Table of Contents

ToggleThe excitement of buying something new is unmatched, especially when it comes to purchasing a new home. But is it that easy? Not quite.

Today, 70% of homebuyers are first-timers. This important decision requires careful analysis to ensure you get the best house.

I’m here to guide you through the process and share six essential tips for first-time home buyers.

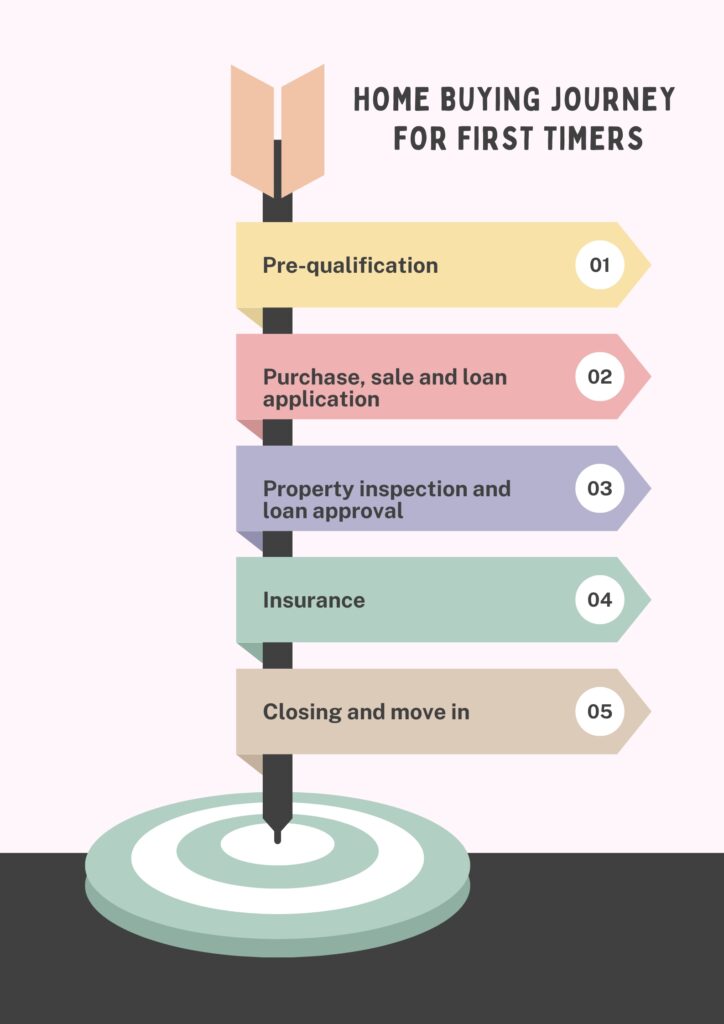

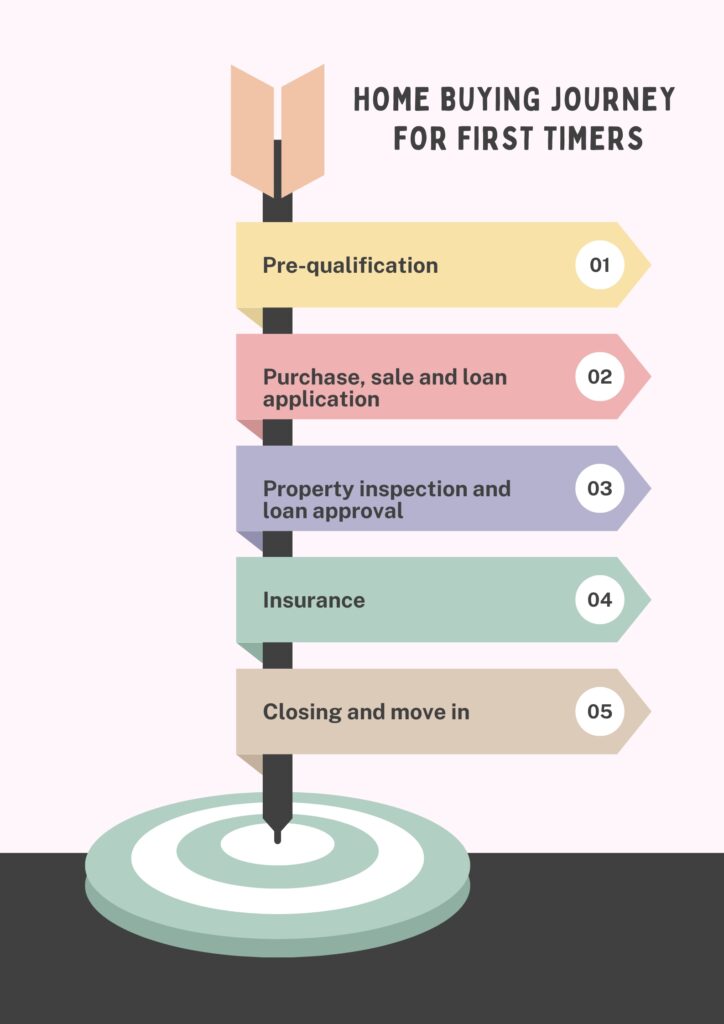

Understand The Buying Process

Understand the process of first-time home buying. Also, get informed about the steps to secure a dream house of yours in a hassle-free manner.

The procedure related to buying a house is a complicated one. As a first-time buyer, it is important to know the whole procedure of buying a house. It will help you strategize and manage the buying process. Also, certain first-time homeowner requirements must be met.

