Table of Contents

ToggleHave you ever wondered why more investors are turning away from traditional banks for construction financing? In recent years, hard money construction loans have gained remarkable traction, reshaping the real estate financing landscape.

In 2023 alone, the market for these loans saw significant growth, reflecting a notable shift from conventional bank financing.

This trend is due to the growing demand for speed and flexibility in funding construction projects, which are critical factors when delays can translate into skyrocketing costs and diminished profits.

So, what’s driving this shift, and why are investors embracing these loans? Let’s dive in.

Weighing the Benefits of Hard Money Construction Loans for Borrowers

As a borrower, you can weigh down the advantages of using hard money loans for new construction projects and maximize your overall profitability from the project.

The top Ins of hard money construction loans are given below:

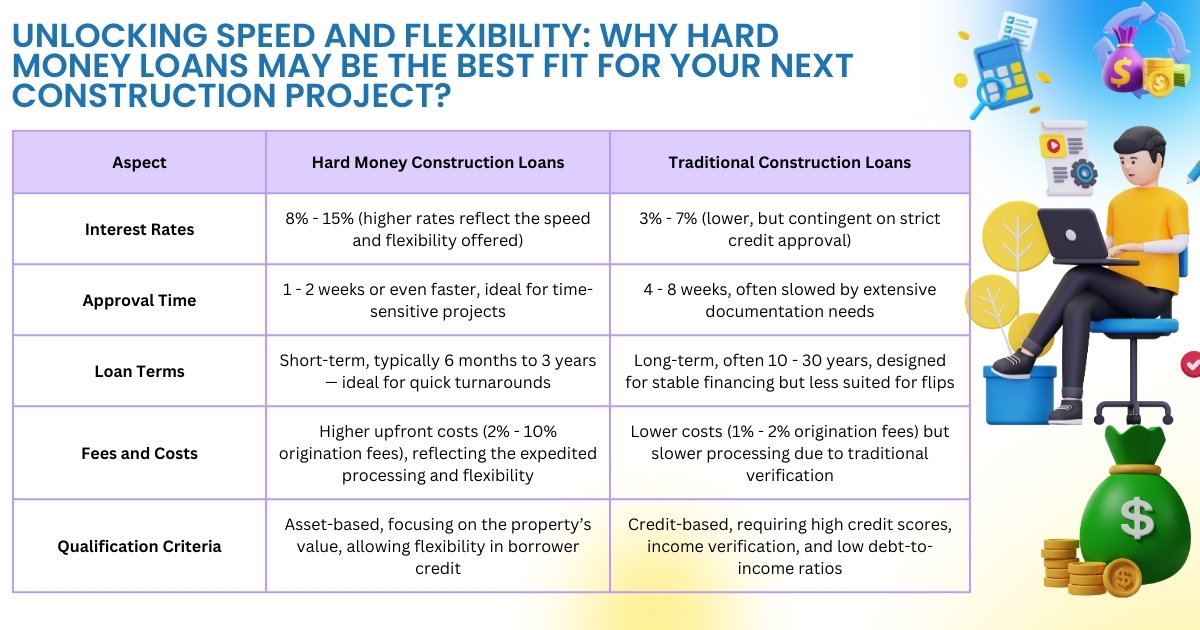

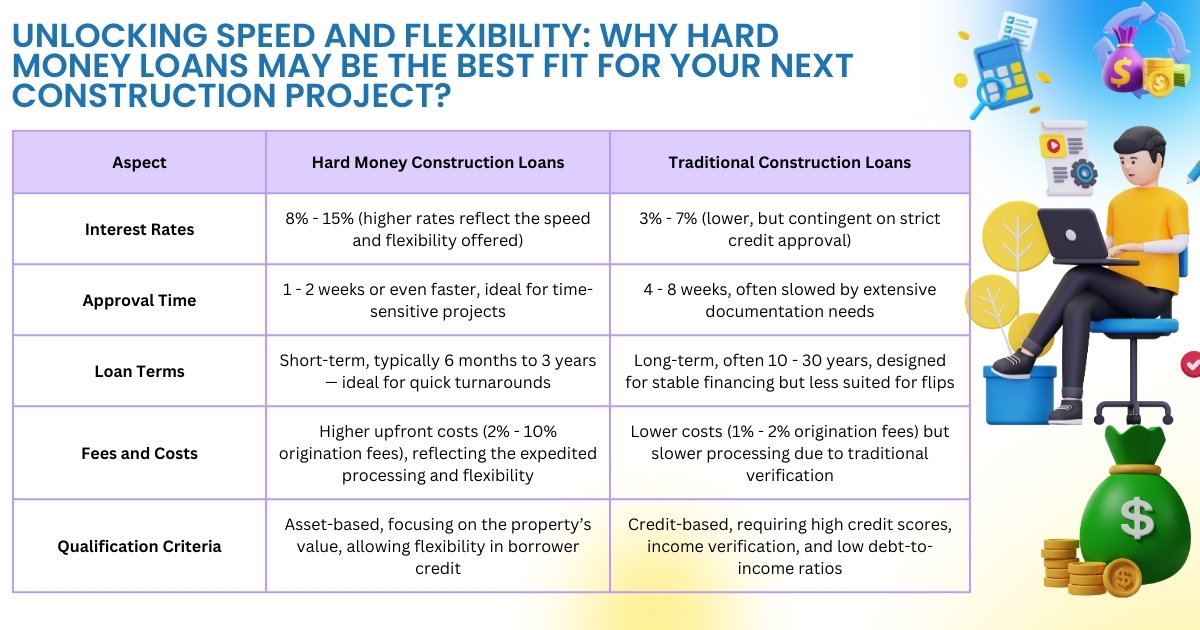

- Quick Funding and Approval: Hard money loans for new construction projects are a viable option compared to traditional loans because they are approved within a few days due to more focus on property value than credit score. Construction projects are critical as they involve securing permits, hiring contractors, and purchasing materials, so quick access to capital is necessary.

- Better Flexibility: Hard money loans lenders also offer customized loan terms, repayment terms, and loan amounts based on the type of project, like residential, commercial, or a specialized build like a renovation or ground-up construction.

- No Credit Score Requirement: If the construction project value is in line with hard money lender projections, the credit score doesn’t play much role in this case. So real estate investors, builders, or homeowners with poor credit scores looking for financing construction projects should consider hard money loans.

- Less Paperwork: As compared to traditional banks, hard money lenders require fewer documents, making the process quicker. The main focus is on proof of ownership and the property’s appraised value documents.

- Better for Riskier Projects: High-risk building projects, like those in regions with uncertain property values or significant renovations on distressed properties, are best suited for hard money financing.

- Availability of Draw Schedules: For construction projects, the hard money loan amount is distributed in 4 phases: foundation, framing, roofing, and final finishes, which helps in the continuation of the project without waiting for the entire loan amount upfront.

