Pros and Cons of Hard Money Rehab Loans

Hard money rehab loans offer quick, flexible financing for real estate investors looking to renovate distressed properties. With fast approval, accessibility for borrowers with low credit scores, and short-term durations, these loans provide a competitive edge. However, they come with higher interest rates, substantial down payments, and shorter repayment periods, posing risks like foreclosure and over-leveraging. To mitigate these challenges, investors should develop a solid exit strategy, choose the right lender, and maintain a contingency plan. Hard money rehab loans can unlock profitable opportunities, but careful planning is crucial for success. Contact Munshi Biz for expert guidance on navigating these loans.

Types of Hard Money Rehab Loans and Their Specific Uses

Hard money rehab loans offer real estate investors fast, flexible financing to renovate distressed properties for resale or rental income. These asset-based loans come in various types—bridge loans, fix-and-flip loans, construction loans, rental rehab loans, and more—tailored to meet specific project needs. With quick approval and high loan-to-value ratios, they provide a competitive advantage, though at higher interest rates (9.5%-14%) and shorter terms (6 months to 2 years). Hard money rehab loans are ideal for investors looking to capitalize on property appreciation, rental income, or house flipping. Choose the right loan type based on your project’s goals to maximize profitability and streamline funding. Contact us for expert advice on securing your next hard money rehab loan.

The Ultimate Guide to Hard Money Rehab Loans

Hard money rehab loans are short-term, asset-based loans designed for real estate investors seeking quick financing to renovate distressed properties. With various types such as fix and flip, rental rehab, and construction loans, these loans offer flexible terms, fast approval, and funding without strict credit requirements. Backed by the property’s value, hard money rehab loans come with higher interest rates (9.5%-14%) but provide a competitive edge for investors looking to capitalize on time-sensitive opportunities. When choosing a lender, consider their reputation, interest rates, fees, and loan terms to ensure a smooth borrowing experience. These loans are ideal for investors aiming to maximize returns on real estate investments.

No Credit Check Hard Money Lenders: Myths and Realities

Hard money lenders that offer no credit check loans focus more on property value and ROI rather than the borrower’s credit score. However, myths around no credit check lending persist. Contrary to popular belief, these lenders conduct background checks, evaluate exit strategies, and offer flexible terms based on the borrower’s financial stability and experience. Licensing requirements still apply, and loan amounts are limited by property value, typically determined by the After Repair Value (ARV). Borrowers must research lenders for favorable terms, considering interest rates, LTV ratios, and fees. No credit check hard money loans are ideal for borrowers with poor credit, offering a fast alternative to traditional loans.

What Hard Money Lenders Look for in Borrowers?

Hard money loans are asset-based loans secured by real estate, making them ideal for borrowers needing quick financing. Unlike traditional loans, hard money loans prioritize the property’s value over the borrower’s credit history. Key requirements include substantial property equity, a down payment of 20-40%, a strong exit plan, and financial stability. Lenders also consider the property’s current condition and market trends. To improve approval chances, borrowers should have liquid reserves, a credit score of 550+, and a proven investment history. Interest rates for 2024 range from 9.5-12%. By meeting these criteria, borrowers can secure favorable loan terms. For expert guidance, contact Munshi Biz.

How to Refinance a Hard Money Loan: A Step-by-Step Guide

Hard money loans have become a popular short-term financing option for real estate investors, with 30% of these loans being refinanced within two years. Refinancing offers numerous benefits, including improved loan terms, debt consolidation, lower interest rates, and extended repayment periods. It’s ideal for investors looking to complete rehab projects, purchase additional properties, or avoid high-interest balloon payments. To refinance, borrowers must meet eligibility criteria such as a minimum credit score of 620, a sufficient loan-to-value ratio, and income verification. The process involves evaluating your financial situation, gathering documents, comparing lenders, and choosing the best loan offer. Refinancing a hard money loan strategically helps investors secure long-term funding and optimize cash flow for future investments.

2024 Jumbo Loan Down Payment Requirements: Tips for Homebuyers

Jumbo loans are mortgages for high-value homes that exceed the Federal Housing Finance Agency’s (FHFA) conforming loan limits, set at $766,550 in 2024. While traditionally requiring a 20% down payment, some lenders now offer jumbo loans with as low as 5% down. Key factors influencing down payments include loan size, credit score, income, and lender policies. Borrowers can improve terms by enhancing credit scores, saving diligently, exploring various lenders, and considering down payment assistance programs. Though jumbo loans do not require private mortgage insurance (PMI), they involve stricter qualifications and higher closing costs. Refinancing is also an option for borrowers seeking better terms. To navigate jumbo loans effectively, consult an experienced mortgage lender for tailored advice.

Conventional Loan vs Jumbo Loan: Which Mortgage Option Suits You Best?

When buying a home, understanding the differences between conventional and jumbo loans is crucial. Conventional loans are government-backed, ideal for first-time buyers with conforming loan limits and flexible down payment options. Jumbo loans, on the other hand, cater to high-priced properties that exceed conforming loan limits, typically requiring stricter qualifications, higher down payments, and slightly higher interest rates. While conventional loans offer more flexibility, jumbo loans are necessary for luxury homes in expensive markets. Assess your financial situation, down payment capacity, and long-term goals to choose the best option. Consult a mortgage expert to guide you through the process efficiently.