Buying process for under-construction projects:

- Verification of property-related documents

- Payment of booking amount

- Sale agreement

- Processing home loan

- Making payments based on the agreed payment plan

- Project completion

- Sale deed

- Stamp duty and registration

Buying process for ready-to-move-in projects:

- Verification of property-related documents

- Down payment

- Sale agreement

- Processing home loan

- Sale deed

- Stamp duty and registration

- Possession of flat

Tips to be Followed by First-Time Home Buyers: Secure Your First Home

Without following certain basic tips and tricks, buying a home for first-time home buyers won’t be an easy task. Below are some important things that you should do before you commence your journey to search for a new home. These tips are important to follow as they will help you make the best decision.

- Check Your Credit Score:

Credit score secures a very central position when it comes to mortgages. A credit report and credit score should be checked regularly to verify information and possibly detect any problems. If you have a bad score, do the necessary things that will help you correct it. It could entail lowering your credit card balances and making on-time bill payments. A good credit score helps you get the best mortgage lenders for first-time home buyers.

- How to Keep an Eye on Your Credit Score and Improve It:

Credit reports should be reviewed for any negative impact on score because they provide information about your credit history. While going through the credit score report, if you come across any errors, challenge that point to have it rectified. Also, do not apply for new credit cards or loans just before applying for a mortgage because this decreases your credit score. It is advisable to link your credit card to automatic payments since timely payment remains one of the critical determinants of a good rating.

- Set a Budget Before Buying a House:

Notably, before you begin the buying process for homes, you should establish a realistic budget. A pre-approval letter is mandatory. It is a professional assessment of a mortgage loan amount that one may qualify for. Hence to get a mortgage loan, you need to first get pre-approved. This will help you set a price range for the home that you can and wish to buy.

Additionally, it will also help you to establish your spending limit as well as eliminate the search. Being prequalified for a mortgage before beginning your search will certainly put you in a favorable position. Lenders welcome pre-approval letters as it proves to them that you are a serious buyer and you have the required money to buy the home. Hence, pre-approval letters act as eligibility for first-time home buyers.

- The Role of Mortgage Pre-Approval in Budgeting:

You should consider going for mortgage pre-approval. Pre-approval is when a lender outlines the maximum amount they are willing and can lend you based on credit history. This also helps in the determination of what you can afford and also informs sellers that they are capable of purchasing a property. Pre-approval is not a guarantee of receiving credit, but it greatly increases your competitiveness in the market.

- Save for a Down Payment:

Minimizing your costs ensures that you make as many deposits as you can so that you’re ready for a down payment. This, in the long run, will help in propelling your financial status. You’d like to have 20% of the purchase price saved and paid as a down payment; nevertheless, you could have other choices as well. A larger down payment translates into a lesser mortgage on the house, potentially saving thousands of dollars in interest.

- Exploring Down Payment Assistance Programs:

If saving appears to be difficult, consider the first-time homebuyer programs that offer help with the down payment. Some of these are government tributary programs that offer grants or loans at very low interest rates to help you with your down payment.

- Budget for Closing Costs:

Remember that closing costs can end up quickly. Hence one must have a budget planned for that. These costs refer to a percentage of the purchase price of the home. They generally vary anywhere between 2% and 5% of the home’s price. Sometimes the closing costs fall under the agreement with the seller. Nevertheless, it is always wise to have money to cater for this.

- Negotiating Closing Costs:

It is, however, important to understand that unlike some of the closing costs, which are standard and cannot be changed or removed, there are others that one can negotiate for or even cut. You can check with your lender about getting closed costs added to your mortgage and pay them off over time. This means that you’ll be paying more in terms of the principal and, therefore, the interest over the long run.

- Gather Your Financial Documents:

To secure a mortgage, you are supposed to submit some documents. These documents include bank statements, recent tax returns, and pay stubs. However, some of the lenders require the submission of documents during their application. Hence, it is best to acquire these earlier to save time.

- Additional Documents You May Need:

This requirement is strictly based on the financial position of the client and it may require other supporting documents. For instance, if you are a freelance worker, the lenders will expect you to submit statements of profit and loss and more tax returns than any other employment categories. Keeping such documents in hand will help the mortgage go as smoothly as planned.

- Don’t Make Late Payments:

While discussing the negative consequences of credit repair, one should mention that missing payments on credit cards, car loans, or other bills damages credit scores and jeopardizes the chances of getting a mortgage. A history of late payments can affect the lending process as it makes you have a bad credit status. Because of this, you might also struggle to get a good loan. Do not forget any of your bills, make sure you pay all your bills as and when required.

- Late Payments’ Effect on Your Mortgage Application:

Defaulting in the payment of credit cards, car loans or any other bills reduces your credit score, which has implications for your mortgage.

- Tips for Avoiding Late Payments:

To overcome the impacts of late payments, one should pay all the bills through an automated system. They will let you make the payment for your subscription on your behalf and on time. Also, it is necessary to write down the due dates of the bills or set them on a calendar so that you do not miss them.

These are some of the notable tips that help you purchase your dream home without having to face any mess.

Conclusion

As a first-time home buyer, you need a correct approach and also know about the techniques of purchasing a house. Beginning from the precise identification of needs, evaluation of one’s financial position, search for property, and ensuring a safe deal, learning the A-Z of home purchasing is very important, especially if you are a new buyer.

Whether you need pre-approval services, the use of templates for the selection of the right mortgage, or assistance in the process of closing your new home, then you are at the right place. Contact us to make your home-buying process as easy and effective as possible. Additionally, we will also tell you how to qualify as a first-time home buyer