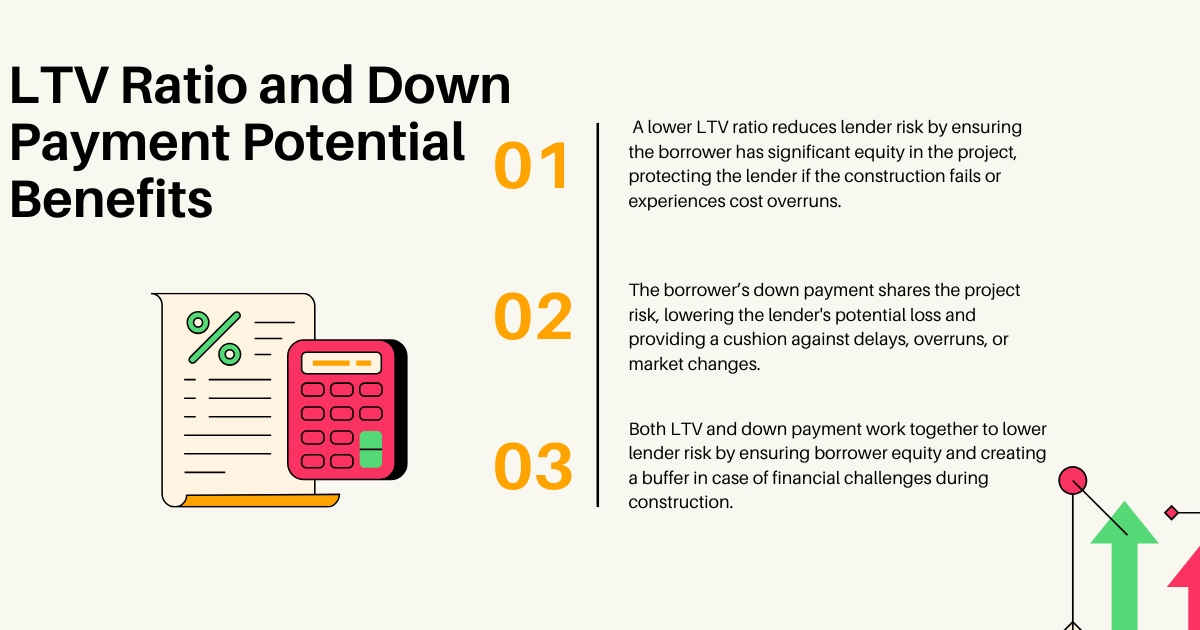

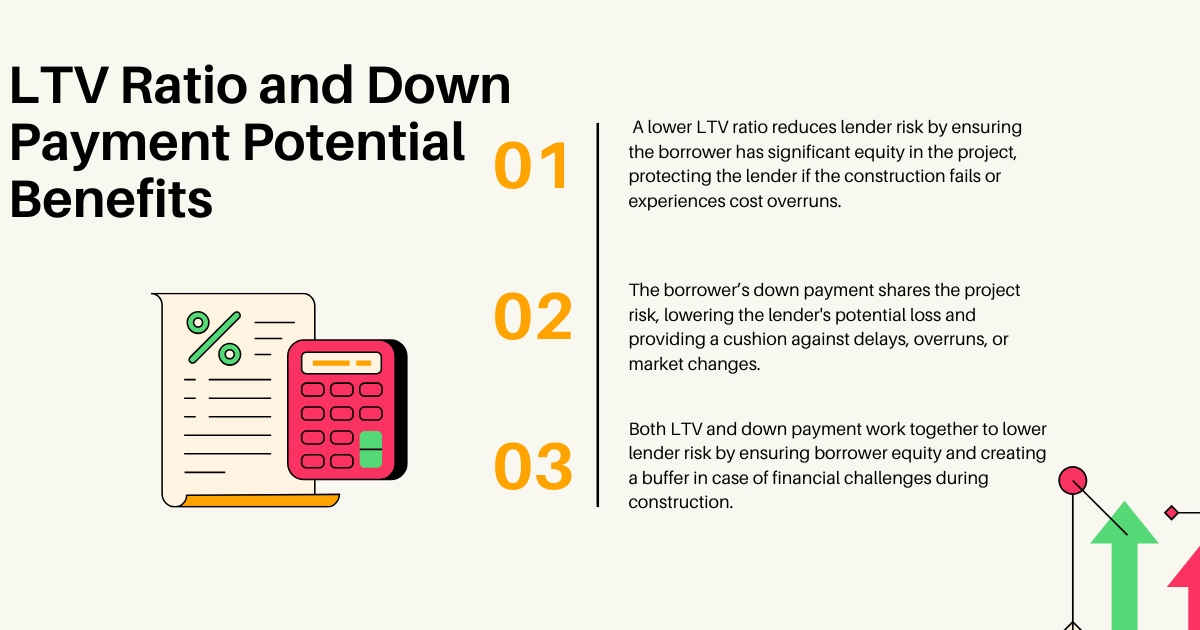

Why LTV Ratio and Down Payment Important Parts of the Financing Structure of Hard Money Loans for New Construction Projects?

The Potential Benefits

What is the Dark Side of Hard Money Construction Loans for Borrowers?

Hard money construction loans can act as a major advantage to borrowers, but they come with a few potential drawbacks if not balanced properly, as explained below:

- High Interest Rates: As compared to traditional loans, the interest rate for hard money construction loans is on the higher side, between 8% to 15%, as the risk attached to the loan is high. Which can also result in high monthly payments impacting the overall cost of the loan.

- Short Loan Terms: Hard money construction loans often have terms of 6 to 3 years, and if the projects get delayed due to any unexpected situations, then it is tough for the borrower to pay in a short time. It forces the borrowers to refinance or repay the loan; refinancing an unfinished project is challenging as it becomes too risky for lenders to finance.

- Limited Regulation and Transparency: Hard money lenders are not regulated as banks as they are private individuals/companies, which can lead to unfavorable loan terms and conditions practiced. Like If the project moves more slowly than anticipated, some hard money lenders have provisions that let them change the draw timeline or impose extra fees.

