset-based lending options to borrowers with flexible loan terms. The lenders do the quick loan approval for homeowners who want to secure investment properties in competitive properties. Private money lending usually has a higher rate of interest, between 8% to 15%, as lenders are going for high-risk profiles and don’t put much emphasis on borrowers’ profiles. Private money lenders are apt for borrowers going for fix-and-flip projects, bridge financing, construction loans, refinancing, or cash out.Why Are Borrowers Turning to Private Money Lenders?

According to the Money Thumb report, the private money lending market has seen significant growth from less than a billion dollars in capital to 1.7 trillion dollars available to borrowers from private money lenders. The exponential increase is due to:- Quick access to capital

- Customized loan structure

- Lenient eligibility standards

- Short-term financing is in high demand in the market

How are Private Money Lenders different from Traditional Mortgage Lenders?

The table below gives a clear distinction between private money lenders and traditional mortgage lenders for borrowers’ understanding:| Parameter | Private Money Lender | Traditional Mortgage Lender |

| Loan Approval Process | Fast typically in a 1-2 week | Requires 30-60 days |

| Source of Funds | Small group of investors or individuals | Credit Unions, Banks, etc. |

| Risk Tolerance | High as the focus is on properties’ ROI | Low as a focus is in on borrower stable financial profile |

| LTV or Loan to Value Ratio | 60-75% | 80-95% |

| Criteria | Lenient credit score requirements focus on property value | Strict borrower requirements: credit score, income, DTI ratio |

Step-by-Step Guide to Find a Reputable Private Money Lender for Borrowers

To navigate the complex process of finding a reputable private money lender, we have listed down the step-by-step guide in a comprehensive manner below:#1. Understand Your Financing Needs

- It is important to understand the purpose of the loan, whether you are financing residential loans, commercial loans, investment properties, special projects like construction financing, and more.

- Determining the loan amount is crucial, as lenders’ specializations differ based on the loan amount. For example, if you are going for a loan between $40,000 and $5,00,000, the lender’s specialization in small loans is required, whereas if the loan amount is substantial, an approach towards large private money loans is needed.

- Understand what collateral and guarantees you can offer because some private lenders for real estate require personal guarantees in addition to collateral, usually for large-scale projects with high risk.

#2. Research Private Money Lenders and Evaluate Their Expertise

- To check the reliability, credibility, and trustworthiness of the private money lender, the borrowers can check online reviews and testimonials, referrals, ratings, and industry standards. If the lender is a part of the American Association of Private Lenders (AAPL), it is a favorable point for borrowers to be assured of ethical practices followed by the lender.

- Research private money lenders based on the specialization you want, the type of loan, and the geographic location. Lenders having local expertise is valuable, especially for real estate investors, as they will have a better understanding of the market dynamics, property values, and regulatory requirements in a specific area.

- The borrower should also check for the number of years of experience the lender has. Private money lenders with experience understand real estate cycles in depth and the risk involved for borrowers and implement sound risk management practices.

#3. Verify Licensing and Credentials

- The borrower should research state licensing laws so the lender’s credibility can be verified. For example, California requires private lenders to be licensed under the California Department of Real Estate (DRE) or the Department of Financial Protection and Innovation (DFPI).

- Suppose the lenders are associated with various professional associations; their high ethical standards, practices, credibility, and reputation increase. Private money lenders associated with the National Private Lenders Association (NPLA) are considered highly reputable.

- The borrower needs to do the background check by investigating legal history, including complaints filed through consumer protection agencies and a history of fraud, unethical practices conducted, misrepresentation, etc.

#4. Ask for Lenders Loan Terms

- Conducting a detailed analysis of loan terms with private money lenders is important to check if the loan terms align with your financial goals. Lenders offering favorable loan terms are accountable and help in building long-term partnerships.

- Check for interest rate offers, repayment schedules, prepayment penalties, LTV ratios, points, and fees charged like underwriting, processing, legal services, appraisal, etc.

- The borrowers can also seek help from lawyers to make sure the terms are fair and no predatory practice is being conducted.

- Loan-to-value ratio plays a key role when finding a reputable private money lender. Check the table below that borrowers can use as a reference while negotiating for the LTV ratio:

| LTV Ratio | Project Type | Considerations |

| 65-75% | Higher-Risk Projects (e.g., Fix-and-Flip) | Be prepared to contribute more capital upfront. |

| 75-85% | Stable and Income-Generating Properties | Having a strong track record can help secure better terms. |

| Negotiation Needed | All Project Types | Negotiate terms or look for additional lenders. |

#5. Assess the Transparency

- The borrower can assess the transparency through lenders by clearly communicating all fees charged, such as origination fees, processing fees, etc., and resolving doubts with open communication.

- Reputable private money lenders don’t go for high-pressure sale tactics and give solutions to borrowers in their best interest.

- Reputable lenders will use independent, licensed appraisers to determine the property’s worth in an unbiased manner.

What Are the Red Flags Borrowers Should Look for When Searching for Private Money Lenders?

Listed below are a few parameters borrowers should pay key attention to when looking for private money lenders:- Lack of Transparency: If the lender is not clear about loan terms, rates, fees associated, etc., this is the major drawback a borrower should look upon. The lender should give a clear breakdown of fees, repayment schedules, and interest calculations.

- Charging High Interest Rates: As compared to traditional loans, private money loans have a higher rate of interest, but if the lender is offering a high interest rate as compared with the other lenders and market lenders, borrowers should pay attention to it so they get a fair deal.

