Table of Contents

ToggleHard money loans are a strong alternative option in the real estate market, offering borrowers quick and flexible financing. It is a lucrative option for borrowers with low credit scores, as they are asset-based lending loans, but as lucrative as it sounds, selecting the right hard money lender can be a complex process as various factors need to be considered, like the impact of loan terms and flexibility, fees associated, credibility factors, etc. We will get a detailed insight on 7 key factors you should look at before selecting a hard money lender.

Loan Terms and Flexibility

When you are choosing a hard money lender, loan terms and flexibility are critical factors that can aid you in your successful investment strategy. Listed below is a detailed explanation:

- The borrower should understand one of the key loan terms, which is the interest rate. Hard money loans have a higher rate of interest ranging from 7% to 15% or more depending on the risk associated with the loan as assessed by the lender.

- Another key term is a loan-to-value ratio, which tells how much percentage of property the lender will finance. The usual LTV ratio in hard money loans is between 60% to 75%. The impact of high LTV and low LTV is explained in the table below:

| Ratio | Result | Impact |

| Low LTV ratio | The lender requires a higher down payment and finances a small portion of the property value. | Lower interest rates and favorable terms. The hard money loan lenders risk is also reduced. |

| High LTV ratio | The lender requires fewer down payments and finances a large portion of property value. | Higher interest rates and strict loan terms. The lender risk is high. |

- Check if hard money loan lenders are offering conversion options so that the loan can be converted into a refinance or long-term mortgage option.

- Before selecting the hard money lender, it is important to see if the lender at what percentage is willing to adjust the interest rate, LTV ratio, or repayment structure.

- Some lenders are also flexible in the type of collateral options, like non real- estate collaterals such as inventory, equipment, etc.

“Risk mitigation strategies for borrowers as per high, moderate, and low risk hard money loans”

Credibility and Market Reputation

The borrower experience can largely be influenced by lenders’ market reputation and credibility. The hard money lender should be trustworthy, reliable, and showcase transparency. To evaluate market reputation, you can check online reviews and ratings, through the lending industry networks, and by references and testimonials.

The market reputation of the lender can be assessed by his experience and longevity, professional affiliations such as the Mortgage Bankers Association (MBA), if the lender is known for high-pressure sales tactics, which can be a red flag because the lender wants you to rush into a decision, etc.

Expertise and Loan Specialization

A hard money lender should be well-equipped with the required expertise and specialization to offer tailored loan solutions and assess risk by understanding loans and the market. Lenders who have expertise in specific loans also help speed up the loan approval process as they are familiar with the structure and the procedure.

