Introduction

Do you know from April 2022 to March 2023, approx $53.3 billion has been spent by foreign nationals for purchasing real estate properties in the US. This led to an increase in the median price of home to $396,400. With the surge, hard money loans have become a viable option for foreign nationals as they offer a flexible and efficient alternative to traditional financing.

The current market size of hard money loans is more than $12 billion and is expected to increase double-fold in the coming years, making it an attractive option for foreign investors who want to have quick access to U.S. real estate opportunities.

But the basic question arises whether or not foreign nationals can get a hard money loan? Let’s find an answer to this in this blog.

Understanding Hard Money Loans

Hard money loans are short-term financing that offers asset-based lending rather than focusing on the borrower’s credit portfolio. Unlike traditional financing, these loans provide potential borrowers, mainly foreign investors, with faster access to capital, essential to building a competitive edge by securing profitable real estate opportunities on time.

Why Are Hard Money Loans Attractive To Foreign Investors Seeking To Enter The US Real Estate Market?

Securing financing in the U.S. can be quite daunting for foreign investors who often face the challenges of extensive documentation, a strong U.S.-based credit portfolio, and evidence of consistent U.S.-based income.

Let us understand why foreign investors must consider hard money loans and how they can be used to achieve their investment goals:

Overcoming Documentation Barriers

- Hard money loans eliminate the need for extensive documentation by solely focusing on the collateral’s value and its profit potential.

- Hard money loans lenders have simplified the documentation prerequisites for foreign investors by asking for:

- Business Plan: Lenders often request a detailed investment plan, especially in the case of income-generating properties, to ensure timely repayment of the loan.

- Proof of Funds: Investors must disclose their liquid assets and other resources, which must be sufficient for the down payment and any upfront costs involved.

- Identity Verification: Certain hard money lenders may ask for identification documents such as passports, etc. for legal verification of potential foreign investors.

Leveraging Hard Money Loans For Quick Market Entry

- In fast-paced markets like the U.S. where properties are sold within days or hours, time is extremely crucial for foreign investors to purchase properties swiftly with fewer delays.

- Hard money loans benefit investors with a competitive edge by offering quick access to capital funds, thus attracting various profitable and great opportunities.

Overcoming Credit Challenges

- Traditional hard money loans lenders follow the stringent prerequisite of having a strong U.S.-based credit history to invest in any real estate project.

- Traditional financing usually rejects investors without a U.S.-based credit history, which makes it nearly impossible for foreign investors to purchase real estate in the U.S.

- Potential investors can easily secure hard money loans for bad credit scores, as they primarily focus on the property’s value rather than the borrower’s credit score, which encourages foreign investors to easily enter and invest in the local U.S. real estate market

Flexibility In Loan Terms

- Hard money lending offers investors customization of the loan structure according to their specific needs and future investment goals.

- Although these loans are offered at a higher interest rate than traditional loans and involve other fees, these terms can be negotiated if the investors offer a substantial down payment or have a clear exit strategy for the timely repayment of the loan.

