Table of Contents

ToggleIntroduction

When it comes to loan applications, remember timing is everything. Here, a loan estimate is not just a piece of paper; it’s your pathway to your dream home. A loan estimate gives you an overview of the cost of your home loan.

As a borrower, your role is to understand the core importance of acting upon your loan estimate within the given timeline because a small delay can cause you a major financial setback.

In this blog, we will explore answers to questions like, What is the validity period for a loan estimate? What if I miss the deadline? How can I avoid missing the validity period deadline?

Understanding Important Components of Loan Estimates

The loan estimate is a crucial document for the mortgage process that guides borrowers in understanding what the loan terms are, the costs, and the proposed loan features. After receiving the loan application, lenders have three business days to provide the borrower with loan estimate documentation. The key components of a loan estimate include:

The key components of a loan estimate include:

|

Key Component |

Sub-Components |

|

Loan Terms |

Loan Amount, Rate of Interest, Prepayment Penalty, Monthly Payment, and more. |

|

Projected Payments |

Principal and Interest, Mortgage Insurance, Taxes and Insurance, Other Costs |

|

Closing Costs |

Loan Costs including Origination Charges, Other Costs like Appraisal Fees, Credit Report Fees, and Taxes |

|

Comparisons |

Total Interest Percentage, Annual Percentage Rate |

|

Other Considerations |

Appraisal, Assumption, Late Payment, Refinancing |

|

Contact Information |

Lender’s Name, Address, NMLS ID, Loan Officer Information |

|

Additional Information |

Cautionary Statements, Inquiries for Additional Information |

What is the Validity Period for Loan Estimate?

A loan estimate is valid for 10 business days after the lender issues it; it is not valid for an endless amount of time. During these ten days, you must examine the loan estimate and determine whether or not to proceed with it.

This brief validity period is because mortgage conditions and rates are subject to quick fluctuations as a result of shifts in the financial market. The lender cannot ensure that the same terms will be offered when you ultimately decide to move forward if you delay too long to act on the loan estimate. By guaranteeing that all agreements are current and represent the state of the market, the validity period protects both the borrower and the lender.

What if I Miss the Validity? Key Repercussions

If you miss the 10-day business deadline to act upon the loan estimate, you can go ahead with your loan mortgage application, but with few repercussions, like:

- The lender will send you a new loan estimate with changes in fees, interest rates, terms, etc. Potential market changes can lead to changes in the interest rate; then you may have to pay higher monthly payments if the interest rate is higher than the initial estimate.

- There can be a delay in the mortgage process due to revised documentation that can include additional review and signatures or requirements for additional documents affecting your closing timeline.

- If a 10-day business deadline is missed, then it can lead to increased fees and higher out-of-pocket expenses in the form of closing costs, appraisal fees, etc. It overall increases loan costs.

- You might have to start the application process over if you miss the loan estimate date, particularly if the lender is unable to move forward with the old/same terms.

How Can I Avoid Missing Loan Estimate Deadline? A Step-by-Step Guide

In order to help you stay on track so you don’t miss the deadline, here is the step-by-step guide

