Table of Contents

ToggleWithout making a sizable down payment, is it possible to secure your next significant real estate investment?

Hard money loans may be your next best financing option in the fast-paced real estate industry of today, where transactions must be completed more quickly for a quicker turnaround and standard financing can be difficult.

Hard money loans are a flexible substitute for standard/traditional mortgage loans’ strict requirements and provide rapid access to finance.

But here’s the real question: does the flexibility of hard money financing can eliminate the need for a down payment, or is it still an essential part of the process?

Let’s take a closer look at this.

Is Down Payment Really Required For Hard Money Loans?

A down payment amount is the portion of the property’s purchase price that the borrower needs to pay upfront, while the rest is financed by the lender.

When opting for hard money loans, your down payment percentage determines your loan terms determined by hard money lenders.

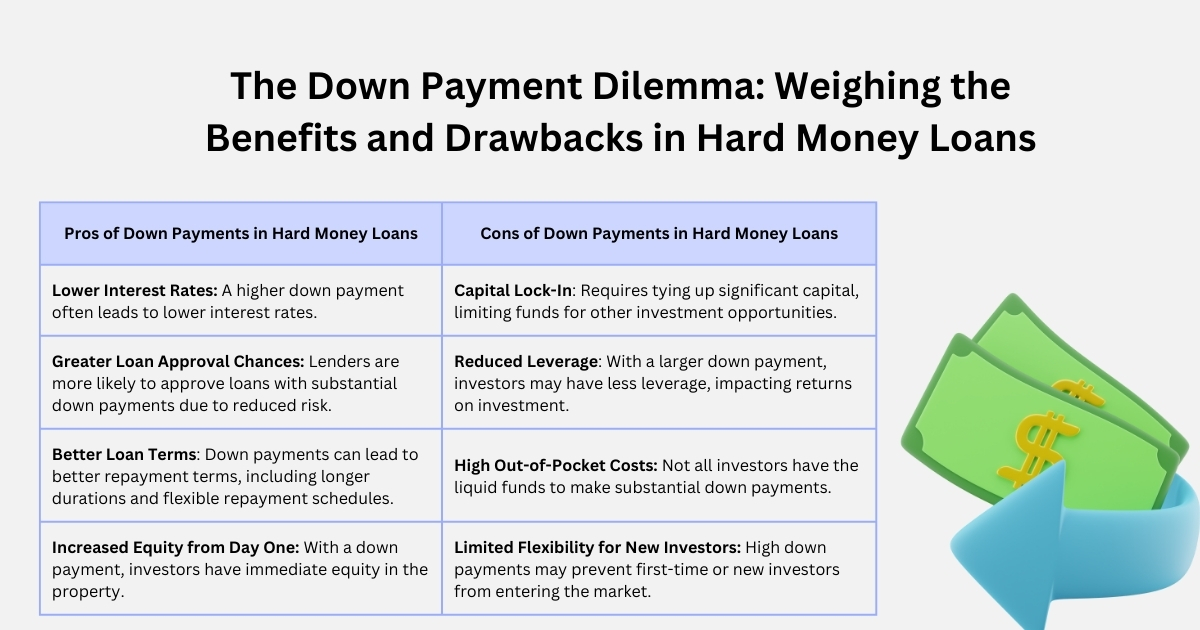

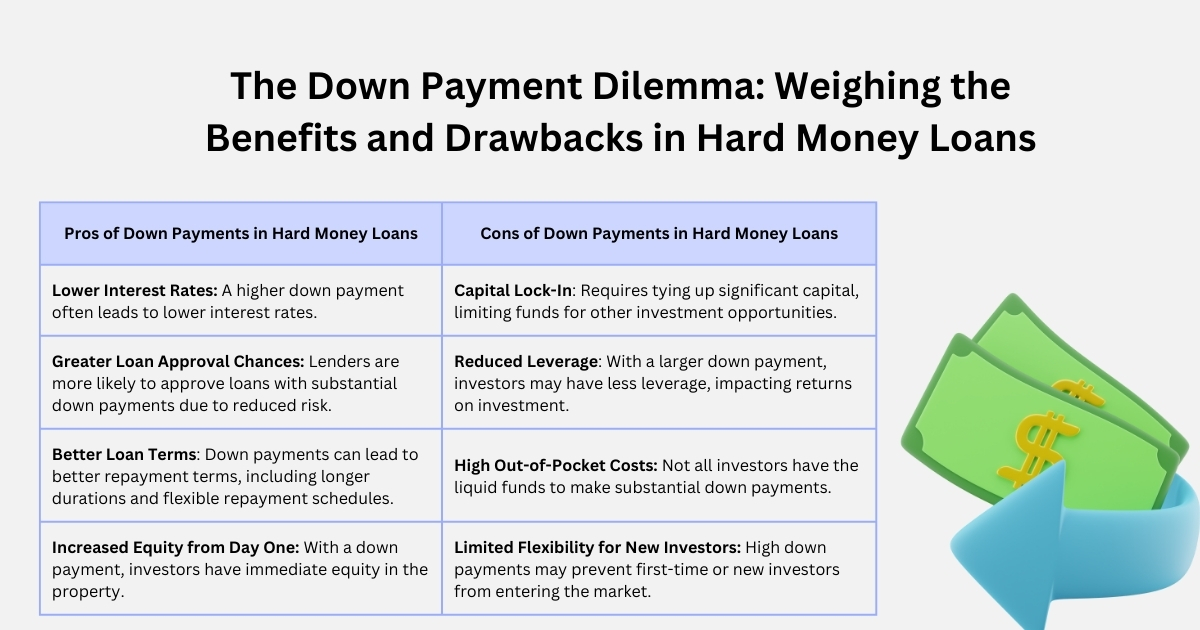

Let’s understand in brief why down payments are an integral part of hard money loans:

- Lowered in particular ranges down payments above or below the limits will invariably limit the loan amount or carry higher interest rates especially when availed risk is greater than the base rate of risk; higher down payments will assist the borrower in getting better loan sizes.