Jumbo vs Super Jumbo Mortgages: A Comprehensive Guide for Homebuyers

Jumbo and super jumbo loans offer financing options for buyers seeking luxury homes in high-priced markets like New York and Los Angeles. A jumbo loan exceeds the conforming loan limit of $726,200, while a super jumbo loan typically starts at $3 million. Both require strong financial qualifications, such as excellent credit, substantial down payments, and proof of income. While jumbo loans are more widely available, super jumbo loans cater to ultra-high-net-worth buyers. Despite higher interest rates and a complex application process, these loans allow affluent buyers to purchase premium properties. Choosing between the two depends on the home’s price and your financial situation. For expert advice and to find the right lender, contact munshi.biz today.

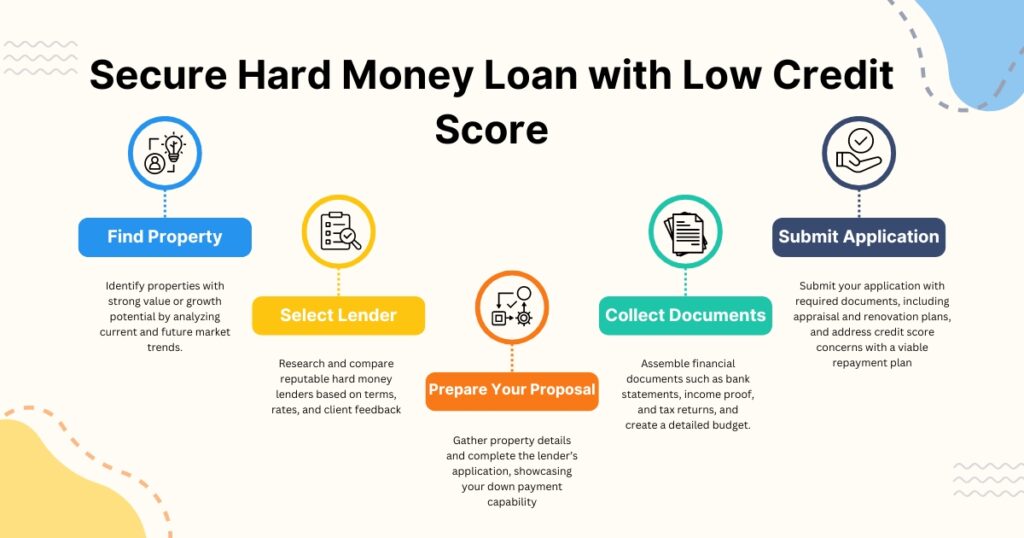

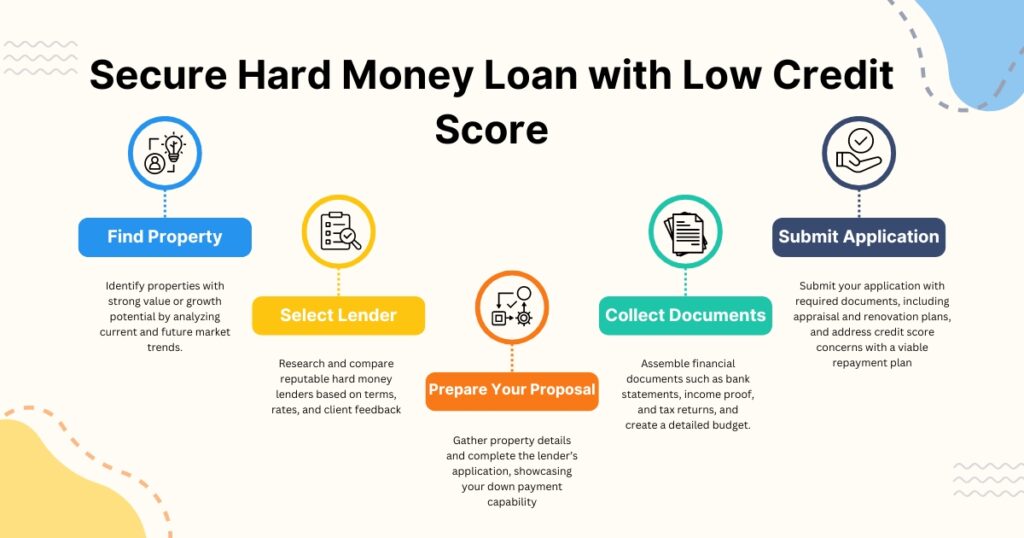

How To Secure A Hard Money Loan With A Low Credit Score?

Hard money loans are a flexible and quick financing solution for multi-family real estate investments, offering an alternative to traditional loans. These asset-based loans prioritize property value over the borrower’s credit score, making them ideal for investors with less-than-perfect credit or those needing fast capital. Their short-term nature provides bridge financing, allowing investors to secure a property quickly and refinance later. Key benefits include a faster approval process, higher risk tolerance, and quick funding, though they come with higher interest rates, typically 8%-15%, and a lower loan-to-value (LTV) ratio. To secure a hard money loan for a multi-family property, borrowers should prepare necessary documentation, compare lenders, and negotiate terms. It’s important to assess property values accurately, plan for potential risks, and have a solid exit strategy to convert the loan into long-term financing or sell the property. Working with commercial lenders specializing in multi-family investments can maximize returns by leveraging quick funding and tailored financing solutions.