What is After Repair Value?

After Repair Value (ARV) is the value of a property estimated once all repairs/ renovations/ improvements have been done. It is an important metric used in real estate investment, primarily for fix-and-flip projects and hard money loans.

How Can Borrowers Calculate the After Repair Value (ARV) of Their Property?

Listed below is a 5-step process to calculate the after repair value for real investment properties:

- Step 1: Evaluate the property’s condition to identify needed repairs.

- Step 2: Identify comparable sales, gather data on comps, and make adjustments to the comps’ sale prices to account for any disparities with your home.

- Step 3: Create a detailed repair plan, obtain contractor quotes, and add a 10%-20% contingency fund if required to determine renovation cost

- Step 4: Calculate the ARV by using the formula: ARV=Estimated Sale Price of Comps+ Renovation Costs

- Step 5: Adjust ARV Based on Market Trends: Consider market conditions; increase ARV if appreciation is expected, and decrease if not.

Decoding the Role of ARV (After Repair Value) in Hard Money Loans

Let’s understand why after-repair value plays an important role in hard money loans for borrowers and lenders going for fix and flip projects, renovations, etc., overall in detail:

Role of After-Repair Value for Borrowers

Listed below are crucial points why ARV in hard money loans is important for borrowers:

#1: To Determine the Loan Amount and Approval

ARV helps in determining the loan amount post-renovation plan and not on the basis of current property value. Lenders usually offer 65-75% of ARV, which means if the property is more valuable after repair, the higher loan amount can be secured. This is particularly beneficial for borrowers with weaker credit profiles, as the focus is on the property’s potential future value rather than their financial history.

#2: Better Interest Rate and Terms

Borrowers who want hard money loans with higher ARV can get better loan terms and interest rates. Lenders also prefer investments with higher ARVs as they get higher returns if the property sells out at the projected value. Let’s see this through an example and understand the impact:

| Scenario | Property A | Property B |

| ARV | 2,00,000 | 3,00,000 |

| Loan Amount (70% of ARV) | 1,40,000 | 2,10,000 |

| Interest Rate | 10% | 8% |

| Loan Terms | 12 months | 12 months with option to extend |

| Perceived Risk | Higher (due to lower ARV) | Lower (due to higher ARV) |

| Profit Potential | Limited (higher costs) | Greater (lower costs) |

| Borrower Leverage | Less (higher risk) | More (lower risk) |

| Investor Appeal | Lower | Higher |

We can see a higher ARV result with better interest rates, loan terms, and greater profit potential. Additionally, if the property’s ARV increases post-renovation, borrowers have the option to refinance the hard money loan at better terms, such as lower interest rates and higher loan amounts. This is an effective strategy for reducing overall loan costs.

#3: Profit Margin Calculation

After Repair Value is a key metric when it comes to fix and flip projects, as it helps determine if the investment will give the desired result. If the ARV is higher compared to purchase and renovation costs, it results in a higher profit margin for both borrowers and lenders.

Formula: Profit Margin = ARV – (Purchase Price + Renovation Costs + Other Expenses)

#4: For Exit Strategy

After-repair value helps investors pan out the exit strategy, which ensures that if ARV is well-calculated and covers all the costs, repaying the loan, and securing a profit, borrowers can effectively plan their sales timeline and repayment schedule. A higher ARV makes planning for an effective exit strategy easier, as it provides more flexibility to repay the loan while ensuring profit.

In the table below are two scenarios that show why ARV helps in exit strategy as it determines the potential sale price, ensuring the borrower can cover all costs and achieve profit.

