Table of Contents

ToggleIntroduction

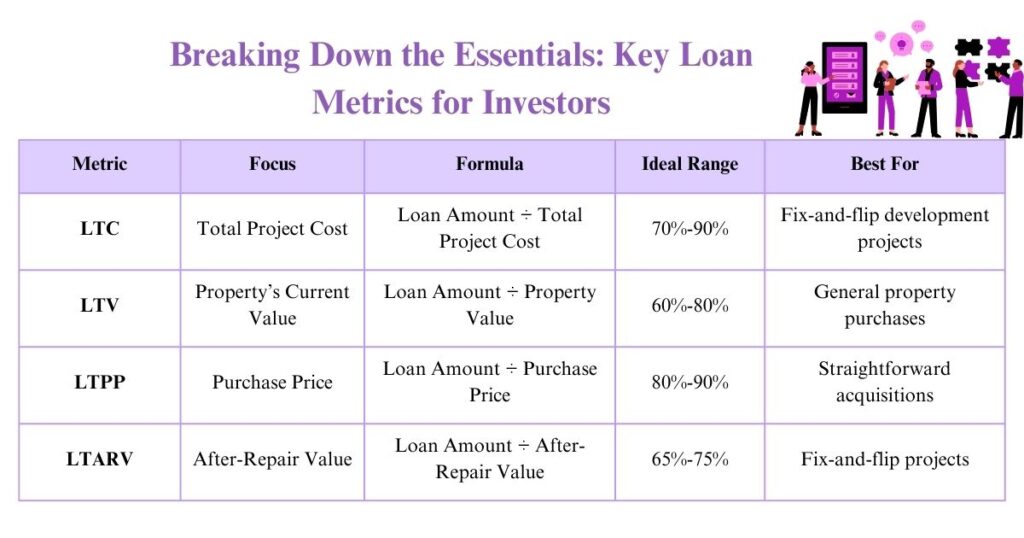

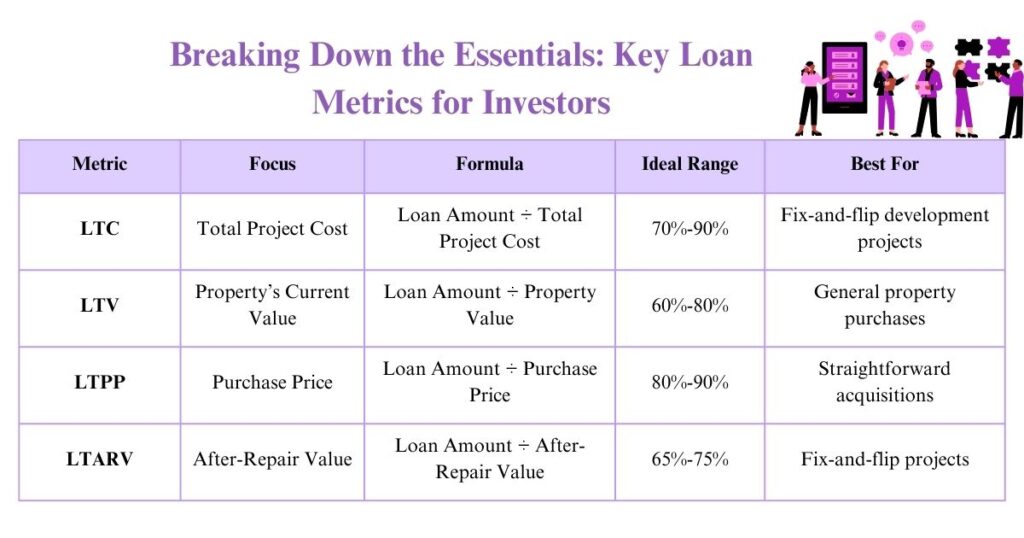

When it comes to hard money lending, there is a basket filled with complex acronyms. No matter, if you are a first-time homebuyer or an experienced investor, understanding terms like LTC, LTV, LTARV, or LTPP, can be confusing.

But cracking these terms can create a difference for you in making smart decisions, whether it comes to expanding your portfolio or even flipping your first property. Let’s break down all these loan metrics terms so you can make informed financial decisions.

Demystifying: Loan-to-Cost (LTC): What’s the Total Project Expense?

LTC tells the difference between the amount the lender will cover and the amount you will need to contribute. Your project may be easier to finance if the LTC is higher because you will want less cash upfront. However, lenders may impose higher interest rates or event costs if you contribute less since they use the amount as a risk cushion.

Formula: LTC= (Loan Amount/Total Project Cost) × 100

What is the Role of LTC for Borrowers and Lenders?

Let’s use an example to understand this: for a $300,000 project cost, including purchase and refurbishment, the borrower obtains a 75% loan-to-cost loan. The borrower here invests $75,000, while the lender here contributes $225,000.

What is the Impact?

- The $75,000 in equity held by the borrower is a cushion for the lender if the project fails.

- In addition to boosting liquidity, the lower cash need increases the borrower’s dependence on the project’s profitability to protect them from financial strain.

Loan-to-Value (LTV): Know How Much Is Your Property Worth Right Now?

The LTV ratio tells you the property’s value the lender is willing to finance. LTV focuses solely on the property’s value when purchased rather than the total project cost, as considered in the LTC ratio.

