Do you know hard money loans have become the quick refinancing option among borrowers over the last 5 years, the lending market for hard money loans has seen a growth of 10-15%.

As per the industry report, a significant trend has been noticed: around 30% of hard money loans are refinanced within two years, making it a key strategy for investors to optimize the financing terms. In this blog, we will understand the detailed process of refinancing a hard money loan that will help you improve your investment portfolio.

Comprehensive Insight into Hard Money Loans, Ideal Candidates, Refinancing Benefits, and Reasons to Go for Refinance

Hard money loans, also called asset-based loans, are a type of short financing option for borrowers/real estate investors looking for quick access to capital. The loans are easier to obtain when compared to traditional loans, as the focus is on the collateral value rather than the borrower’s income and creditworthiness.

Refinancing a hard money loan is best suitable for real estate investors who need immediate access to capital for development or property acquisition; individuals with bad credit scores, flippers and developers who need short-term funding for improvements; and homeowners who own valuable properties and can leverage equity for better loan terms.

Benefits of Refinancing a Hard Money Loan

- If you are refinancing your hard money loan during a lower interest period and for a longer term, it helps improve the cash flow as monthly payments are reduced.

- Investors with multiple hard loans can leverage the refinance option through debt consolidation and ease out the financial complexities with one monthly payment.

- Refinancing helps in obtaining better loan terms, such as longer repayment periods, which can change from 6 months-3 years to 15-20 years.

- A balloon payment, or one-time payment, is required for all hard money loans after the period. You can spread out payments over a longer period by replacing this with a structured payment plan through refinancing.

When Should You Look To Refinance Your Hard Money Loan?

- You should look to refinance your hard money loan when you want to maximize the gains on inherited property value, as you can use the loan money to renovate and increase the potential property value.

- You can use the loan money to purchase additional properties in different markets or grab the right business investment opportunity and diversify your real estate investment portfolio.

- If your current loan is due, you can fall under the default category by the lender, and as per the promissory note, the standard interest rate can jump to 20% or more. Refinancing a hard money loan can result in better terms and more time to finish your project or sell the property while providing funds to pay off the maturing loan and avoiding prepayment penalties and default rates.

- If you are working on a rehab project and your budget has been exceeded, then refinancing can offer funds to complete the project and maximize your returns through increased property value.

Eligibility Requirements for Refinancing a Hard Money Loan

- To refinance a hard money loan, a minimum credit score of 620 is required. Having a credit score above the minimum value helps borrowers obtain better lending terms.

- Lenders have a requirement of having a sufficient equity ratio in the property. The desired loan-to-value ratio is 70%-80% or lower.

- The borrower needs to complete income verification by showing bank statements, tax returns, etc.

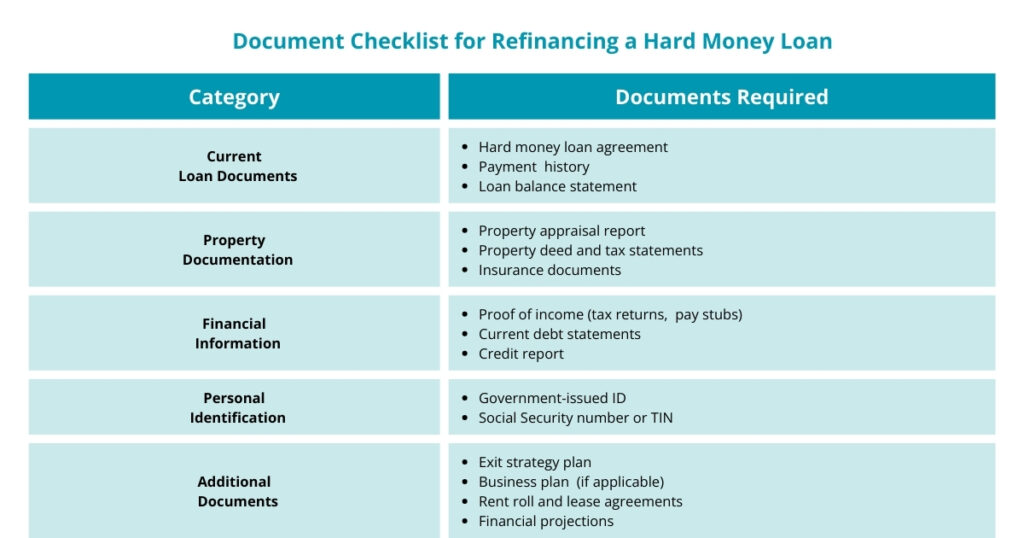

- A comprehensive list of documents needs to be verified, which shows payment history, current loan details, property appraisal, etc.

- The lenders prefer borrowers with a debt-to-income ratio of 43% or below.

- A DSCR of 1.25 or above, which shows that the property’s income can comfortably meet the loan payments, may be required by some lenders.