| Details | Scenario 1 (ARV = 250,000) | Scenario 2 (ARV = 230,000) |

| Loan Amount | 1,75,000 | 1,75,000 |

| Total Investment | 1,90,000 | 1,90,000 |

| After Repair Value (ARV) | 2,50,000 | 2,30,000 |

| Sale Price | 2,50,000 | 2,30,000 |

| Profit Calculation | 250,000 – 190,000 = 60,000 | 230,000 – 190,000 = 40,000 |

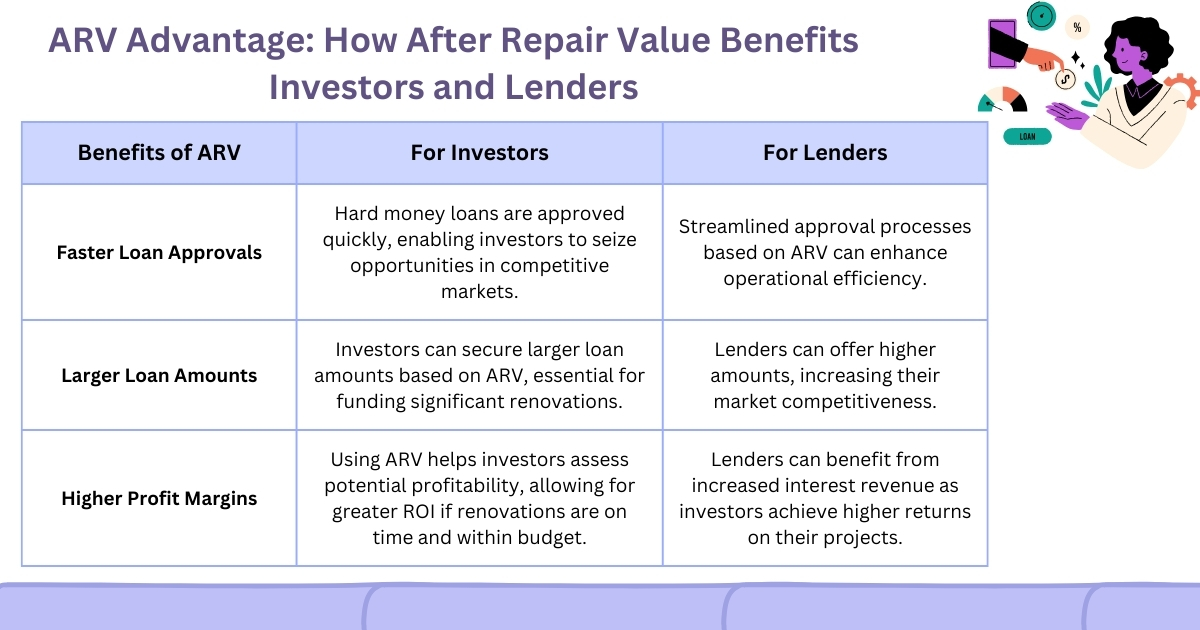

Why After Repair Value is a Key Metric for Hard Money Lenders?

Listed below are key points why ARV or After Repair Value plays a key role for hard money loans lenders:

- It determines the loan amount based on future property value.

- Manages risk by aligning loan with after-repair value.

- Evaluates investment potential for higher resale/refinancing value.

- Evaluates investment potential for higher resale/refinancing value. Lenders also factor in ARV when determining whether the borrower may be able to refinance the loan after repairs, reducing the risk of default.

- Assesses credit risk by focusing on collateral over borrower credit.

- Checks project viability, ensuring sufficient value addition.

- Safeguards lender’s profit margin if borrowers go into the default category.

- Helps in offering flexible loan structuring based on ARV parameters.

What Are the Risks of Relying on ARV in Hard Money Loans, and How Can Investors Protect Themselves?

The table below gives comprehensive insight into the risk associated with borrowers relying on ARV in hard money loans and strategies to mitigate them:

| Risk | Description | Strategies |

| Regulatory Delays | Delays in permits can extend project timelines, impacting ARV. | Plan for regulatory timelines and include delays in cost estimates. |

| Unforeseen Market Changes | After repairs, the value of the property may decrease due to shifting market conditions. | Analyze market trends and consider worst-case scenarios. |

| Overestimated ARV | Profit margins may be lowered if actual repair expenses turn out to be higher than projected. | Hire independent appraisers to get a more accurate ARV calculation and ensure market analysis is thorough. |

| Inaccurate Comparables | Incorrect comparables may lead to faulty ARV calculations. | Make sure comparable properties are recent and located in the same area. |

| Underestimated Repair Costs | Profit margins may be lowered if actual repair expenses turn out to be higher than projected. | Obtain multiple contractor bids and include contingencies. |

Conclusion

As discussed, ARV is crucial in hard money loans for assessing a property’s post-renovation value, benefiting both borrowers and lenders. While it enhances financial prospects, relying solely on ARV without due diligence can lead to risks like overvaluation and regulatory delays. Incorporating accurate ARV calculations, considering refinancing options post-repair, and managing risks effectively ensures a successful loan process.

MunshiCapital simplifies the process by offering tailored financial services and guiding borrowers through ARV calculations, market data, loan structures, and more, making the loan application process smoother and more reliable.

Read More: How to Avoid Common Scams from Hard Money Lenders

Frequently Asked Questions

1. Can borrowers get hard money loans for bad credit if their property has a high ARV?

Yes, borrowers can get hard money loans if they have bad credit and their property has a high ARV (After Repair Value) as hard money lenders focus is more on the value of the property after repairs than the credit score.

2. Can I refinance a hard money loan if my property’s ARV increases after repairs?

Yes, refinancing hard money loan is possible if the property ARV increases after repairs to get better loan terms like lower interest rate and a higher loan amount.

3. What do I need to provide to the best hard money lenders in California when applying for a hard money loan?

Borrowers need to provide a detailed renovation plan, estimated ARV, current property details, ownership proof, etc.

4. Can the best hard money lenders in California fund both residential and commercial properties based on ARV?

Yes, many of the best hard money lenders in California provide loans for both residential and commercial properties based on ARV. The lenders evaluate the value of the property after repairs, in a residential fix-and-flip or a commercial renovation project.