Table of Contents

ToggleChoosing the right financing option while investing in real estate can positively impact your financial results. DSCR loans and conventional loans are the most commonly chosen loans. This blog will focus on understanding the key features, advantages, and disadvantages so you can evaluate which is the right option for your real estate investment.

Understanding DSCR Loan

DSCR Loan, also known as Debt Service Coverage Ratio, is usually offered to borrowers going for commercial real investment by assessing property income revenue potential. The desired ratio accepted by lenders is 1.25 or higher, indicating sufficient cash flow.

Formula: Net Operating Income/Debt Service

DSCR Loan Advantages

- Leveraging Property Income: Rather than the borrower’s personal income or credit history, the loan is approved mostly based on the property’s cash flow.

- Higher Loan Amount: Given the property’s financial performance, a larger loan amount than a conventional loan might be feasible.

- Longer Loan Terms: If going for big commercial buildings with extensive revenue cycles, DSCR loans offer longer repayment terms ranging between 15-30 years. This can assist investors in managing cash flow and low monthly payments.

- Opportunity for Growth: Investors can maximize their property income potential and improve their real estate portfolio.

DSCR Loan Disadvantages

- High Interest Rate: Compared to conventional loans, DSCR loans have a high rate of interest as they focus on property income and not borrower creditworthiness. The current rate in the market is between 6%-7% and tends to go higher.

- Prone to Rental Risk in the Market: Tenant turnover rates, variations in rental income, and shifts in the local rental market can impact a DSCR loan’s profitability. Investors need to evaluate the rental market’s stability.

- Higher Down Payments: Higher down payments are needed for DSCR loans compared to conventional loans leading to a decrease in investment for additional investments.

Learn About Conventional Loan

A conventional loan is used for both residential and investment properties and is sanctioned based on borrowers’ creditworthiness. It is not granted by any government agency but given by private lenders. It is bifurcated into conforming and non-conforming loans.

Conventional Loan Advantages

- Flexible Terms and Conditions: The conventional loan offers flexible loan terms ranging from 10 to 30 years and more as per the borrower’s financial goal and situation

- Low Interest Rate: As the risk is involved less due to the loan being based on creditworthiness rather than property income, the interest rate is lower

- Flexibility in Variety of Property Types: The loan is available for different properties ranging from residence to investment properties

- PMI Added Advantage: If a borrower can make a down payment of up to 20% then the cost of PMI can be avoided

Conventional Loan Disadvantages

- Extensive Documentation: Documentation of assets, income, and employment is required for conventional loans, and this can be a time-consuming and complicated procedure.

