Wondering how the requirements for getting a hard money loan compared to a traditional mortgage differ? The differences in loan requirements can significantly impact borrowers financing options. From credit score and income verification to property appraisal and loan terms, understanding these differences is important for selecting the right option for your needs.

The article will cover in-depth detail about how hard money loan requirements differ from traditional mortgage loans.

Key Features and Use Cases of Hard Money Loans vs. Traditional Mortgage Loans

Listed below in the table are key parameter comparisons for traditional and hard money loans for borrowers:

| Feature | Hard Money Loans | Traditional Mortgage Loans |

| Lending Basis | Asset-based lending (property value) | Credit-based lending (borrower’s financial history) |

| Loan Duration | Short-term financing (months to a couple of years) | Long-term financing-15 to 30 years |

| Interest Rates | Higher interest rates due to increased risk | Lower interest rates due to lower risk for lenders |

| Approval Process | Quick approval and funding | Rigorous and lengthy approval process |

| Use Case | Ideal for time-sensitive deals | Suitable for homebuyers and real estate investors |

What are the Key Differences Between Hard Money Loans and Traditional Mortgage Loan Requirements: Eligibility Criteria, Document Requirements, and More

The traditional mortgage loans and hard money loan requirements differ for borrowers in terms of credit score, financial documents, property type, and more. Let’s understand the requirements in detail:

Eligibility Criteria: Credit Score, Loan Purpose, Down Payment & Debt to Income Ratio

- Credit Score: Hard money lenders put much emphasis on property value rather than borrowers’ credit score as compared to traditional mortgage loans. Borrowers applying for hard money loans should have a minimum credit score of 550, whereas for traditional mortgage loans, it should be a minimum of 620 or higher.

- Loan Purpose: A hard money loan is best suited for investment properties and a traditional mortgage loan for primary residence.

- DTI Ratio: In hard money loan, the DTI ratio is not a major key criterion for loan approval; hard money lenders are more considered with the LTV ratio as it compares the loan amount to the value of property. Traditional mortgage loans require a DTI ratio, which must be below 43% when evaluating the loan application.

- Down Payment: Hard money loans lenders require larger down payments ranging between 20% to 30% of the property’s value due to the higher risk associated as compared to traditional mortgage loans, which require at least 3%–5%, or if going for 20% can help eliminate the need for PMI.

Property Appraisal

Listed below is the property appraisal aspect requirements comparison for both hard money loans and traditional mortgage loans, so borrowers can understand how hard money loan requirements differ:

| Aspect | Hard Money Loans | Traditional Mortgage Loans |

| Appraisal Type | Quick evaluation with comparative market analysis | Detailed appraisal conducted by a licensed appraiser |

| Focus | Primarily on the property’s value and potential resale | Ensures loan amount does not exceed property value |

| Time Frame | Fast, completed in couple of days | Time-consuming process, that can take several weeks |

| Impact of Low Appraisal | May require larger down payment or decline the loan | May request a cash difference, lower the loan amount, or deny |

