Table of Contents

ToggleAre you eager to dive into promising real estate opportunities but don’t want to wait months for loan approval?

Hard money loans offer a faster solution than traditional mortgage loans. These short-term, asset-based financing options provide quick access to capital for borrowers ready to act on time-sensitive opportunities.

The best part is that the hard money loan application process can be streamlined more effectively if the borrower has planned paperwork, from having a clear exit strategy to giving proof of property value. Proper documentation helps in the smoother finalization of a borrower’s hard money loan contract.

If you are wondering how to speed up your approval process, this blog will give you a comprehensive overview of essential documents borrowers need to be prepared for the hard money loan application process with additional pro tips for faster approval.

Don’t Let Paperwork Hinder Your Loan Approval Process: Here Are Must-Have Documents for a Quick Hard Money Loan Approval for Borrowers

Listed below is the comprehensive overview of essential documents required for easy hard money loan approval:

1. Hard Money Loan Application Form

The loan application form is a compilation of all the documents given in the article. The form includes information related to:

- How much loan amount is requested? That affects the loan-to-value ratio and loan terms.

- What is the purpose of the loan?

- What type of property needs to be financed?

- Basic personal information and financial information

- Borrowers credit score

2. Financial Statements

To showcase financial stability to the lender, the following documents must be ready beforehand:

- Recent personal bank statements—last 2–3 months

- Personal financial statement that lists assets, liabilities, and net worth

- Proof of income like recent pay stubs, W-2 forms, or tax returns

- Proof of liquidity or reserve funds if required for renovations or emergencies

3. Exit Strategy

- Exit strategy helps lenders assess that borrowers have a clear plan to repay the loan, comprising strategies related to property sale, rental income, and refinancing (if applicable).

- The borrower should provide an exit strategy schedule, including the anticipated time on the market prior to the sale, the estimated time the renovations will take, and the date the property will be sold after the modifications.

- If the borrower is going for rental income, then market analysis with comparable rental properties and expected rental income should be given for quicker approval.

4. Documents Related to Property

- Borrowers, when submitting a hard money loan application, should have property documents ready, like a full address with the full address including street, city, state, and ZIP code.

- Specification of property types like residential, commercial, industrial, or mixed-use helps understand the terms and risks of a hard money loan agreement.

- Hard money lenders also require a recent appraisal or comparative market analysis (CMA) to verify property value.

- Hard money loan contracts should align with local regulations, for which lenders may ask for zoning information.

- A property current report may be required so the lender can assess additional costs that will be incurred in property improvement, especially in the case of renovation or rehab projects.

5. Legal Documents and Identity Proof

For hard money loan applications, several documents are required, as listed in the table below within each category:

| Document | Details to Include |

| Government-Issued Identification | • Accepted Forms: Passport, driver’s license, or state ID card. • Verify: Name, photo, DOB, expiration date. |

| Social Security Number (SSN) | SSN for background verification and compliance purposes. |

| Proof of Property Ownership | Deed of ownership or property title to confirm current ownership status. |

| Mortgage Statements | Recent mortgage statements to show current outstanding loans or liens on the property. |

| Property Tax Records | Most recent property tax records to confirm no outstanding property tax dues. |

6. Property Insurance

- Offering property insurance helps borrowers get faster loan approval, secures lender confidence, and acts as a financial safeguard with sufficient coverage. The main three coverage types are fire insurance, liability insurance, and builder’s risk insurance.

- The borrower should include the following documents in property insurance:

- Proof of Existing Property Insurance, including policy copy, term length, proof of payment, and coverage details.

- Insurance Quote for New Policies, including quote details, payment and premium schedule, and insurer information.

7. Title Report

- Title reports help lenders assess the risk associated with the property along with ownership verification for hard money loan agreements in the future.

- What should the borrower include in the title report?

- Ownership Details

- Outstanding Liens

- Encumbrances

- Easements

- Restrictions

- Legal Description

- Past Property Transfers

- Clearance Certificate

8. Repair or Renovation Cost Estimates

Lenders require repair or renovation cost estimates to understand the scope of work, timeline, and completion, budget assessment, etc.