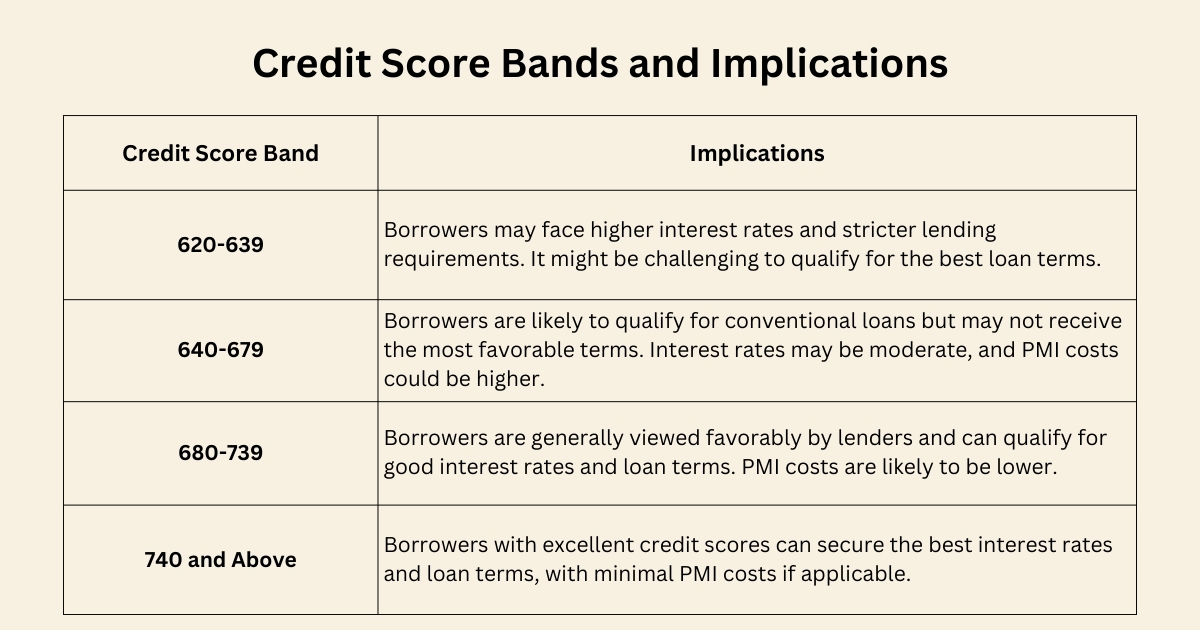

- Stringent Qualification Criteria: To be eligible for a conventional loan, a ratio of a minimum credit score of 620 is needed, which can lead to limitations in applying for a loan.

- High PMI for Lower Down Payments: If a borrower is not paying up to 20% down payment then the monthly mortgage payment increases

DSCR Loan vs Conventional Loan- Key Differences

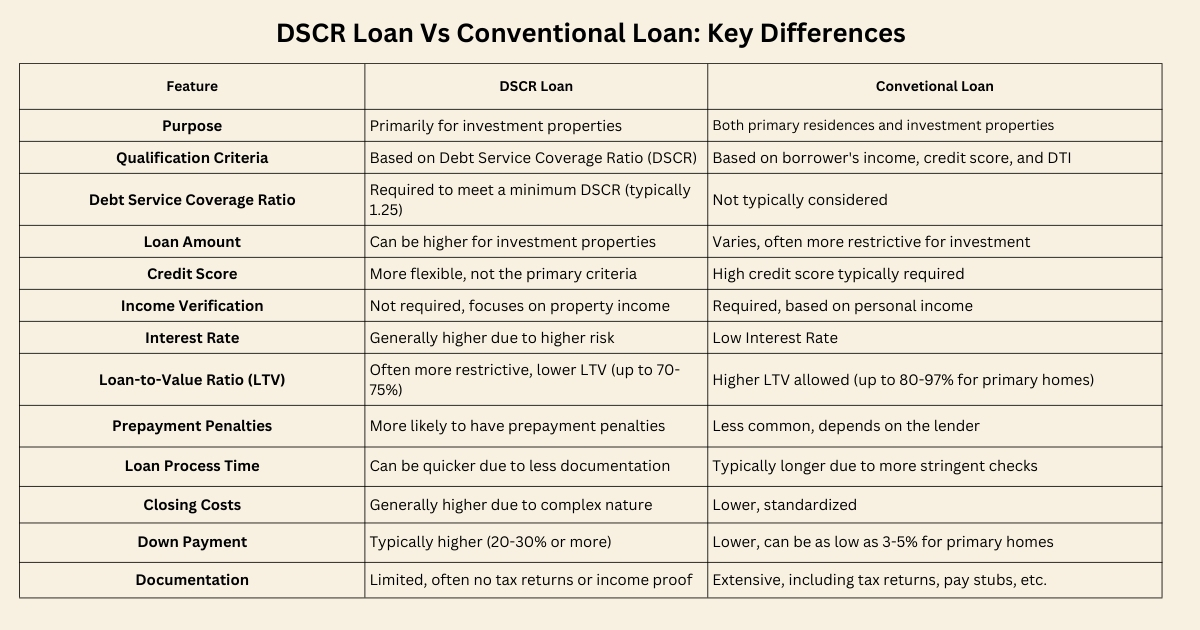

The chart below highlights the key differences between DSCR loans and Conventional Loans, so the borrower can evaluate the characteristics and select the best option according to financial goal and position.

Evaluate Which is the Right Option For You

Before selecting the loan for your investment it is important to understand a few considerations and how they align with your financial goal.

Listed below are key pointers.

- Evaluate your long-term investment plan. For example, if you look for cash flow coming from rental income, which may potentially result in a higher down payment, you can go for a DSCR loan, but if you want to go for low initial costs and expand in a broad range of properties, going for a conventional loan is better.

- Understanding risk mitigation strategies like DSCR loans reduces personal finance risk due to strict property cash flow requirements, whereas conventional loans provide clearer terms, one must carefully assess their exposure to personal financial risk, particularly in times of economic volatility.