- Having No Reviews or References: While searching for reputable private money lenders reviews, testimonials, references, etc., matter a lot. Private lenders with no reviews or negative reviews should be avoided.

- Charging Unrealistic LTV Ratio: If a lender is going for a higher LTV ratio that is unusual, that means the lender wants the borrower to have less equity in the property and a higher debt.

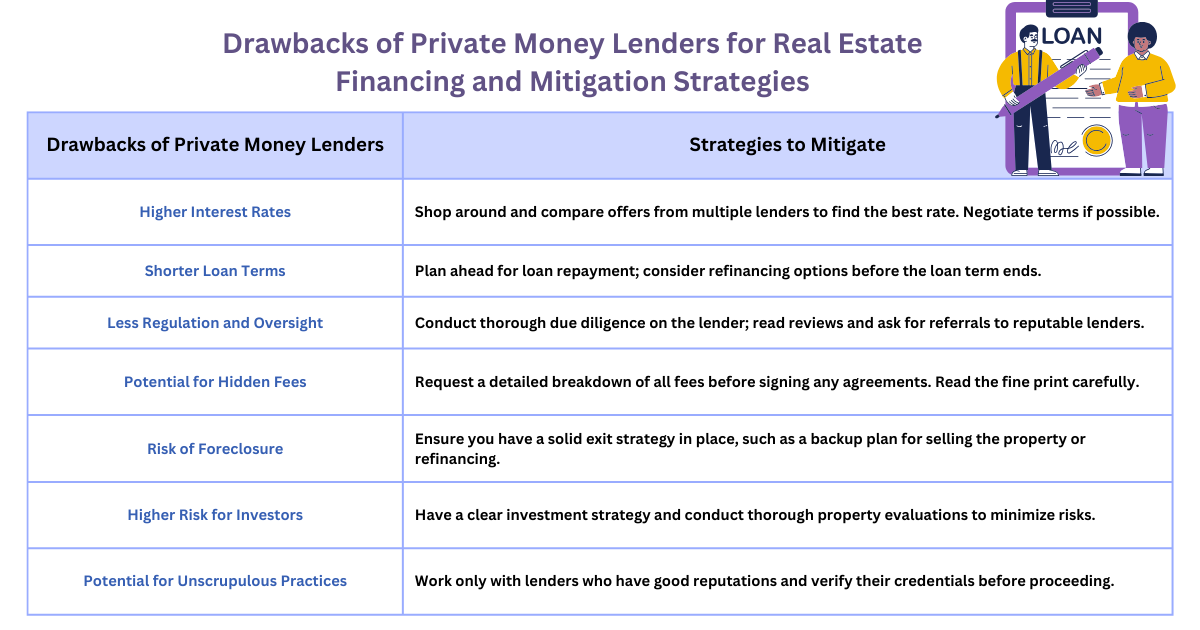

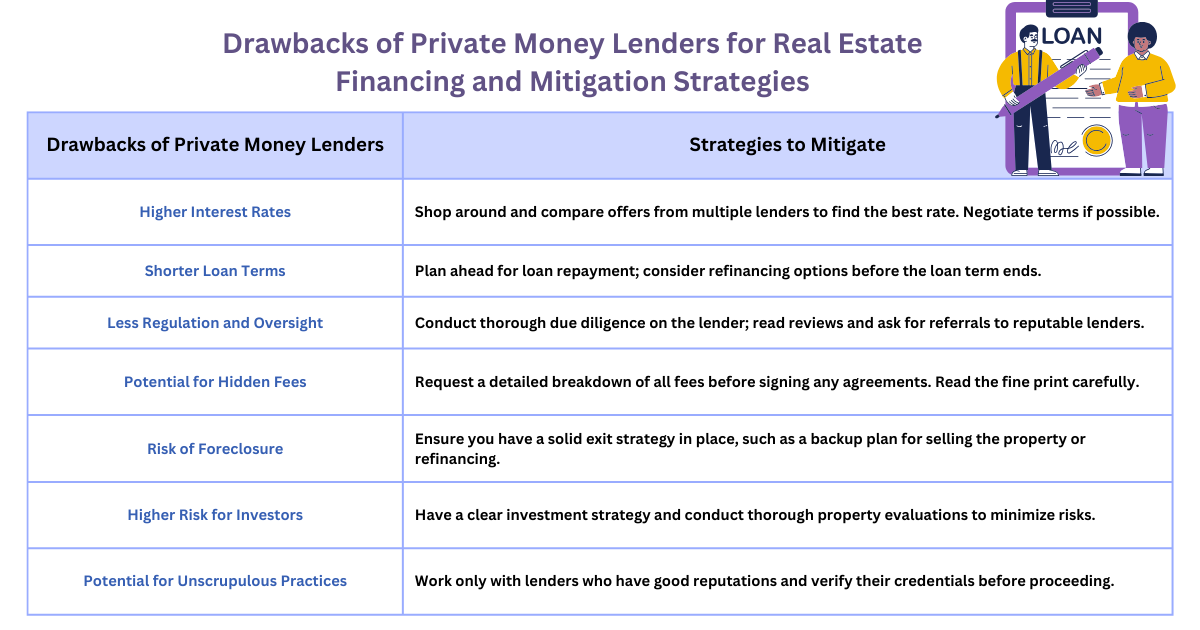

“What are the potential risks of using private money lenders for real estate financing and strategies to mitigate?”