- Risk of Foreclosure: In construction, a partially completed property is worth much less than a finished one, so if foreclosure happens in between, the borrower can have a loss on the initial investment if they have invested time and money before cash flow problems arise.

- High Fees and Costs: Borrowers need to understand fees associated with hard money construction loan and if overall project planning is not done strategically how they can negatively impact the end result.

| Fee Type | Typical Range | Impact on Project |

| Origination Fees | 1% – 5% of the loan amount | Can significantly increase upfront costs, especially for larger loans. |

| Processing Fees | Varies, typically a flat fee | Increases the overall loan cost, affecting the project’s budget. |

| Inspection/Draw Fees | Varies, per draw (can range from $300 – $800 per inspection) | Delays in projects due to inspections can stall progress and increase costs. |

| Legal/Document Fees | Varies, typically flat fee | Adds to the administrative burden and total cost. |

| Prepayment Penalties | 1% – 3% of the loan balance | Affects flexibility if the project needs to be paid off early or refinanced. |

| Late Fees | Varies, typically flat or percentage of the overdue amount | Can quickly add up and strain the borrower’s finances. |

- Draw Disbursement Delays: In construction projects, loan money is distributed in phases or draws. Each loan phase requires an inspection to verify completion, which, if delayed, can disrupt project timelines. Any delays in inspections or disagreements over progress can halt funding, leading to idle workers, missed deadlines, and increased costs.