- Borrowers should include the following components in the repair/renovation cost estimate plan:

- Breakdown of cost item-wise

- Labor and Material costs

- Contingency line budget

- Project and Timeline phase, like;

| Phase | Tasks | Estimated Duration |

| Phase 1 | Demolition and foundation repairs | 2 weeks |

| Phase 2 | Interior framing, electrical, plumbing | 4 weeks |

| Phase 3 | Finish work (painting, fixtures, landscaping) | 3 weeks |

9. What are the Additional Documents that Could Speed Up the Hard Money Loan Application Process?

- Borrowers may also be required to present additional documents, like property purchase agreements, to check transaction terms and closing timelines.

- Hard money loan lenders may also ask for past real estate history and business plans so that investors can check the projected ROI, property management plan, credibility, etc.

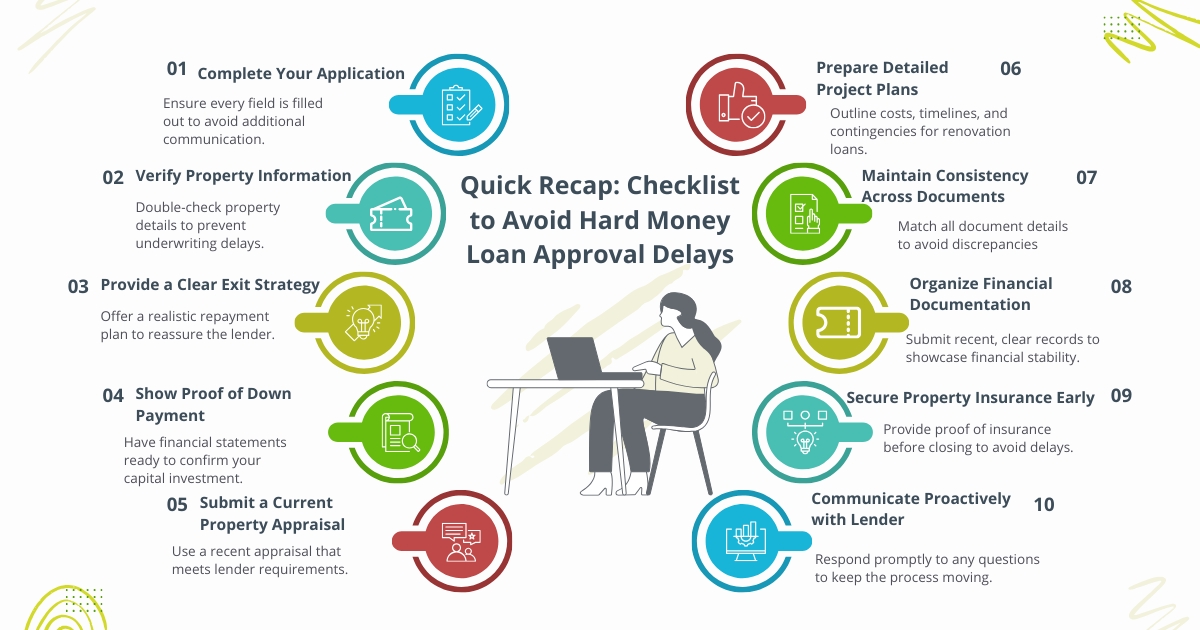

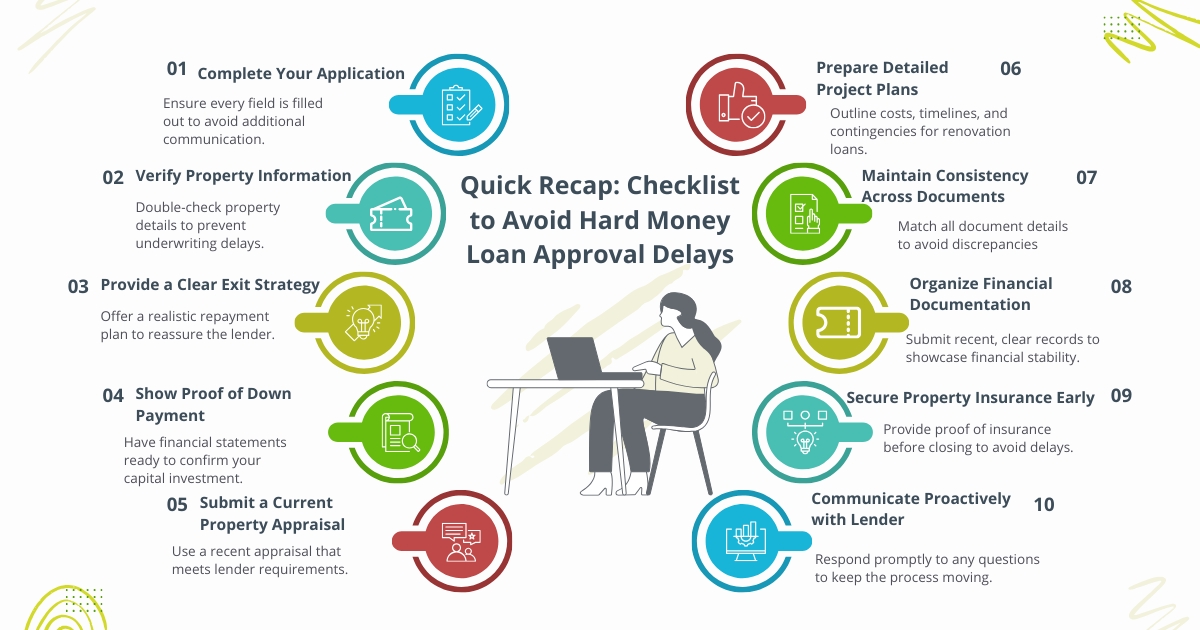

What are some additional pro tips for borrowers applying for Swift Hard Money Loan Approval?

- Draft a detailed loan proposal that gives your loan purpose and exit strategy; also, try to include financial projects that demonstrate the viability of your project.

- Research the best hard money lenders in California who have a track record of quick hard money loan application approval. The lender requirement may differ depending on the type of hard money lender, so assess the situation accordingly.

| Type of Hard Money Loans Lenders | Typical Criteria | Advantages | Best Suited For |

| Private Individuals | Minimal documentation | • Flexible terms • Fast processing | Small projects or personal loans from trusted sources |

| Hard Money Companies | • Property value assessments • Minimum credit score | • Established processes • Quick access to funds | Larger projects needing significant funding |

| Real Estate Investment Groups | Strong project proposals | • Shared expertise • Networking opportunities | Collaborative funding for property investments |

| Peer-to-Peer Lenders | • Detailed project presentation • Good credit history preferred | • Competitive rates • Diverse funding sources | Borrowers seeking quick alternatives to traditional banks |

- In order to reduce lender risk, go for a higher down payment to showcase your commitment to the project, which can lead to quick approval.

