Table of Contents

ToggleIntroduction

When exploring the real estate market, hard money loans offer a compelling financing option for borrowers seeking speed and flexibility. According to Morgan Stanley, the private lending market, including hard money loans, is projected to grow to $2.8 trillion by 2028. These loans are primarily asset-based, simplifying the borrowing process even for those with low credit scores. A crucial aspect of securing a hard money loan is the decision between accepting higher interest rates or paying upfront points. This choice can significantly impact the overall profitability and quality of your investment. In this blog, we will delve into both options, helping potential borrowers make an informed decision that aligns with their long-term financial health.Understanding Interest Rates and Points in Hard Money Loans

Interest rates and points are the two main factors in hard money loans, which play a major role in influencing the overall cost of borrowing. Let us understand crucial aspects:Interest Rates

Interest rates in hard money loans are the cost of borrowing that the borrowers must pay over the due course of time. These rates are regulated by various factors such as the borrower’s credit portfolio, loan-to-value ratio, and existing lender’s and market conditions. As of 2024, hard money loan interest rates, which range between 10% and 18%, are prominently higher than the regular mortgage, which offers interest rates between 6.95% and 10.5%.Points

Hard money lender points are the upfront costs that the borrowers pay as a percentage of the total amount. A substantial payment of these points diminishes the interest burden on the borrower in the long run. Potential borrowers have the advantage of negotiating the number of points they are willing to pay by the loan structure and lender’s guidelines. Let us understand both aspects with the example given below:| Scenario | Loan amount | Interest rates | Points | Total Interest | Total points cost | Overall cost |

| High rate, Less points | $200,000 | 10% | 1 point | $20,000 | $2,000 (1%) | $22,000 |

| Low rate, high points | $200,000 | 6% | 3 points | $12,000 | $6,000 (3%) | $18,000 |

What Are The Major Factors That Must Be Considered When Deciding Between Interest Rates And Points?

