Table of Contents

ToggleIntroduction

California’s real estate market is one of the most lucrative and competitive markets in the United States. Investors often resort to hard money loans as they provide quick and easy access to capital but at higher costs and risks than conventional loans. Hard money lenders in California attract quite a lot of popularity from real estate enthusiasts in their fast-paced real estate market, resulting in more than 20% of potential investors depending on hard money lending to secure capital funds.

With lucrative benefits of hard money lending Investors must make informed and strategic decisions while considering hard money loans due to the risks and additional costs involved. This blog offers insights into the five mistakes that potential investors must avoid to make smarter decisions and protect their investments.

5 Mistakes to Avoid When Working with the Best Hard Money Lenders in California

Hard money lending can be a bit tricky and complex when compared to traditional financing. Avoiding common mistakes and keeping a close eye and open mind while searching for the best deals can benefit your real estate substantially.

Let us understand these five common mistakes that real estate investors often indulge in while finalizing the best hard money lenders in California:

Ignoring the Lender’s Reputation

Not paying attention to the hard money lender’s reputation can cause a major downfall in your investment journey. While traditional financing can be heavily stringent, hard money lenders offer flexibility, often attracting exploitative lenders.

Selecting the wrong lender can cause various repercussions of hidden fees, faulty customer service, and even legal problems that can compromise your investment. Listed below is the overview:

- The hard money lending estate market in California is quite dynamic and robust, which involves a lot of lenders operating within the state. Still, not all of them follow the path of ethical standards and professionalism.

- Engaging with genuine lenders ensures that the investors receive appropriate guidance to navigate California’s complex real estate landscape, in addition to transparent and honest loan terms.

- Borrowers must look out for certain red flags like hidden fees, lack of transparency, negative online reviews, confusing loan terms, and high-pressure sales gambit when selecting the best hard money lender in California.

Not Fully Comprehending the Loan Terms

Misunderstanding or failing to comprehend the loan terms can cause unwanted financial distress to the borrowers. Potential investors must look for certain key terms while considering hard money lending, which are discussed below:

- Investors must ensure beforehand that there is no penalty involved in the early repayment of these loans.

- Hard money loan rates in California range from 8% to 15%, and investors must confirm whether it is fixed or variable.

- Borrowers may face a financial crunch if the loan requires balloon payments, which involve large upfront payments.

