Table of Contents

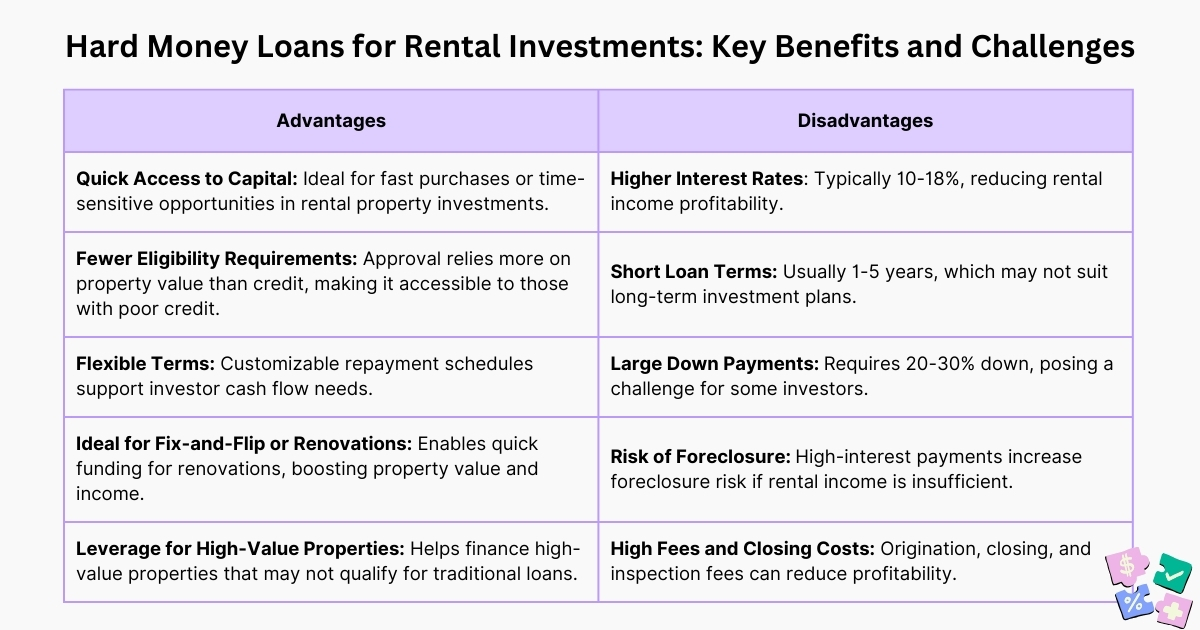

ToggleWondering whether you should go for a hard money loan for your next rental property investment?

There are only 2 questions you need to ask yourself:

- In which scenarios are hard money loans the right choice for your rental property investment?

- In which situations are hard money loans not suitable for your rental property investment?

The answer to the first question is when you need quick access to funds to get a rental property, have a poor credit score, are planning to go for fix and flip projects, or are opting for high value investments that can generate potential rental income.

Coming to the second question, a hard money loan may not be the right fit for your rental investment if you are planning for long term rentals, have limited capital, which can restrict the ability to pay large down payments or fees associated with it, or if the property in the future is not expected to generate sufficient rental income to cover loan payments.

It is important to understand the key advantages and disadvantages of hard money loan to buy rental property to get deeper knowledge to make an informed financial decision and maximize gains on rental investment.

Step-by-Step Guide for Securing a Hard Money Loan For Rental Properties

To secure hard money for your next rental investment, understand the key steps involved for a streamlined approach:

Step 1: Look for Rental Properties that Meet Your Financial Needs

- Choose the rental property that is aligned with your financial goals, whether you want to go for renovation to increase rental value or need to have long-term renting.

- Verify the rental property value through comparable sales (comps) or an appraisal to make sure it meets the loan amount.

- It is important to do a cash flow analysis to calculate potential rental income to check if it covers taxes, loan payments, property management fees, insurance, and maintenance costs.

Step 2: Research and Choose Rental Specialized Hard Money Lenders

- Finding the lender is the most important part of securing a hard money loan to buy rental property. Look for lenders specializing in rental property loans offering favorable terms and rates.

- Compare terms on the basis of parameters like a loan-to-value ratio (usually offered in the range of 65-75%), repayment terms, interest rates, and terms.

- Getting reliable reviews and testimonials from other investors or borrowers can help in finding a trustworthy hard money lender for your next rental investment.