Formula: LTV=(Loan Amount/Property Value)×100

What is the Role of Loan to Value Ratio for Borrowers and Lenders?

In the hard money lending market, LTV helps in shaping the loan terms and the outcome for both borrowers and lenders. Here’s a breakdown:

Aspect | Low LTV Impact (Usually below 60%-65%) | High LTV Impact (Usually above 75%-80%) |

For Borrowers | Lower fees, interest rates, and better loan terms due to less lender risk. | Higher total cost but easier loan approval with a lower down payment. |

For Lenders | A loan with a buffer against borrower default or changes in the market. | Higher chance of loss if borrower is in default or there is a sharp decline in property value. |

Loan to Purchase Price of LTPP: Explore the Relation With Purchase Price

When you are buying a house and don’t have any urgent plans for renovations or repairs, a loan to purchase price, or LTPP, can be useful.

LTPP helps you know how much of the property’s cost you’re getting financed. It only matters how much you paid for the property compared to the loan you are receiving if you are not going for any repairs.

Formula: LTPP=(Loan Amount/Purchase Price)×100

Let’s understand this through a simple example: If you are buying a property for $350,000 and the lender offers a loan of $300,000, your LTPP would be:

(3,00,000/350,000)×100=85%

As a result, you’re borrowing 85% of the purchase price of the property. You are borrowing a larger percentage of the property’s worth, so you don’t need to make a large down payment—just 15% of the purchase price. In the future, if you are short on funds, this can be helpful.

Loan to After Repair Value or LTARV: Know Property Value After Renovations

Consider that you are opting for a fix and flip project, you need to make sure that you are borrowing the right amount of money given the property value after repair or renovation. That’s where LTARV, or loan to after-repair value, comes as a major parameter.

Formula: LTARV=(Loan Amount/After Repair Value)×100

What is the Role of LTARV for Borrowers and Lenders?

- For borrowers, LTARV helps calculate the project risk. Check this table to know the higher and lower LTARV impact for you:

LTARV Range | Explanation |

High (80% or more) | Less room for error; borrowing more means lower profit margins if the property doesn’t sell as expected. |

Low (65%-70%) | More flexibility; borrowing less gives greater safety if things don’t go as planned. |

- For lenders, a lower loan to after repair value is a good sign because it means the loan amount is smaller than the property’s value after repairs. This reduces the lender’s risk and reduces the borrower’s chances of being in default.

What Mistakes One Should Avoid When Dealing with Hard Money Lending Terms?

Let us discuss common mistakes to avoid when dealing with complex hard money lending terms and how to mitigate them:

|

Pitfall |

Why It is a Mistake? |

How to Avoid It? |

|

Overestimating After-Repair Value (ARV) |

If the home does not sell for the expected price, overestimating ARV may result in financial difficulties. |

When calculating ARV, use local comparable sales (comps) as a parameter. |

|

Focusing Only on One Metric |

The risk and benefit of a loan agreement may not be accurately assessed if only one parameter is used, like LTC or LTV. |

To evaluate offers strategically, one should combine indicators such as LTV, ARV, LTC, and LTARV to understand the viability of the investment. |

|

Not Having an Exit Strategy |

Without a defined exit strategy, you can be stuck with a property that doesn’t sell or perform as anticipated. |

Fix your closing strategy, whether you are going to sell, rent or refinance |

|

Failing to Understand the Borrowing Terms |

Unexpected expenses may arise if you don’t understand loan terms, such as repayment plans, fees, and penalties. |

To understand loan arrangements, consult with experts for better terms, including flexible repayment plans, reducing fees, etc. |

Simplify Complex Loan Metrics with Us

We understand unlocking complex final terms like LTC, LTV, LTPP, and LTARV can be overwhelming, but once you crack them, it can be a game changer for you in the hard money lending market, from reducing risks to building a profitable portfolio.

At Munshi Capital, we focus on breaking down complex numbers and terms for you so you don’t feel lost in the complex intricacies of loans. Connect with us today and achieve your investment goal with confidence.

Also, Know About: Understanding the Role of ARV (After Repair Value) in Hard Money Loans

Frequently Asked Questions

- Do hard money loans for bad credit offer favorable LTC or LTV ratios?

Getting favorable LTC or LTV ratios depends on the borrower’s investment plan and their ability to offer a larger down payment. Borrowers with poor credit scores can also get a better LTV or LTC ratio, as the focus is on the asset’s value rather than the borrower’s credit score. Also, borrowers can improve their terms by providing additional collateral.

- What are typical LTC, LTV, and LTARV ranges offered by the best hard money lenders in California?

In California, the best hard money lenders commonly provide loan-to-cost (LTC) ratios of 80–90%, loan-to-value (LTV) ratios of 65–75% and loan-to-after-repair value (LTARV) ratios of 70–85%. However, these ranges may differ based on the location of the property, the lender’s risk tolerance, the borrower’s background, etc.

- Do hard money loans lenders provide a higher LTC or LTARV for experienced investors?

Yes, higher LTC or LTARV ratios are available to seasoned investors. For instance, a lot of lenders give investors who have a history of successful real estate ventures up to 90% LTC and 85% LTARV. To preserve long-term relationships and get better returns, hard money loan lenders are willing to offer seasoned professionals flexible terms.