Table of Contents

ToggleIntroduction

Hard money lending is often the first choice of borrowers who require quick and flexible financing. However, when you receive your hard money loan estimate document, it can be quite overwhelming, and the numbers and percentages feel anything but simple to comprehend.

The good news is that understanding a hard money loan estimate helps you to make informed decisions and eliminates the risk involved with agreeing on loan terms that are detrimental to your financial health. Let’s take it step by step to ensure that your hard loan estimate is no longer a mystery!

What is a Hard Money Loan Estimate?

- A hard money loan estimate offers a detailed breakdown of the financial terms and conditions, which essentially paints a clear picture for borrowers regarding the costs involved, the repayment structure, and additional costs tied to the loan.

- It is a great tool for transparently communicating the loan’s risks and rewards and whether it aligns with their financial needs.

Hard Loan Estimate Demystified – No Jargon, Just Clarity

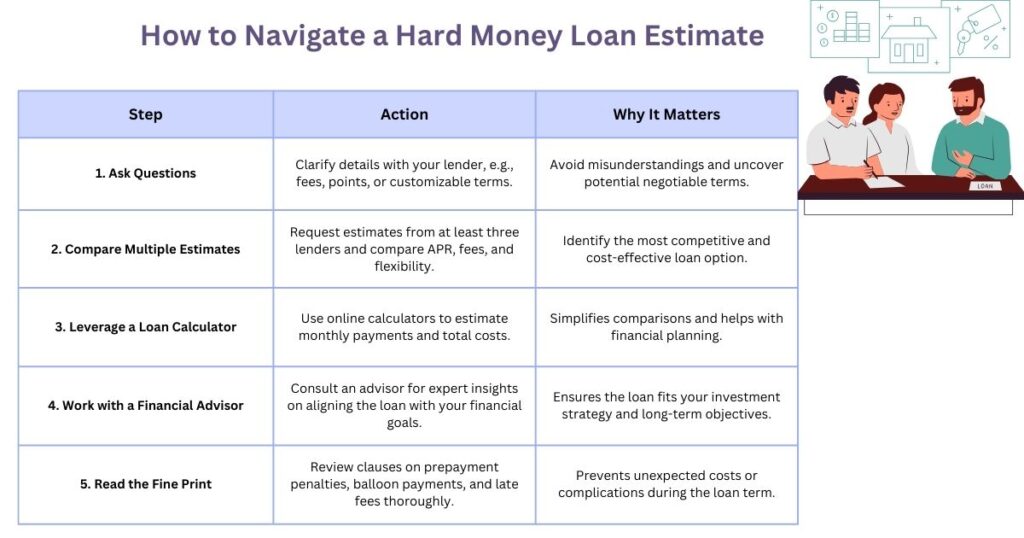

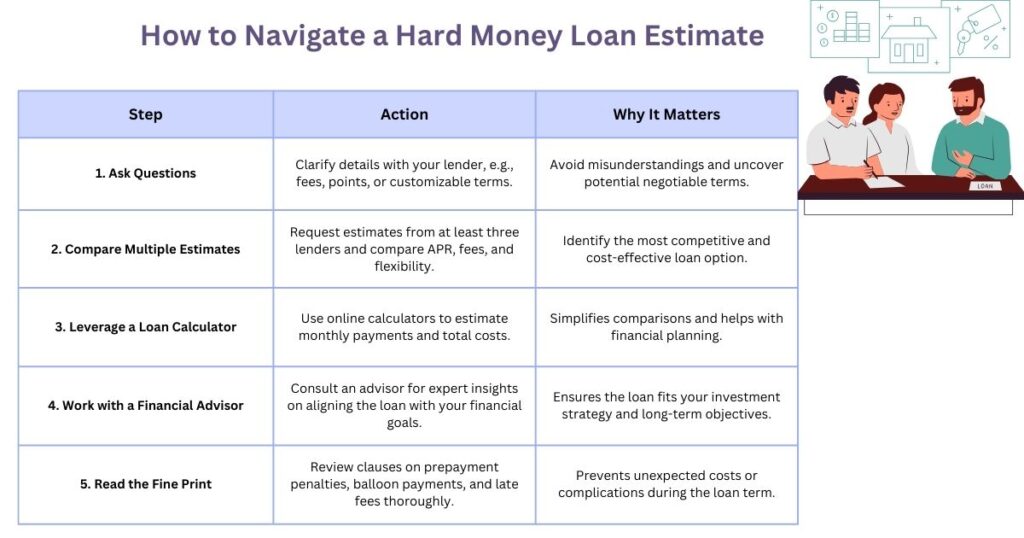

When potential borrowers receive a hard money loan estimate from hard money loan lenders, it looks quite difficult and altogether an alien concept. But it is not as complicated as it looks. Let us dive into the various aspects to help you confidently navigate the road of hard money loan estimate:

Loan Term

- The loan term is the duration for which the lender provides the loan to the borrowers. In the case of hard money loans, this period usually varies between 6 and 36 months.