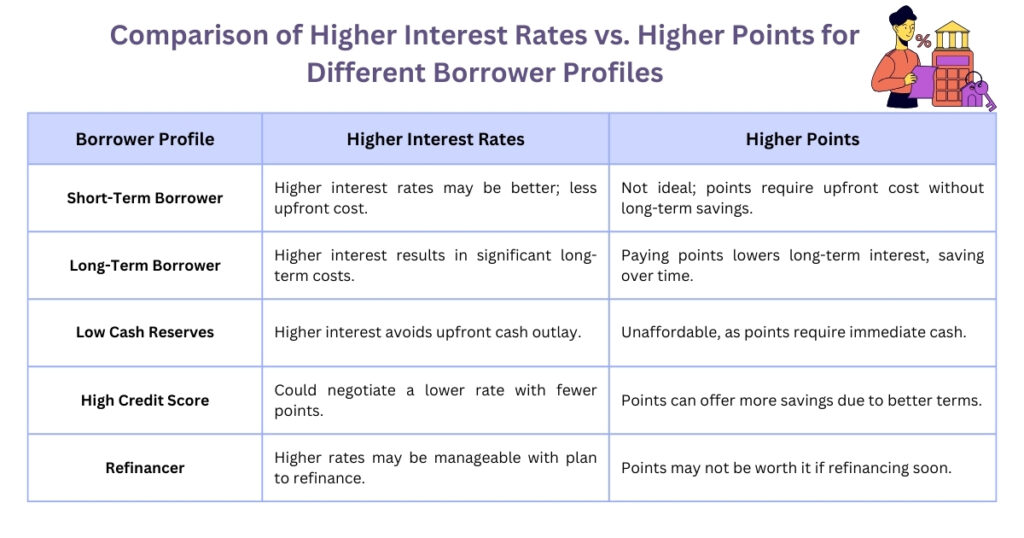

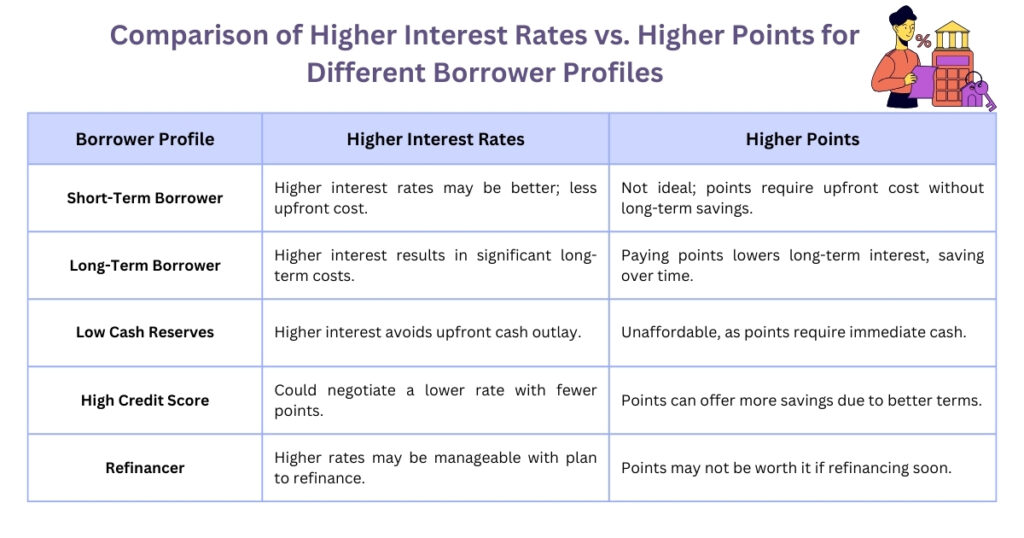

Hard money lending places the potential borrowers in a major dilemma of choosing between higher interest rates or points, either of which has a significant effect on the overall cost of acquiring the investment. Let us explore the key considerations that must be taken into account when opting for the best approach to securing a hard money loan:#1 Profitability of the Investment

- The profitable position of the potential investment is a key factor that influences the borrowers to pay upfront points for a project that promises strong returns and provides protection against the unstable nature of the real estate market.

- Projects with a not-so-profitable position result in lesser payment of points in order to maintain the cash reserves of the potential borrowers to ensure flexibility and liquidity.

#2 Total Cost of the Loan

- Borrowers should calculate the total cost of the loan by adding the interest to be paid over time, which is based on the repayment period of the loan.

- Potential investors can take advantage of loans with longer repayment periods by paying upfront costs of points, which automatically lowers interest rates.

- These savings incurred due to lower interest rates easily counterbalance the initial cost of paying upfront points.

#3 Project Duration

- Projects with a shorter duration attract higher interest rates with lower upfront costs to decrease the overall cost of borrowings of the investors.

- Projects with a longer timeline benefit the borrowers by charging lower interest rates with higher points upfront, which automatically boosts the savings of the investors.

#4 Immediate Capital Requirements

- Investors with cash constraints prefer to pay fewer upfront points to strengthen their liquidity position, which ensures access to funds for renovations and other operational costs.

- On the other hand, investors with hefty cash flows prefer upfront payment of points to reduce their interest burden, especially for long-term investments.

#5 Risk tolerance and market conditions

- The existing economic conditions of the market as well as the risk-taking capacity of investors is a crucial aspect for consideration of point usage or higher interest rates.

- If the market is operating in a rising rate of interest scenario, potential investors can lock their investments at a lower interest rate by offering upfront payment of points, to protect themselves against any increase in interest rates in the future.

- If the market is operating at a declining rate of interest, investors can accept higher rates in the short term, while expecting to refinance the same loan at a lower rate in the future.

#6 Flexibility to refinance or exit early

- Borrowers who wish to exit early from the loan arrangement must opt for fewer points and higher interest rates to not weaken their liquidity position in the long run and have the option of refinancing the loan at their will.

- Borrowers who continue their loan full term must pay higher points upfront to ensure less interest burden due to lower interest rates, ultimately resulting in savings in the long run.

How to Calculate Hard Money Loan Payments?

Calculation of hard money loan payments involves mainly two primary components: interest rate and points. Let us understand the structure of hard money loan monthly payments for both the components mentioned above:- Monthly interest payment = Loan amount * Annual interest rate / 12

- Points upfront cost = Loan amount * points / 100

| Loan amount | Interest rate | Points | Monthly interest payment | Upfront points cost | Total cost for 12 months |

| $200,000 | 10% | 2 | $1,666.67 | $4,000 | $24,000 (interest) + $4000 (points) = $28,000 |

| $300,000 | 8% | 3 | $2,500 | $4,500 | $30,000 (interest) + $4,500 = $34,500 |

Conclusion

Navigating the real estate market as a newcomer or as a seasoned investor can be quite challenging and complex due to the cutting-edge competition prevailing in the market. This is where hard money lending works as a savior for potential investors who want to have a competitive edge over their rivals. However, borrowers must understand the hard money rates and terms to ensure that they match their financial circumstances, project timelines, and long-term goals. The most crucial aspect that investors must explore before opting for hard money loans is a selection of interest rate scenarios and upfront payment of points. For businesses that struggle with the complexities of the real estate market, Munshi Capital offers expert guidance and support to evaluate loan terms that cater to their unique needs and make the best financial choice for your hard money lending future. Read More: Hard Money Loans: Your Key to Maximizing Real Estate ReturnsFrequently Asked Questions

- Are interest rates and points negotiable in hard money loans?

- Do points influence my loan-to-value ratio?

- Which option is suitable for newcomers?