- Step 1: Get Pre-Approval Before Requesting a Loan Estimate

- Step 2: Submit Your Application Early and Track the Date

- Step 3: Proactively Confirm the Loan Estimate Delivery

- Step 4: Carefully Review the Loan Estimate as Soon as Possible

- Step 5: Stay Connected with Your Lender

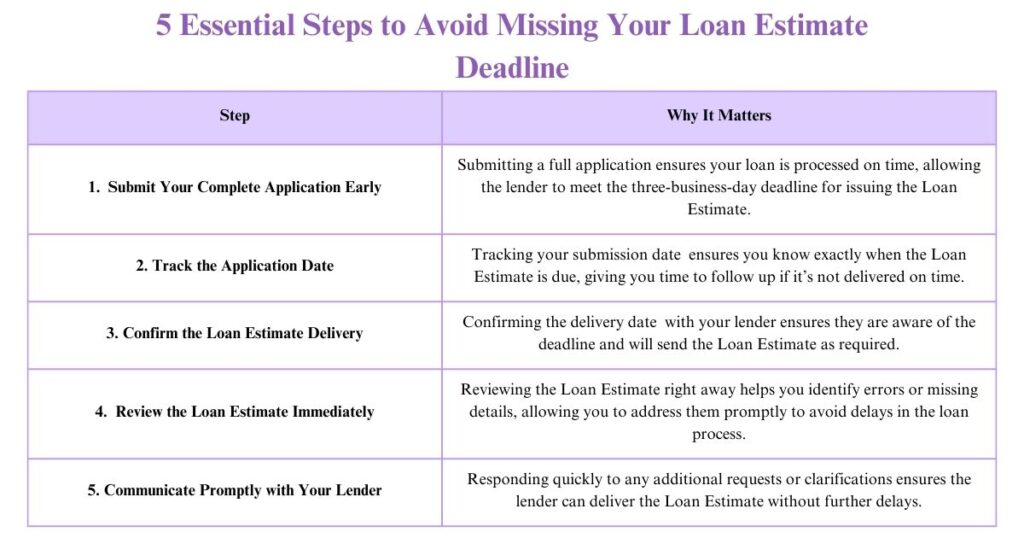

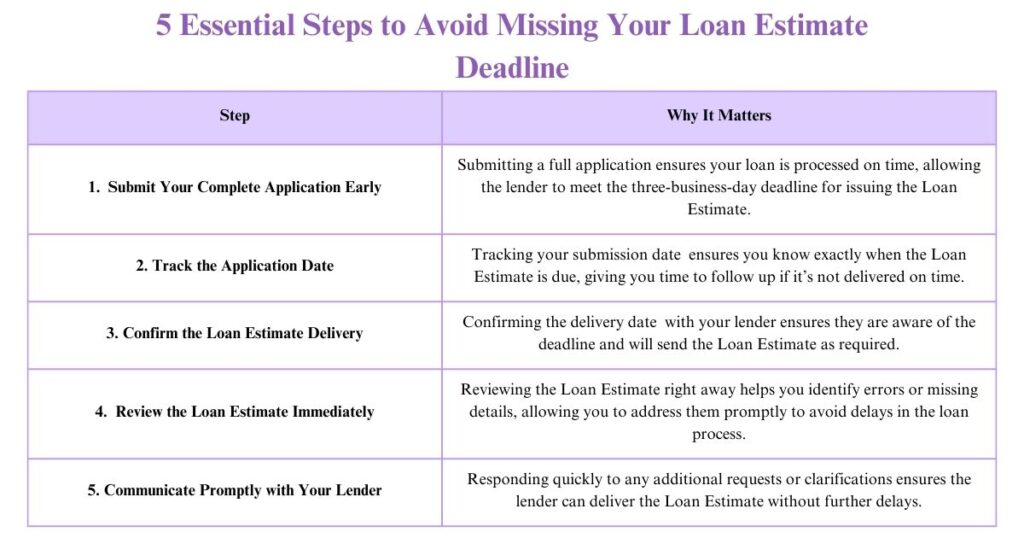

To elaborate further and understand why these steps matter in avoiding missing the loan estimate deadline, check the infographic below:

What Actions Can I Take as a Borrower if I Miss Meeting the Deadline?

- Contact the lender immediately, as lenders can help you provide advice on whether you need to update the terms or if the original terms can be reinstated.

- Negotiate for better terms with your lender with a new loan estimate based on your creditworthiness, previous financial history, and other variables.

- To make an informed financial choice, find out how the new loan terms will impact your monthly payments, closing fees, and costs, along with the total cost of the loan.

- Make a calendar to remember important dates, such as the updated loan estimate validity period. Set up follow-ups and deadline reminders with your lender. To guarantee that every step is finished on schedule, keep a to-do list.

Conclusion

To avoid stress and avail the best loan terms, acting promptly and staying up to date with loan estimate deadlines is important, as missing the deadline results in additional paperwork, increased costs, delays, and increased costs.

At Munshi Capital, we offer you practical insights and knowledge to ease your financial journey. From comparing loan estimates to securing the best terms for your mortgage and meeting deadlines, we are here to offer you expert guidance. Connect with us today!

Frequently Asked Questions

- After ten days, is it possible for a lender to alter the loan estimate’s terms?

Yes, if you haven’t locked the rate or completed the loan, the lender might change the loan estimate after ten days. Changes could be dependent on your financial profile or the market dynamics.

- How can I use the loan estimate to lock in my interest rate?

Inform your letter that you want to lock in your interest rate with a predetermined amount of time, usually 30, 45, or 60 days. The loan estimate terms could alter depending on market conditions if you don’t lock in the rate within the 10-day validity period.

- How can I know that the loan estimates provided by the best online mortgage lenders are correct?

The borrowers can review the print and check about lender fees, origination fees, and third-party costs; check the lender’s reputation, reviews, and ratings; and also compare different loan estimates to get clarity on interest rates and APR.