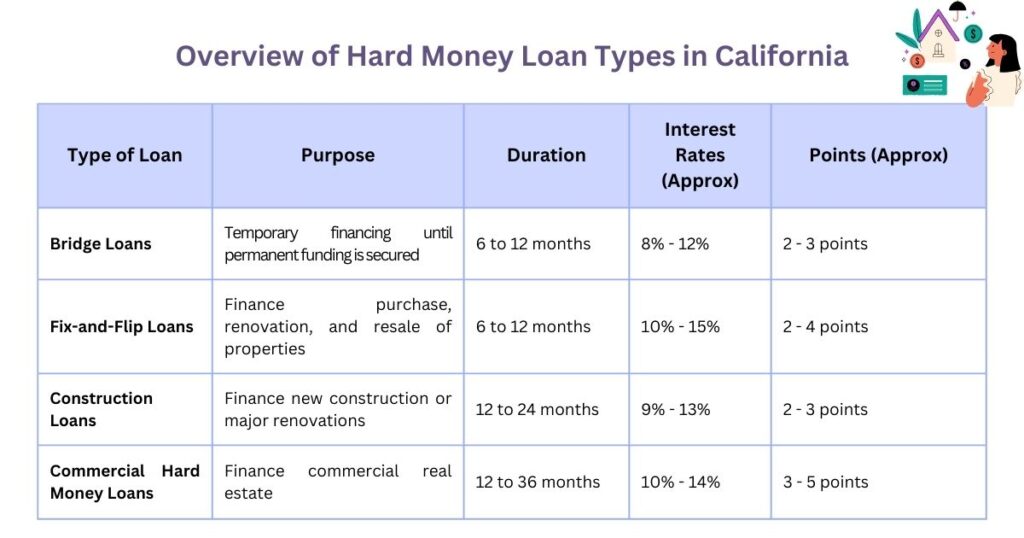

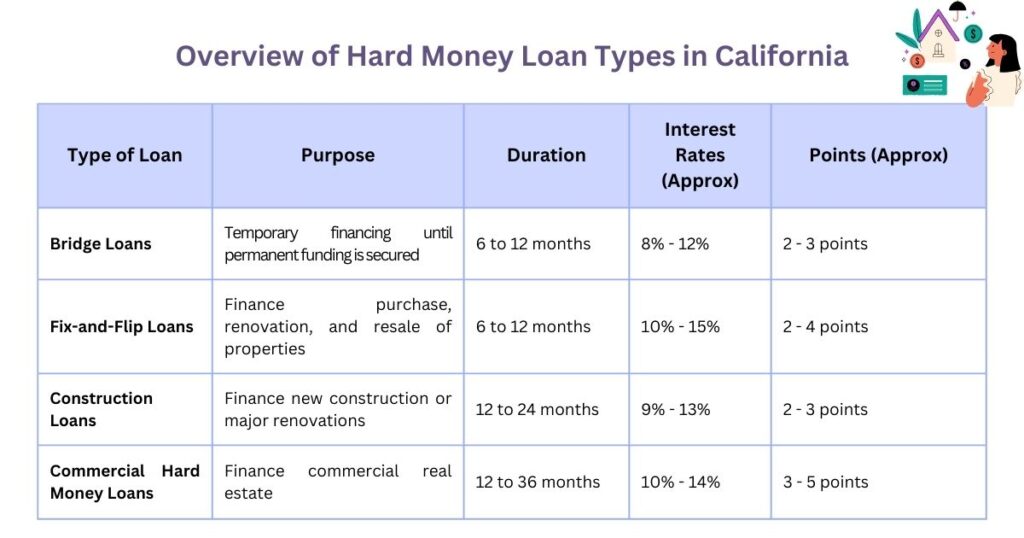

The borrower can assess lender experience concerning the industry, similar loan track record, and specialization in loans like fix-and-flip, bridge loans, or construction loans.

Key questions you can ask the hard money lender:

- Can you give insight on recently funded bridge loans and what have been the outcomes?

- What kind of support services will you offer during my renovation project?

- How do you stay up to date with market trends and changes in commercial property loans?

Customer Service and Support

Timely assistance and transparent communication are the integral parts that should be offered by the hard money lender. The borrower can assess this factor by evaluating the response time, 24/7 availability of personalized services like custom loan structuring, project-specific consultation, documentation assistance, financial counseling, and more.

The borrower should evaluate the customer support requirements in different stages as given in the table:

| Type of Support | Requirements |

| Pre-Loan | Help with the application process, answering questions, and providing assistance with documentation. |

| Ongoing | Regular updates, progress tracking, and addressing issues during the life of the loan. |

| Post-Loan | Handling loan modifications and resolving issues after the loan is disbursed. |

Digital Tools and Technology Integration

The borrower should evaluate whether the hard money lender is offering online application platforms, automated processing systems, document management systems, communication channels, real-time updates and tracking, integration of technology with financial management tools, and data security measures for efficient decision-making.

Approval Process Speed and Efficiency

The hard money loan lenders should be able to have an efficient loan approval process through shorter loan application processing time within 48 hours, less underwriting time, a streamlined documentation process, and more. These factors help reduce the holding cost, provide timely access to funds, and give a competitive edge in the market.

Key questions you can ask the hard money lender:

- What is the expedited processing time you take for urgent applications?

- What documents do I need to submit?

- What is the timeline from approval to funding of the loan?

- Can borrowers get hard money loans for bad credit?

Transparency in Fees and Cost Charged

The lender should offer a clear picture of fees and costs associated with the loan to build trust, do financial planning, and make informed decisions. The borrowers can ask for detailed fee structures, inquire about additional costs, compare fee structures with different lenders, and then select the right lender. Listed below are a few common fees charged by hard money loans lenders:

- Origination fees, which is 1% to 3% of the total loan amount.

- Points, which are between 1 to 5

- Underwriting fees from 0.5% to 1%

- Appraisal fees

- Inspection fees

- Closing costs

- Prepayment penalties

- Late fees

- Extension fees

Conclusion

Choosing the right hard money lender requires a lot of basic considerations like transparency, flexibility, reputation, terms, customer service, and more. But to find the right lender that aligns with your investment strategy and understands your goals, you should also look for additional factors like loan specialization, partnership potential, project management approach, data privacy and security adherence, and more. Munshi Capital helps you to make sure all these boxes are ticked and works closely with you in your investment journey.

Read More: What Hard Money Lenders Look for in Borrowers?

Frequently asked questions

1. What is the loan-to-value ratio charged by hard money loan lenders?

The minimum loan-to-value, or LTV ratio, charged by a hard money loan lender is between 60% to 75%; that can vary as per property type, market conditions, and value.

2. What are a few hidden costs that are charged by a hard money lender that a borrower should know?

A borrower should be aware of hidden costs such as origination fees, processing fees, inspection fees, and prepayment penalties. The percentage of these fee charges may vary from lender to lender.

3. What due diligence process is conducted by a hard money lender?

The due diligence process conducted by a hard money lender involves title review, property appraisal, market analysis, borrowers experience, financial stability, and exit strategy evaluation.

4. How does the hard money lender evaluate the value of collateral?

The hard money loans lender evaluates the value of collateral by evaluating the value of the property through both current and after-repair value, inspection of the property, local real estate market assessment to calculate potential resale value, and more.

5. What is the hard money lending interest rate?

From 2024 data, it is reported that interest for first-position hard money loans has increased from 9.5% to 12%, and for second-position loans, the rate increased from 12% to 14%, due to hard money loans becoming a more favorable option, resulting in increased competition.