- The repayment period of the loan entirely depends upon the nature of the project. If it is a short-term project, the borrowers will prioritize a shorter duration to mitigate interest costs, and vice versa.

- It is essential for investors to align the projected timelines of their projects with the loan term to ensure no penalties or unnecessary interest payments are incurred in the near future.

Prepayment Penalties

- Certain hard money loans lenders charge prepayment penalties to safeguard their potential interest income in case the loan is repaid before the full term of the loan is completed.

- Let us understand the calculation of these penalties through the example given below:

Method | Description | Example Calculation | Result |

Percentage of Loan Balance | A fixed percentage of the remaining loan balance | 3% of $250,000 | $7,500 |

Months of Interest | Interest for a set number of months on the loan | 6 months of interest on $250,000 at 12% annually | $15,000 |

Flat Fee | A predefined flat penalty fee | A prepayment penalty is a flat $6,000 | $6,000 |

Sliding Scale | Reduces based on how long the loan is active | 3% in year 1, 2% in year 2, 1% in year 3 on $250,000 | $5,000 (in year 2) |

If you plan to repay the loan early, it is essential to consider those lenders who offer zero to negligible prepayment penalties to avoid unnecessary costs in the future.

Fees and Closing Costs

- Hard money loans often include various additional fees and costs that are charged to cover the services provided for the successful finalization of these loans.

- Let us take a look at the fees and costs that are quite common when considering a hard money loan:

Fee Type | Description |

Origination Fees | Charged for creating and processing the loan |

Underwriting Fees | Covers the lender’s evaluation of your loan risk |

Appraisal Fees | Fee for assessing the property’s market value |

Title and Escrow Fees | Ensure clear property ownership and secure funds |

Document Preparation | Cover the preparation of legal and loan documents |

Inspection Fees | Charged for property inspections during underwriting |

Monthly Payment

- Hard money loan borrowers have two options to consider when deciding their course of action in case of monthly payments: interest-only payments or fully amortized payments.

- Let us understand these approaches through the table given below:

Payment Type | Description | Example Calculation | Result |

Interest-Only Payments | You pay only the interest each month, keeping the principal unchanged. | $200,000 loan at 10% interest = $200,000 × 10% ÷ 12 | $1,666.67 per month |

Fully Amortized Payments | You pay both interest and principal, reducing the loan balance over time. | $200,000 loan at 10% over 2 years = $9,212.79/month (approximate) | $9,212.79 per month |

Borrowers must decide on either of these approaches based on their project timelines and cash inflows, as it plays a pivotal role in how your loan reduces over time.

Points

- Points are the upfront fees that lenders charge as a percentage of the total loan amount.

- These points usually vary between 1% to 5% and can result in a significant rise in the initial costs.

- However, in certain cases, paying points upfront can reduce your interest rates, resulting in long-term savings.

Interest Rate

- Hard money loans are on the pricier side and attract higher interest rates ranging between 8% to 15%.

- Interest rate is basically the annual cost of borrowing charged by the lenders, which is paid as a percentage share of the total loan amount.

- Borrowers must explore other potential offers to ensure that they secure a great deal with the lowest interest rates.

Loan Amount

- In a hard money loan, the loan amount is determined by the property’s value and loan-to-value ratio (LTV).

- Loan amount serves as a foundational factor for major financial aspects such as interest rates, monthly payments, and closing costs.

- Borrowers must closely assess the property’s value as against the loan taken to avoid extreme financial strain while ensuring sufficient funding for their investment goals.

Conclusion

Understanding a hard money loan estimate doesn’t have to be overwhelming. By comprehending all the essential components of a hard money loan estimate, borrowers can easily navigate and choose the best offer that benefits and aligns with their financial goals.

At Munshi Capital, we understand the importance of time and clarity. Whether you are a first-time borrower or a seasoned investor looking to refresh your knowledge, Munshi Capital offers you straightforward guidance, competitive loan offers, and expertise to help you make informed investment decisions and navigate the complexities of hard money loan estimates with ease.

Read More: What Hard Money Lenders Look for in Borrowers?

Frequently Asked questions

- How does the approval process work for hard money loans in California?

The approval of hard money loans in California is based on the property’s value and LTV ratio and is quicker than traditional loans, with approvals often within days.

- Do hard money lenders California charge prepayment penalties?

Certain hard money lenders in California take prepayment penalties. It is essential for the borrowers to discuss and review the loan offer document carefully to avoid any miscommunication.

- Are hard money loan rates California higher for first-time borrowers?

Yes, new investors attract a higher rate of interest for hard money loans California as compared to seasoned investors to mitigate the involvement of the lender’s risk.