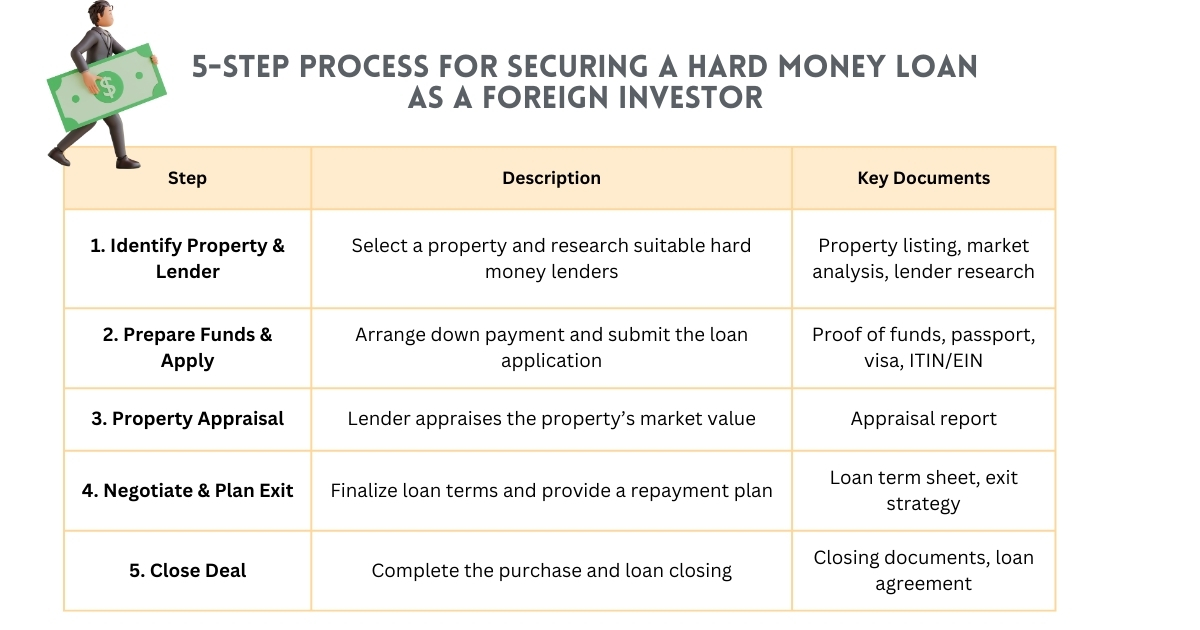

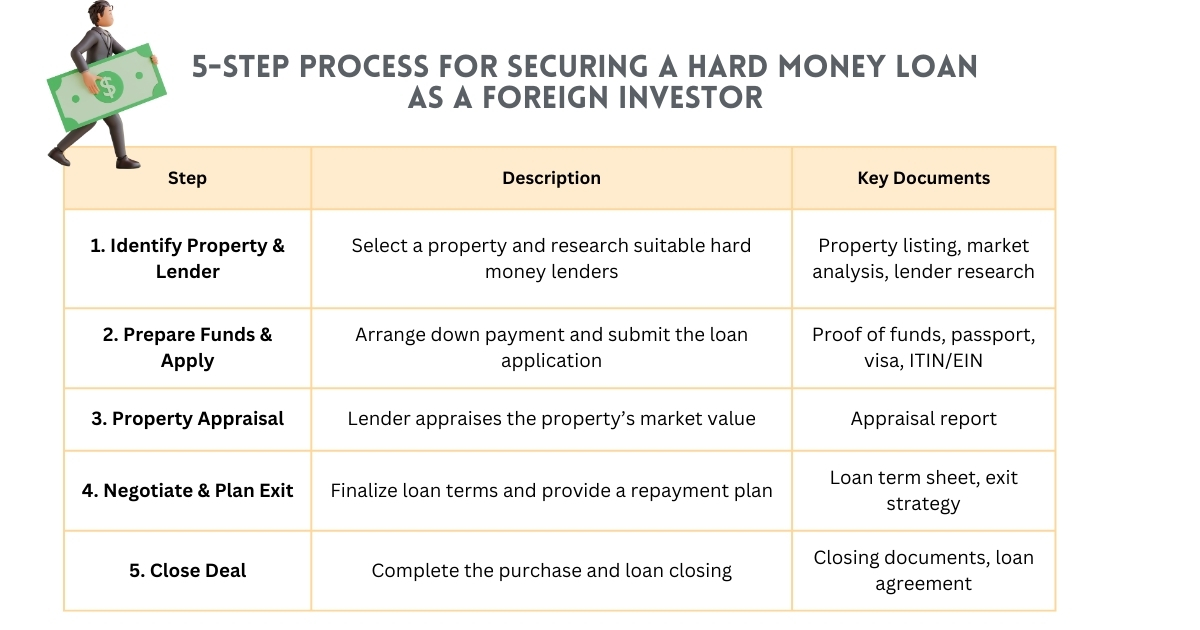

Step-by-Step process for securing a hard money loan as a foreign investor

What Are The Eligibility Criteria Of Foreign Investors For Hard Money Loans in the US?

Foreign investors are mainly attracted to the U.S. real estate market due to its growth and profit potential. Let us understand the various considerations and eligibility criteria that they must fulfill to secure hard money loans:

Due Diligence And Documentation

- Hard money loans usually do not involve extensive paperwork, but foreign investors are expected to furnish essential documentation.

- Lenders may also conduct a property appraisal to ensure that the property is worth the loan amount. Investors must hire legal professionals to meet the local law requirements essential for the ownership and financing of the property involved.

U.S. Tax Identification Number (IITN Or EIN)

- Hard money loans lenders often ask their foreign investors to furnish a Taxpayer Identification Number (ITIN) or Employer Identification Number (EIN), especially in the case of income-generating properties.

- Foreign investors who do not have a social security number can apply for ITIN, whereas those who are purchasing a property through a U.S.-based LLC or corporation can apply for EIN.

Down Payment Requirements

Since lenders take upon higher risks when providing hard money loans to foreign investors, they demand higher down payments to mitigate their risks.

Non-U.S. Resident Status

One of the major advantages of hard money loans is that it is not stringent about whether the potential investors are residents and offer loans to international clients, unlike traditional financing. Nevertheless, investor’s residency status may still affect their loan terms and documentation requirements.

Proof Of Funds

Foreign investors can strengthen their eligibility by furnishing appropriate and sufficient funds to meet the lender’s financial requirements, which include a down payment, any upfront costs, and closing costs.

Conclusion

Hard money lending facilitates and encourages foreign real estate investors to purchase any residential, commercial, and land development U.S.-based properties. It offers fast and flexible financing, which helps bypass the stringency that traditional financing involves.

At Munshi Capital, we specialize with interested foreign real estate investors in converting their residential and commercial property dreams into reality through hard money lending. Whether you are facing any obstacles with traditional financing or need tailored solutions catering to your financial and investment goals, Munshi Capital is here to provide the perfect professional assistance while effectively managing your potential risks and rewards.

Read More: What Hard Money Lenders Look for in Borrowers?

Frequently Asked Questions:

- What percentage of the loan is required as a down payment in hard money loans?

Hard money loans require investors to pay upfront a substantial 20% to 40% as a down payment of the property value due to the higher risks involved.

- What is the approval time for a hard money loan?

These loans are usually approved within 7–15 days, and in cases of emergency, foreign investors may receive approval within 48 hours of applying.

- What types of properties are eligible under hard money lending?

Multi-family, commercial, fix-and-flip, distressed, residential, and land-for-development properties are eligible for hard money loans.

- Can foreign investors benefit from refinancing hard money loans?

Yes, foreign investors can benefit from refinancing, as it will potentially lower their interest rates and improve their overall financial position once their property’s value has increased