Hard Money Loan Terms Vs Conventional Loan Terms

| Feature | Hard Money Loan | Conventional Loan |

| Interest rate | 8 – 15 % | 3 – 6 % |

| Loan term | 6 – 24 Months | 15 – 30 years |

| Prepayment penalty | Often applicable | Rare |

| Loan-to-value ratio | 60 – 75 % | 80 – 90 % |

| Approval time | 3 – 10 days | 35 – 40 days |

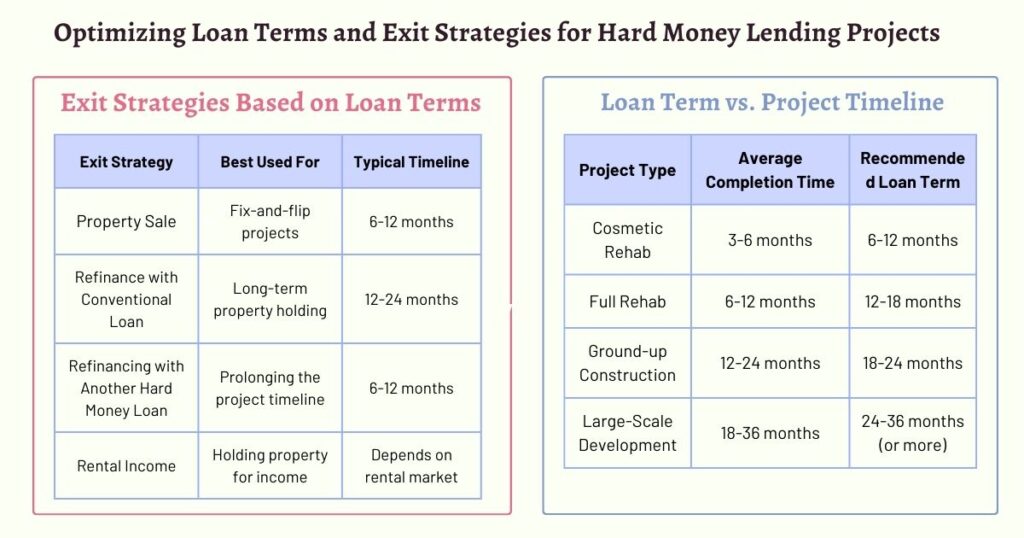

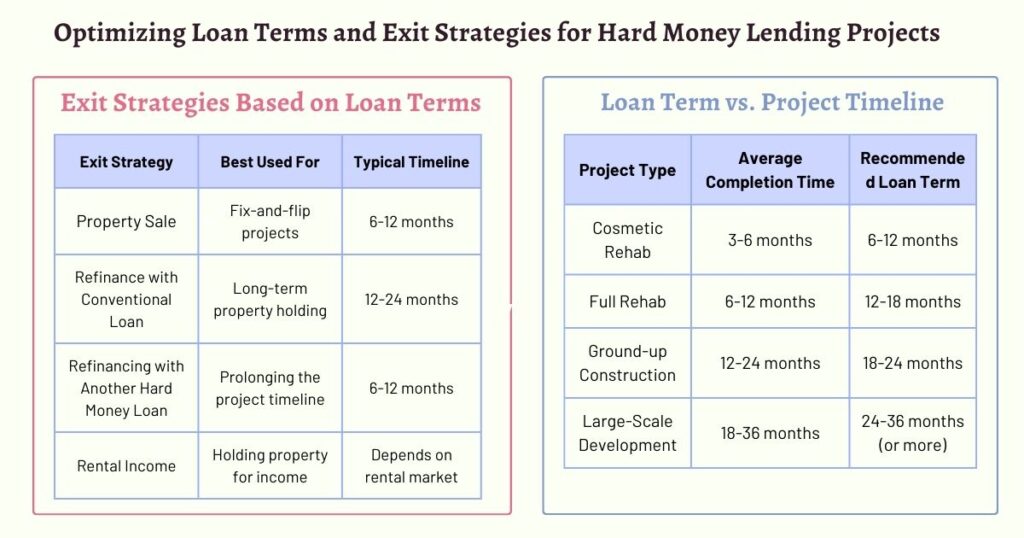

Failing to Maintain an Exit Strategy

Hard money loans are short-term in nature. Having a clear exit strategy automatically becomes a prerequisite as these loans attract additional financial and foreclosure risks.

Without a clear exit strategy, borrowers face the risk of defaulting on the loan, which can cause serious consequences, which are mentioned below:

- Legal battles

- Poor credit score

- Foreclosure of the property

- Loss of investment property

Before closing any loan deal, borrowers must have a laid-out exit strategy that may

involve refinancing the loan, reselling the property, or securing the loan with another

type of financing.

“Loan terms and Exit Strategies for Hard Money Lending Projects”

Not Streamlining Loan Periods with Project Timelines

Considering project timelines is important when opting for hard money loans to strategically plan the negotiating terms, have a contingency fund, align with lenders’ expectations, and more. Listed below is an overview of how important it is to streamline loan periods with project timelines:

- When securing a hard money loan in California, investors must prioritize aligning the loan period with the estimated project timelines. In case they expect any delays, the terms of the deal should be negotiated upfront to maintain emergency funds to prevent the derailing of your investment.

- Hard money loans have a shorter duration of 6 to 24 months as compared to certain rehab construction projects, which are long-term in nature.

Let us understand the concept of mismatched timelines with the information given below:

| Project type | Completion time | Loan duration |

| Small rehab | 3 – 6 months | 6 – 12 months |

| Large rehab/flip | 6 – 12 months | 6 – 18 months |

| Ground-up construction | 12- 24 months | 12 – 24 months |

Overseeing the Extra fees and Costs

Investors, when going for hard money loans, often neglect the fees and costs associated with it as they are inclined towards the potential benefits of it, like the low credit score requirement, quick financing, flexible terms, etc. It is equally important to understand the additional fees and costs involved in the process, as given below:

- Hard money loan lenders can easily fool investors by cleverly adding additional costs and hidden fees, which can substantially affect the borrower’s overall investment budget.

- Investors must always keep an open eye and demand a complete breakdown of the costs and fees involved in the loan process. Let us shed light on all the potential costs involved while considering hard money loans in California.

| Fee type | Estimated costs |

| Underwriting fees | $500 – $2,000 |

| Legal fees | Vary accordingly |

| Origination fee | 1 – 3% of the loan amount |

| Administrative fees | Vary accordingly |

| Appraisal fee | $300 – $600 |

Conclusion

Navigating the complexities of hard money loans in California’s dynamic real estate market demands a detailed comprehension of both the benefits and risks involved. An often overlooked essential step in hard money loans is a thorough investigation of the property involved. This ensures that the borrowers save their precious time and money from potential legal issues, hidden costs, or even project collapse.

Eventually, partnering with a reliable professional like Munshi Capital can resolve all of these issues. Whether you are a newcomer or an experienced investor, experts like Munshi Capital offer the support and guidance that support your long-term financial goals and confidently grasp the best real estate opportunities in California’s competitive real estate market.

Read More: How to Choose the Right Hard Money Lender: 7 Key Factors

Frequently Asked Questions

- What types of projects are suitable for hard money loans?

Distressed properties, bridge loans, construction loans, and fix & flip projects are the best choices for hard money lending.

- Are hard money loan terms negotiable?

Yes, investors with a strong financial portfolio and repayment capacity can easily negotiate the terms of hard money lending.

- Can I get a hard money loan with a weak credit score?

Yes, hard money loans are offered based on the collateral provided rather than the credit score of the potential investors.