- A significantly larger down payment might also hasten the processes of approval. This is because the lenders’ risk exposure is minimized which increases their willingness to approve the loan request within a short time especially in situations that require quick turn of investments such as when undertaking a property flip or other similar fast paced scenarios.

Why Do Hard Money Lenders Require a Down Payment?

- It acts as a security measure for lenders as the loan is given on the basis of the borrower’s property value rather than their credit score.

- Having a down payment amount helps lenders create a lower loan-to-value or LTV ratio in case the future value of the property decreases. If the LTV ratio is the same, then the property resale value can cover the loan balance.

- It also showcases borrowers’ commitment towards the investment and improves lenders’ confidence in terms of timeline payments and ability to repay the loan. Down payment is also seen as a sign of borrowers’ financial stability and project feasibility.

- Down payment improves lender track as the defaults and foreclosure cases decrease, resulting in enhancing their reputation in the industry, which increases their business.

Down Payments Made Easy: How Much Should You Put Down for a Hard Money Loan?

This is the most asked question by borrowers when going for a hard money loan. Let’s understand this:

The general range for a down payment is between 20% and 30% of the property value, which can vary based on lenders’ policies, property type, and other related factors.

The estimate of a down payment percentage is given in the table below based on the property types:

| Property Type | Typical Hard Money Loan Down Payment Range | Why Does it Differ? |

| Residential | 20% to 30% | The standard requirement for residential properties. |

| Fix-and-Flip | 10% to 20% | Generally lower, especially if the property has a high after-repair value (ARV). |

| Commercial | 25% to 40% | Higher requirements due to the increased risk associated with commercial properties. |

The loan-to-value ratio is another vital component that influences the financing of your hard money loan down payment.

It analyzes how much of the property’s value the lender is willing to finance, with the difference amount being the down payment percentage.

Let’s understand this through a brief example below:

| Property Value | LTV or Loan-to-Value Ratio | Loan Amount | Hard Money Loan Down Payment (Remaining %) | Down Payment Amount |

| $200,000 | 70% LTV scenario 1 | $140,000 | 30% | $60,000 |

| $200,000 | 80% LTV scenario 2 | $160,000 | 20% | $40,000 |

A lower down payment is required if your LTV ratio is higher. Lenders will offer a higher LTV ratio if a property has a high After-Repair Value (ARV), is situated in a market that is in high demand or expanding, the borrower has a track record of success, etc.

Looking for a Hard Money Loan with No Down Payment? Know the Key Considerations

When hard money loans lenders offer no down payment loans, they are taking a huge risk against the borrowers that is often substituted by lenders’ strategies of higher interest rates, additional fees, or stricter terms.

Ask these questions as considerations when opting for a no down payment hard money loan:

- Can I Handle the Increased Cost? The no-down payment comes with a higher interest rate and fees

- Do I Have Sufficient Cash Flow for Ongoing Project Needs? A hard money loan with no down payment allows investors to keep more money upfront for other expenses. However, future cash flow may be more constrained due to increased interest and fees. It’s more accessible initially, but it’s not limitless money.

- Is My Exit Strategy Solid? When going for no down payment, it is important to have an exit strategy like refinancing or selling or another backup plan to repay the loan.

- What Are the Lender’s Terms and Conditions? Hard money lenders, when offering no down payment loans, may include a few restrictive clauses like prepayment penalties, shorter loan terms, or additional collateral requirements.

Are There Any Special Considerations For Hard Money Loans With No Down Payment?

- The borrowers having high-equity properties or located in prime areas where there is potential for appreciation can get leverage of no down payment.

- Borrowers with a good track record and real estate experience may be preferred by lenders for no down payment.

- Having a strong loan-to-value ratio may benefit you with no down payment. A lower LTV ratio reflects that the borrower is eligible for a decreased loan amount in relation to the property’s value or worth, which mitigates the lender’s risk.

- Borrowers offering other assets as collateral can get no down payment for the hard money loan feature.

Key Takeaway

Down payments can be a smart move rather than just an obligation; they’re an intelligent investment that helps enhance the speed and leverage that make hard money loans a lucrative choice.

While most hard money loans do require a down payment, borrowers with strong credit portfolios may be offered zero or flexible down payment options along with favorable loan terms by hard money lenders.

To know if you are eligible for a zero-down payment, contact Munshi Capital today and get tailored financial solutions for your investment.

Know More About: How Do Hard Money Loan Requirements Differ from Traditional Mortgage Loans?

Frequently Asked Questions:

- What is the minimum percentage for a hard money loan in California?

The down payment percentage for a hard money loan is 20% to 30% for residential properties, whereas for commercial properties it is between 30% to 40%. The percentage varies based on market fluctuations and borrowers’ credit portfolios.

2. Are hard money loans for bad credit and no down payment available for borrowers?

Hard money loans for borrowers with bad credit scores are available, but with some down payment percentage so that the risk can be offset. However, some lenders may offer a cross-collateralization option where no down payment option is possible.

3. How can I find hard money lenders who provide flexible down payment options in California?

To find the best hard money lenders in California offering flexible down payment options look for lenders offering loans for limited cash reserves, poor credit, or unique solutions like cross-collateralization.

4. What factors influence down payment amount in hard money loans?

Factors like property location, borrower’s experience, loan terms, collateral, and other related factors influence the down payment percentage in hard money loans.