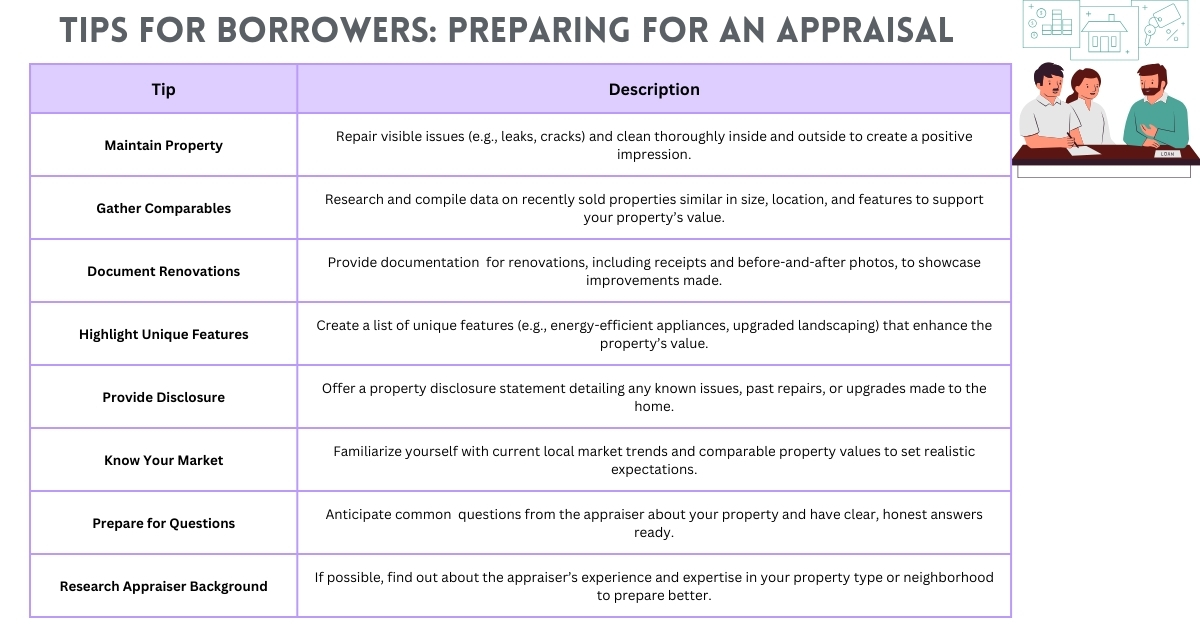

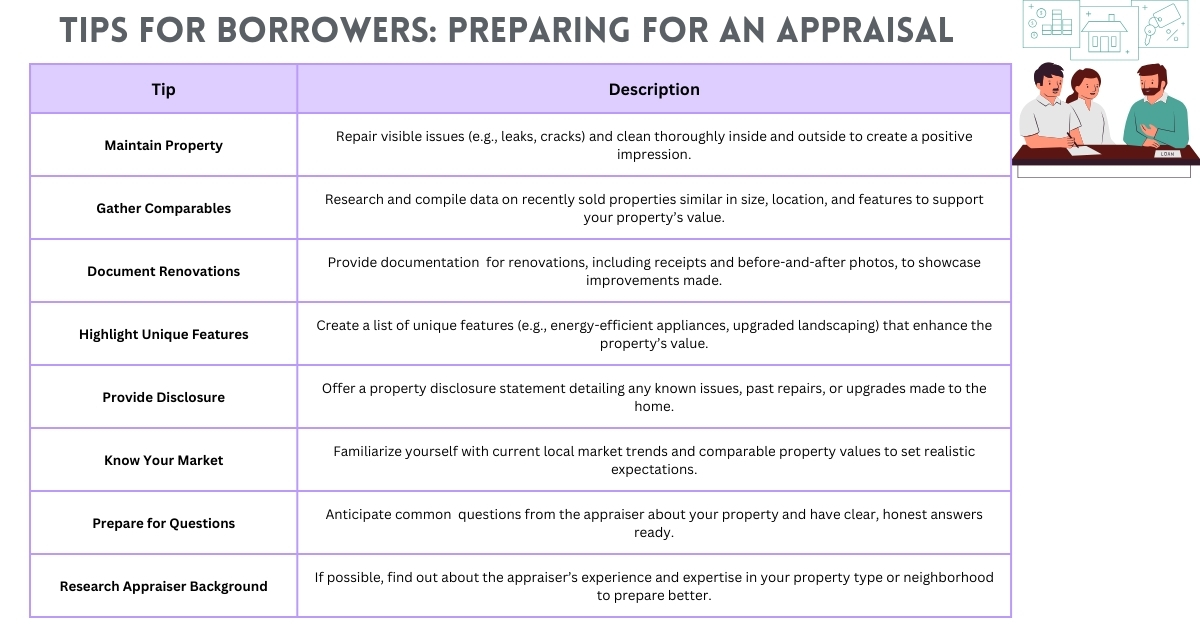

How can Borrowers Prepare for a Successful Appraisal?

