Table of Contents

ToggleComprehensive Insight on Why Hard Money Loans Are a Popular Choice in California?

California is considered to have the most highly valued properties in its competitive real estate market due to factors like high demand, fast and efficient transactions, and more. Due to its dynamic nature, for investors who want to gain maximum return and capitalize on the opportunity at the right time, the traditional mortgage option may not be the right option due to stringent policies and lengthy processing time.

In this scenario, hard money loans emerge as the most feasible option for investors or borrowers. Do you know? In April 2024, California’s median home price rose to more than $900,000, which makes it the best option for investment and gaining high ROI through a hard money loan, a quick financing option.

The blog will focus on giving insights regarding hard money lenders California, the application process, lenders’s requirements, and more for you to make an informed decision.

Hard Money Lenders Requirement in California

Listed below are key requirements by hard money lenders in California that the borrower needs to fulfill for the loan:

- The type of property should be either residential or commercial property in good condition so the maximum value can be obtained. The properties have to be in California. Lenders are knowledgeable about local laws and market situations, which might affect the terms and approval of the loan.

- Hard money lenders in California or in general require an LTV ratio between 60% to 75%, if the LTV is lower, it results in a reduction in lender risk by large down payments and borrower equity contributions.

- The borrower should also give the loan a clear purpose and use, whether it is for property purchase, renovation, or flipping, so the lender can project viability for ROI.

- Respective state, local, and federal laws about hard money lending and the real estate market must be complied with by borrowers. This includes following building codes, environmental regulations, zoning laws, etc., in California.

- The borrower should also check the type of collateral accepted by the lender, which may also differ as per location. Commercial property-type collateral is more valued in prime urban locations like Silicon Valley or the Bay Area, as they have high rentals.

Key Factors While Choosing Hard Money Lender in California

Listed below are a few key factors that borrowers should look for while choosing a hard money lender in California:

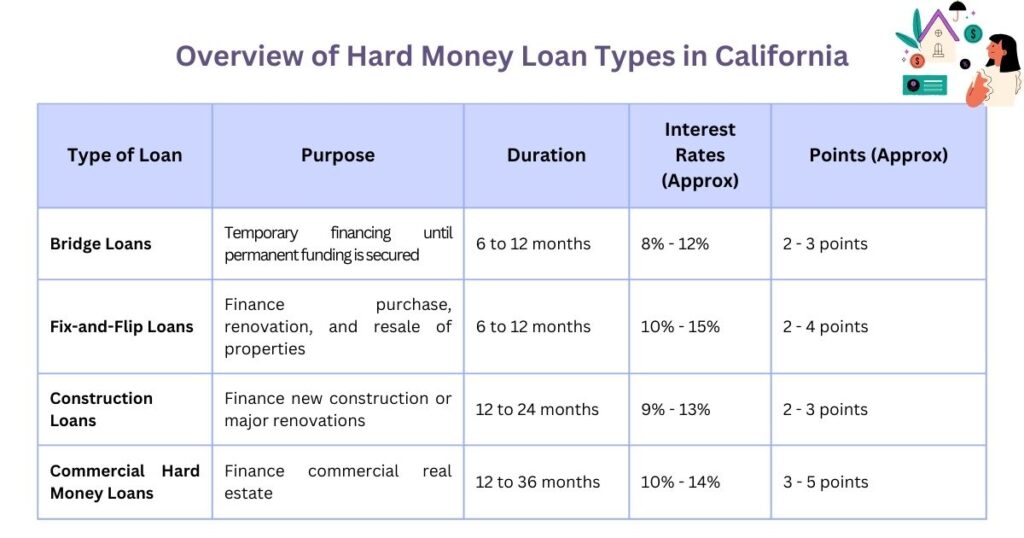

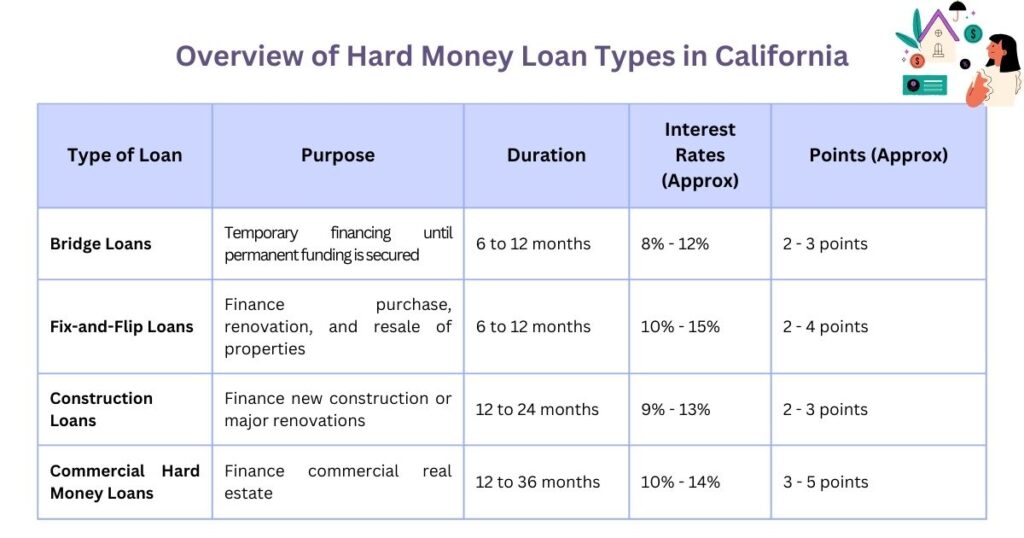

- The borrower should check the hard money loan rates in California, the interest rate is between 8% to 12%, it may also go up to 15% depending on the loan type and may vary across lenders, so the borrower should compare and go for the lender with the best competitive rates.

- Check for fees involved and how they impact loan costs, like the origination fee, which starts from around 2%.

- Understand repayment structure, which includes monthly payments and prepayment penalties.

- Check lender reputation through networks, reviews, licenses, associations, etc. The lender should have a license obtained from the California Department of Financial Protection and Innovation so they have a standard quality practice. Also, lenders in residential hard money lending should have a license from the California Residential Mortgage Lender License.

“Types of Hard Money Loans in California”

Step-by-Step Guide for Hard Money Loan Application Process in California

Listed below are easy 5 steps to get a successful hard money loan application in California:

Step 1: It is important to assess the need for the loan and then start searching for lenders based on interest rate, local expertise, LTV ratio, market reputation, etc.

Step 2: Collect documents like personal identification like a California driver’s license, proof of income, property information like condition, current value, etc., project plans, and also have a credit card report. The loan is asset-based, but some lenders may require it as per their requirements.

Step 3: Fill out the application form with documents specific to California regulations and pay the application fee to the lender.

Step 4: The next step is appraisal. Hard money lenders in California assess the property value based on market conditions and current value. The lender will further go for the underwriting process and give a loan commitment letter.

Step 5: Review terms as there may be specific clauses related to state laws, sign the agreement, look for that the loan is as per California’s legal requirements, and finally disbursement of funds is done.

Munshi Capital: A Leading Hard Money Lender in California

If you are living in California and want to finance your investment through a hard money loan, then Munshi Capital is your perfect financing solution partner.

Here’s why:

- Having local expertise will help in better assessment of local market trends and property value so you get the loan at the best competitive rates.

- We offer tailored loans as per borrowers’ needs, like bridge loans, fix-and-flip loans, construction loans, and commercial hard money loans.

- Through our streamlined approach, loan applications are processed efficiently, which is important in the fast-paced real estate market of California. Also, our transparent fee structure helps property owners build trust.

- Technological adaptations like real-time market analysis, digital document management, online application systems, etc., help in increasing the accuracy and optimization of the loan.

Conclusion

The California real estate market is evolving, and borrowers want to maximize their financial gains by opting for hard money loans, which is possible with the right sources available to them. It is important to have the right hard money lender who can offer efficient financing, tailored services, and flexible terms. Just comparing the interest rates of different lenders is not the optimal way to delve into the investment journey; it is pivotal to find the right platform like Munshi capital that can help you make informed decisions by offering detailed analytics of lenders, credibility checks, future market forecasts, customized loan solutions, and more. Connect with us today and optimize your financial goals.

Read More: Essential Tips for Competitive Home Pricing in California

Frequently asked questions

1. What is the processing time for a hard money loan in California?

The average processing time of a hard money loan in California ranges between 7 to 15 days; it depends from lender to lender.

2. How can I find the best hard money lenders in California?

To find the best hard money lenders in California, look for aspects like track record, transparent terms, reviews, local expertise or familiar area experience like in Los Angeles or San Francisco, network recommendation, etc.

3. What fees should borrowers look for when taking a hard money loan in California?

Borrowers should look for fees like origination fees, underwriting fees, appraisal fees, and potential prepayment penalties. The fee percentage varies from lender to lender; the average is between 1% to 10% of the total value of the hard money loan.

4. In California’s volatile real estate market, how can hard money lenders determine the value of a property?

Hard money lenders in California determine the value of property through appraisal reports, comparative market analysis, automated valuation models, local market trends, and more.