Step-By-Step Guide to Refinance a Hard Money Loan

Step 1: Analyze Your Current Financial Situation and Loan Terms

- Evaluate your current loan interest, payment schedule, prepayment penalties, debt-to-income ratio, and loan duration.

- It is important to assess the property’s value through a current appraisal, which can be done by scheduling a call with us so you can have a result-driven approach.

- Get your credit score report and understand in which bracket you stand and how it can impact your refinancing option. For example, if you have a credit score between 300-579, then refinancing options are limited and lead to higher interest rates. On the other hand, if you have a score between 600-739, you can obtain better loan terms and interest rates.

Step 2: Evaluate Your Refinancing Goals

- It is important to identify your financial objectives, like whether you want to lower your monthly payments by refinancing at a lower interest rate (typical hard money loan interest rate is between 15%-20%), consolidating debt, cashing out for home renovation, etc.

- Once you have identified the objective, evaluate the type of loan you need as per the interest rate, eligibility criteria, loan terms, etc.

Step 3: Look For Hard Money Lenders

- Identify the potential lenders, which can be traditional banks, private lenders, credit unions, etc., and compare interest rates, fees, eligibility criteria, and loan terms.

- The table below showcases a comprehensive overview of types of lenders for hard money loans with distinct comparisons, so you can evaluate the best lender for you.

| Type of Lender | Private Lender | Credit Union | Traditional Bank |

| Interest Rate | 6%-12% | 2.5%-4.5% | 3%-5% |

| Percentage of Fees | 2%-5% | 0.5%-2% | 1%-3% |

| Loan Term (In Years) | 5-10 | 10-30 | 15-30 |

| Debt-to-Income Ratio | Max 50% | Max 40% | Max 36% |

| Credit Score | Min 600 | Min 650 | Min 680 |

Note: The data is subject to change as per the location and lender.

Step 4: Consolidate the Required Documents

- Obtaining all the documentation, including your financial information—such as tax returns, pay stubs, bank statements for the previous two to three months, etc.—is crucial for a seamless refinancing option, and property information, such as a mortgage statement that shows the current loan balance, interest rate, escrow account information, etc., and insurance proof, so lenders can evaluate the associated risk.

- Lenders may also require an explanation letter if you have any employment gaps, unusual activities in your financial documents, or a large sum borrowed.

Step 5: Apply for Refinancing and Choose the Best Loan Offer

- After gathering all the documents, you can apply for refinancing options with different lenders so you have more options to obtain the best option for you.

- After submitting the documents, analyze all the offers received in terms of interest rate, prepayment penalties from your existing loans, closing fees, and other additional charges.

- Calculate the total cost, evaluate whether it aligns with your refinancing financial goals, and choose the best offer that is most favorable.

Standard Formula: Total Cost= Total Interest + Total Fees+ Principal Amount + Prepayment Penalty

Step 6: Finalize and Close the Newly Obtained Loan

- Once the best loan offer is selected, review and sign all the documents so that you can use the new loan to pay off the existing hard money loan.

- Manage a new loan efficiently by structuring a payment plan. To ease the process, you can go for the automatic payment option.

- Make sure to regularly monitor your loan statements so you can take the right action at the right time and maintain your financial health, offering better investment opportunities in the future.

Quick Additional Tips for Refinancing a Hard Money Loan Successfully

- Look for Market Trends and Timing: Understand property trends in your areas and analyze economic indicators and interest rates. If you are refinancing a hard money loan during a low-interest rate period, it can result in potential savings.

- Optimize Loan Structuring: This can be done by structuring new loans during the initial interest-only period, resulting in lower monthly payments and improved cash flow that can be used for additional investments.

- Optimal Financial Planning: Once your property value has improved, you can optimize your financial planning with cash-out refinance that can extract equity and reduce payments. For example, refinancing a $450,000 balance at 10% to $ 600,000 at 6% results in $150,000 in cash and $570 in monthly savings. Better loan terms can be obtained by showcasing rising equity and rental income through optimal financial planning.

Conclusion

Refinancing a hard money loan strategically helps borrowers obtain better financial terms and flexible payments, with the added advantage of an improved credit score and appraised property value. To move from high-interest, short-term loans to more reliable, long-term funding, refinancing hard money loans is the best option. For in-depth refinancing strategies and expert guidance, explore the articles and resources at MunshiCapital.

Read More: Ground-Up Construction Financing: How Hard Money Loans Can Help

Frequently Asked Questions:

- If I want to refinance a hard money loan what costs will be incurred?

Various costs are incurred when refinancing a hard money loan, such as closing costs, appraisal fees, origination fees, application fees, and more. The percentage of these fees may vary as per the lender, but they are usually between 2%-5% of the total loan amount.

- Does California have any specific regulations for refinancing hard money loan?

Yes, the regulations require lenders to have licenses issued by the Bureau of Real Estate/ California Department of Financial Protection and Innovation (DFPI), disclose loan terms, and comply with the interest limits set.

- When should I get a hard money loan before refinancing?

The average period is between 6 months to 1 year before refinancing.