Interest Rates, Fees, Loan Terms, And Property Condition

Listed below are the key requirement differences for the key parameters:

| Parameters | Hard Money Loans | Traditional Mortgage Loans |

| Interest Rates | 8% to 15% or more | Generally 3% to 7% |

| Rates vary based on borrower risk and property value | Influenced by credit score, market conditions, and loan type | |

| Loan Terms | Short-term loans lasting 6 months to 3 years | Long-term loans structured for 15 to 30 years |

| Extensions can be given with additional costs | Standard repayment schedules | |

| Fees | Higher fees, usually 3% to 5% of the loan amount | Lower fees, usually 1% to 3% of the loan amount |

| May include points at closing | Fewer additional fees may include origination fees | |

| No or minimal prepayment penalties | Some loans may have prepayment penalties | |

| Property Condition | Flexible regarding property condition; can finance distressed properties | Stricter requirements: the properties must meet safety and habitability standards |

Document Requirements

Listed below is the document checklist for both hard money loans and traditional loans to understand the difference in requirements:

Hard Money Loan Document Checklist

- Basic ID (driver’s license, passport)

- Property deed

- Purchase agreement or proof of ownership

- Minimal to no income documentation required

- Quick property evaluation or comparative market analysis

- Minimal disclosure of existing debts

- Proof of funds for down payment (if applicable)

- Title search may be performed, but documentation is minimal

- Basic property insurance (coverage amounts may not be specified)

Traditional Mortgage Loan Document Checklist

- Government-issued ID

- Social Security number

- Property deed

- Purchase agreement

- Home inspection report

- Detailed loan application form (Uniform Residential Loan Application)

- W-2 forms (usually for the last two years)

- Recent pay stubs

- Tax returns (usually for the last two years)

- Required (lender obtains a full credit report)

- Detailed property appraisal

- Comprehensive disclosure of all debts (credit cards, loans, etc.)

- Proof of down payment (bank statements or other financial documents)

- Title insurance and detailed title search required

- Homeowner’s insurance policy with specific coverage requirements

Note: The document requirements may differ based on the lender; this is the generic overview.

Income Verification

Hard money loans require minimal or no income verification as the focus is on the borrower’s equity in property and value as compared to traditional mortgage loans, where extensive income verification is done through W-2 forms, tax returns, and proof of income because lenders check that borrowers have sufficient income to cover mortgage payments.

Which is the Right Loan for You—Hard Money or Traditional Mortgage Loan? Get Comprehensive Investment Strategies

Borrowers can assess their financial situation, investment goals, and the specific property type to decide which loan is right for them. Listed below are some investment insights for hard money and traditional mortgage loan for borrowers:

| Loan Type | Investment Strategy | Why Go for It? |

| Hard Money Loan | Fix-and-Flip Projects | Quick turnaround on properties that require renovation. |

| Short-Term Investments | Opportunities where quick access to funds is important. | |

| Commercial Ventures | If buying commercial properties and need quick financing. | |

| Traditional Mortgage | Long-Term Rental Investments | Acquire properties for good rental income. |

| Primary Residence Financing | Stable interest rates for home buying. | |

| Refinancing Existing Loans | If you want to take advantage of lower interest rates or cash-out options. |

Conclusion

Two fundamental factors are the primary source of the requirements that distinguish hard money loans from conventional mortgage loans: the first one focuses on property value, and the latter focuses on borrowers’ creditworthiness overall.

Hard money loans are the best option for quick financing, whereas traditional mortgage loans offer better terms to borrowers with good credit histories. Whether the borrowers are looking at fast funding or favorable mortgage terms, we at Munshi capital help borrowers with detailed analysis of loan requirements and other aspects for gaining maximum financial gain from the investment.

Read More: How to Choose the Right Hard Money Lender: 7 Key Factors

Frequently Asked Questions

- Can hard money loans be used for refinancing purposes?

Yes, refinancing hard money loan is possible, this option is used by various investors if they want to have cash for new investments, renovations, or pay off existing debts.

- What documentation is required for hard money loans compared to traditional mortgages?

Hard money loans require less documentation, mainly property appraisal, proof of down payment, exit strategy, etc., are required. Traditional mortgages require credit reports, income verification, employment history, debt-to-income ratio evaluation, etc.

- What is the loan approval process like for hard money loans versus traditional mortgages?

The approval time for a hard money loan is between 7-10 days, whereas for a traditional mortgage loan it is between 30 to 45 days.

- What are the interest rates offered by the best hard money lenders in California versus traditional mortgages?

The best hard money lenders in California offer interest rates between 8% and 12% for hard money loans, higher than traditional mortgages, which range from 3% to 6% due to the risk factors involved.