- Do you know how having a SWOT analysis can change the game in securing a hard money loan? It helps in understanding prime location and renovation expertise, weaknesses such as limited cash reserves, opportunities in a competitive growing market, and threats from economic downturns. This approach in your application helps in addressing lender concerns and improves your credibility as a borrower.

Conclusion

If you are looking to maximize your gain from a real estate investment by grabbing the opportunity at the right time, having the proper documentation for a hard money loan is not a mere process; its more like a streamlined strategy as it has a direct impact on the speed, terms, the success of loan approval and boosts lenders confidence.

We at Munshi Capital help borrowers act quickly on real estate deals by leveraging efficient documentation to ensure a smooth and successful loan experience.

Read More: How Do Hard Money Loan Requirements Differ from Traditional Mortgage Loans?

Frequently Aasked Questions

- Is there a difference between a hard money loan contract and a traditional mortgage loan contract documentation requirement?

Yes, compared to standard mortgage loans, hard money loan contracts typically demand less documentation. Traditional mortgages involve extensive income verification, credit history, and debt-to-income analysis; hard money loans primarily concentrate on property value and the investor’s equity documents.

2. What is the process to apply for a hard money loan in California?

The borrower needs to find the best hard money lenders in California and gather essential documents like the loan application, property appraisal, and proof of ownership. A loan contract detailing the terms will be sent by the lender after they have reviewed your application and assessed the property. The money is usually released within a few days to a week after the borrower signs the contract.

3. Is there any fee associated with the documentation process of a hard money loan?

Yes, fees like application fees, inspection fees, closing costs, appraisal fees, origination fees, etc. are associated with the documentation process of hard money loan approval.

4. Does refinancing a hard money loan have different document requirements?

Yes, hard money loan refinancing documents may vary slightly compared to the initial loan application; borrowers may be required to submit current loan documentation, updated property appraisals, title reports, financial status updates, and more.