Finding the Right Hard Money Lender for Your Rental Property: Essential Tips for Investors

Step 3: Compile Documents Needed for Loan Application Process

To make your document compilation job easy, here we have a list of key documents required by lenders in each category:

| Document Category | Documents Required for Hard Money Rental Loans |

| Property Details | Property Appraisal, Inspection Report, Comparative Market Analysis (CMA), Title Report, Property Tax Statement |

| Exit Strategy | Refinancing Plan (traditional mortgage post-stabilization), Sale Plan (if selling the property to repay the loan), Rental Income Plan (projected rent roll and vacancy rate) |

| Personal Financials | Personal Credit Report, Debt-to-Income (DTI) Ratio, Bank Statements, Tax Returns |

| Income Proof | Rental Income Projections (rent income forecast), Operating Expense Estimates (maintenance, management, insurance costs), Lease Agreements (if tenants are already in place), Market Rental Analysis (comparable rents in the area) |

| Additional Property-Related Documents | Renovation or Repair Plans, Insurance Proof (if applicable) |

| Investment Experience (if applicable) | Real Estate Investment Portfolio, Business Plan |

Step 4: Submit Your Loan Application

- Complete the hard money loan application form by giving detailed information about rental property, personal finances, prior experience (if applicable), etc.

- Keep the down payment amount ready when in the process of submitting the loan application form.

- Make sure you are ready for an independent appraisal or inspection if demanded by the lender to cross-verify the property value.

Step 5: Negotiate Loan Terms Specifically for Rental Investments

After submitting the loan application form, the next part is negotiation, where you need to look for factors ranging from interest rates to prepayment penalties.

| Negotiation Point | What You Can Negotiate? |

| Interest Rates | Lower rates by offering a lower LTV, additional collateral, or refinancing flexibility. |

| Loan-to-Value or LTV | Negotiate a lower LTV for better terms or higher loan amounts if the property’s value supports it. |

| Repayment Schedule | Depending on your financial flow, negotiate flexible payment choices such as interest-only payments, postponed payments, or modified payment frequency. |

| Prepayment Penalties | Ask for lower or no prepayment penalties, particularly if you intend to sell early or refinance. |

Step 6: Close the Deal and Manage the Loan

- The closing process is completed in a few days when it comes to hard money loans. Before closing the deal, review all the loan documents submitted to cross-check terms, interest rate, additional cost, etc.

- Once the deal is closed, track the rental income by making sure that rental income covers your expenses and fits into your loan payment plan.

- Monitor all the expenses related to property management fees, taxes, maintenance, etc., to ensure profitability remains.

Are You Ready to Secure a Hard Money Loan for Rental Property? Key Tips to Boost Your Approval Chances

Let’s understand what borrowers can offer to hard money lenders that can improve their loan approval chances:

- Offer Proof of Funds: While hard money loans lenders primarily focus on the property value, providing bank statements and proof of liquid assets can enhance their confidence in your financial stability, potentially leading to more favorable loan terms and rates.

- Focus on Your Financial Profile: Clearing existing debts and having a decent credit score demonstrates borrowers’ reliability to the lender.

- Showcase a Clear Exit Strategy: The hard money lenders always want to know borrowers’ plans on three fronts that define their exit strategy: Sale of Property, Refinancing, and Rental Income. Having a solid exit strategy will demonstrate to the lender that you have a plan for paying off the loan and that the risk is minimized.

- Opt for Larger Down Payment: Typically, hard money lenders for rental properties require a downpayment between 20% and 30%, but offering them a larger down payment tells the lender that you are financially stable and that the property will have sufficient equity, even in the event of unexpected challenges leading to faster loan approval chances.

- Draft a Strong Property Valuation: The hard money for rental properties loan is dependent on property value; having a strong property valuation that includes a professional appraisal report, comparable sales (comps), property condition report, location and neighborhood analysis, income potential (for rental properties), cost of necessary repairs/improvements, inspection report, etc., helps the loan approval chances more.

Conclusion

Beyond simply fulfilling the prerequisites, obtaining a hard money loan for rental property requires making a compelling case that incorporates a solid property appraisal, a well-defined investment plan, and sound financial standing.

As a hard money lender, Munshi Capital understands that the best investments come from well-prepared borrowers who approach the process with confidence and clarity. Ready to take the next step? Connect with us today to make informed financial decisions and get maximum gains from your rental property investment.

Read More: How to Avoid Common Scams from Hard Money Lenders?

Frequently Asked Questions

- What fees are associated with hard money loans for rental properties?

Hard money lenders for rental properties charge fees, such as origination fees, appraisal fees, inspection fees, underwriting fees, processing fees, and loan servicing fees.

2. Can I refinance a hard money loan for rental properties into a traditional mortgage?

Yes, refinancing hard money loans for rental properties into traditional mortgages is possible, so investors can get lower-interest traditional mortgages for long-term stability.

3. Can I get a hard money loan if I have a low credit score?

Hard money loans for bad credit scores are available, as the loans focus on property value rather than borrowers’ credit scores. The lenders focus on the borrower’s plan for generating returns through rental income or property sales.

4. How do I find the best hard money lenders in California for rental properties?

To find hard money lenders California for rental properties, borrowers can research reputable lenders, compare loan terms and conditions, check online reviews and testimonials, ask for referrals, and more.

5. What are typical hard money loan rates in California for rental properties?

Hard money loan rates california are basically between 8% to 15% for rental properties, depending upon lenders’ policies and other related factors.