How to Mitigate Hard Money Construction Loan Red Flags?

- It is important to review that your hard money lender has a track record in the construction loan industry.

- Wondering how to trust a hard-money construction loan lender? Examine their licenses, certificates, internet reviews, ratings, and testimonials; comprehend their loan application process; go over their price schedule; and assess their customer service and communication.

- Because construction projects might result in several unforeseen expenses, such as material shortages or repair charges, it is advisable to have a contingency reserve. Set away 10% to 20% for emergencies.

- If your ARV estimate is on time, you might end up borrowing more than the property is worth, which can lead to the challenge of paying it off. Getting the ARV right isn’t just important; it’s critical to the construction project’s success.

Are Hard Money Loans the Right Choice for Your Construction Project?

To know if hard money loans are the right choice for your construction project, the borrower should consider a few questions, as given below:

- How urgent is your project timeline?

- Does the property have high potential value?

- Is flexibility more important than lower costs?

- Can you manage a short-term loan?

- Are you comfortable with higher interest rates?

- Do you need asset-based rather than credit-based approval?

Key Questions to Ask Your Hard Money Lender

Here’s a checklist of key questions to ask a hard money lender. This can help you ensure you’re well-informed about the loan terms, fees, and processes involved in financing your construction project.

| Key Questions to Ask Your Hard Money Lender | Why It’s Important |

| What is the total interest rate, including any fees? | Helps you understand the full cost of the loan and compare it to other financing options. |

| How quickly can funds be made available? | Ensures the lender’s timeline aligns with your project’s urgency. |

| Are there penalties for early repayment? | Clarifies if you’ll incur additional costs for paying off the loan early, which impacts flexibility. |

| What documentation will you require? | Prepares you for the paperwork involved and compares the process to other lenders. |

| Can the loan terms be customized for my project? | Determines if the lender can adjust terms based on project needs, such as loan duration or draw schedules. |

| What are the phases of the draw schedule? | Provides clarity on when funds will be available during each project phase, helping you plan finances. |

| Do you have experience with my type of construction project? | Verifies if the lender is familiar with projects like yours, reducing potential misunderstandings or mismanagement. |

| What are the contingency plans if my project faces delays? | Gives insight into flexibility for adjustments if timelines shift. |

| How often will inspections be required, and what are the fees? | Ensures you are aware of additional costs and potential project interruptions due to inspection requirements. |

| How will you communicate throughout the project? | Confirms the level of support and communication you can expect, crucial for smooth project progression. |

Conclusion

The construction real estate market is very dynamic, and with its fast-moving nature, hard money loans can serve as a bridge for investors looking for quick funding and flexibility compared to traditional financing.

However, while they offer advantages, it’s essential to strategically plan for every financial risk, including high interest rates, fees, and the pressure to repay in a short period, which can create volatility.

Working with a knowledgeable hard money lender can help you manage these risks and make wise decisions. Lenders with a strong track record, like Munshi Capital, can provide insights into the complexities of hard money construction loans, helping you assess options and understand financing structures that suit your needs. Always evaluate multiple lenders to ensure you choose the right fit for your project.

Know More About: Ground-Up Construction Financing: How Hard Money Loans Can Help

Frequently Asked Questions:

- What criteria do hard money lenders in California use to evaluate new construction loan applications?

Hard money lenders in California use factors like after-repair value, loan-to-cost (usually between 70% to 90%), loan-to-value ratios (60% to 75%), project viability and timeline, exit strategy, etc., to evaluate new construction loan applications.

2. What documentation is required to secure hard money loans for bad credit in California for construction projects?

Documents like construction plan, property appraisal and valuation, proof of property ownership, financial statements, cash flow projections, construction permits, zoning approvals, etc., are required to secure hard money loans for bad credit in California for construction projects.

3. What fees should borrowers look for when choosing the best hard money lenders in California for construction financing?

Borrowers, when choosing the best hard money lenders in California for construction loan should look for fees like origination fees, underwriting fees, appraisal fees, inspection fees, prepayment penalties, extension fees, etc.