- Perform a thorough examination of the property’s cash flow. Consider whether the property can bring in enough revenue to pay off debt when applying for a DSCR loan (usually a DSCR of 1.25 or above), if not then go for a conventional loan.

Quicks Additional Tips for Getting Successful DSCR and Conventional Loan Application

To get a successful loan application for DSCR and conventional loans, having a good credit score, business plan, complete financial documentation, debt to income (DTI) ratio, and more is mandatory, but there are a few other parameters like pre-approval, property investment details, appraisal and inspection, etc., which should be evaluated for quick approval.

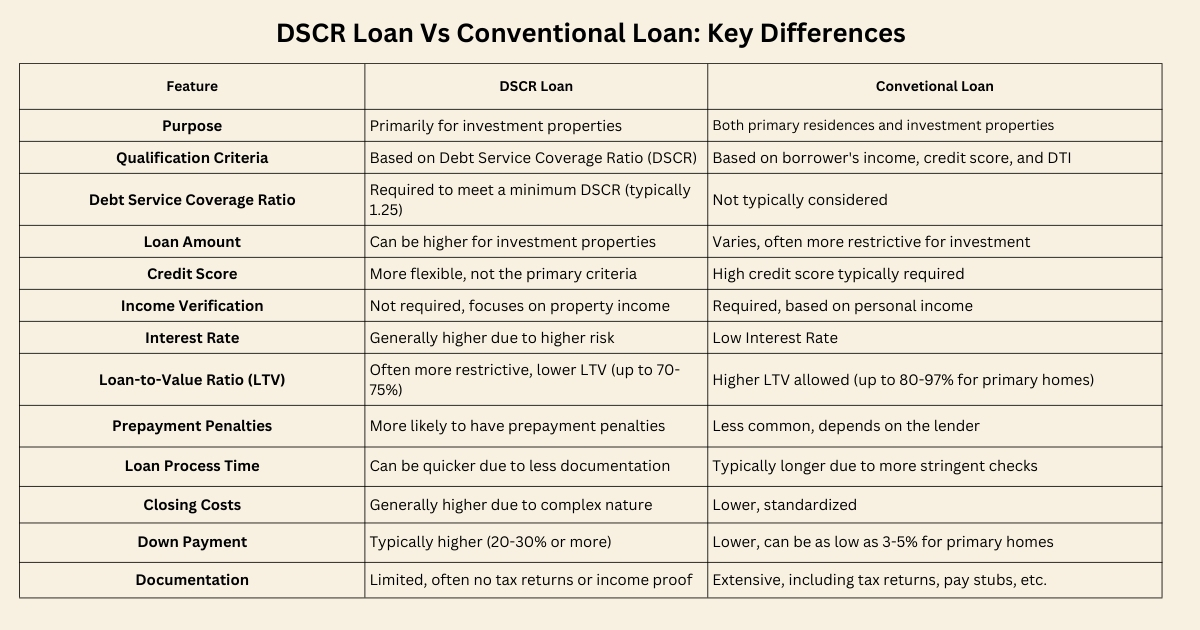

Although the requirements may vary based on the loan type. The chart below consists of a few additional tips for successful loan application and their requirement as per the loan type:

Conclusion

If you have a strong credit profile and personal income, you can apply for a conventional loan as they have lower interest rates and standardized closing costs. If your property generates substantial income and maximizes revenue in the long term, then you can opt for a DSCR loan.

The decision should be based on your investment strategy, financial goals, income potential, and other factors. To get more detailed insight on which loan is best for you, connect with us today and improve your long-term financial gains.

Read More: DSCR Loans vs. Hard Money Loans: Choose the Right Option

Frequently Asked Questions:

1. How do we calculate DSCR?

DSCR is calculated by dividing Net Operating Income by debt service, which is the total interest payment and principal amount.

2. Is there a difference between credit score requirements between DSCR loans and conventional loans?

Yes, DSCR loans require a credit score of an average of 620, whereas conventional loans require above 680.

3. How do DSCR Interest rates differ from the conventional home loan rates?

DSCR loans have higher interest rates as high risk is involved depending on property revenue, whereas conventional loans have a lower interest rate as it is more dependent on borrower creditworthiness.

4. How does the conventional loan requirement in terms of LTV ratio differ from that of a DSCR loan?

Higher LTV percentages are with conventional loans, reaching up to 80% for investment properties and up to 97% for personal residences. LTV ratios for DSCR loans are normally between 65% and 75%, making them more conservative loans