Table of Contents

Toggle

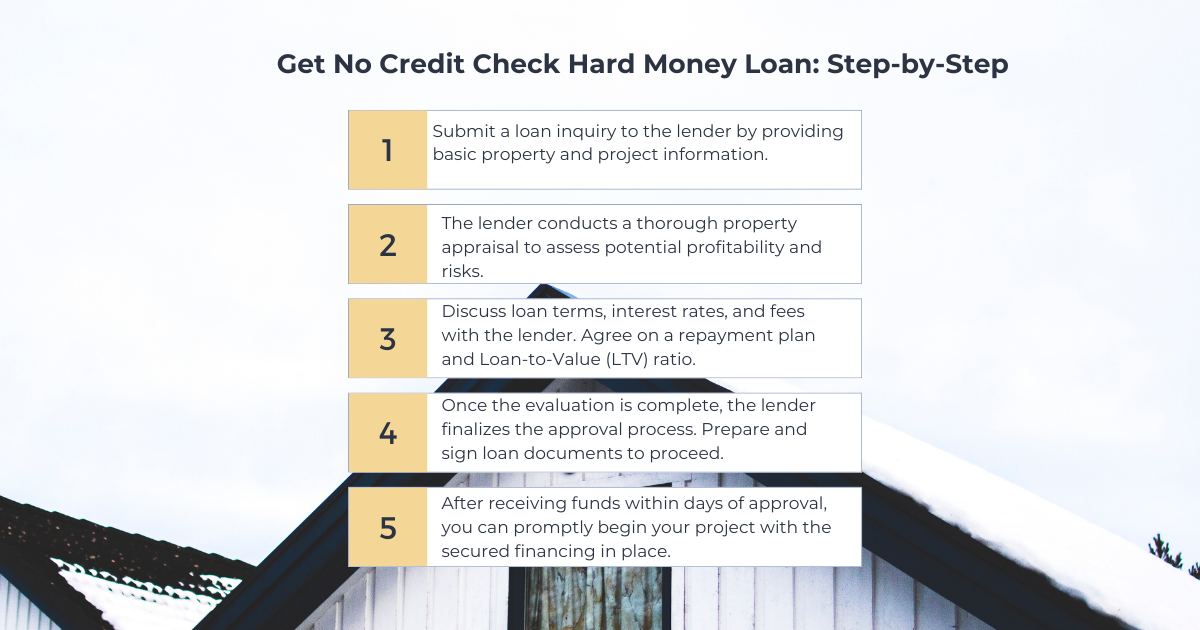

Are you looking for hard money loans but have a poor credit score? We know going to traditional lenders for real estate loans may require a strong credit score and credentials, and to ease the process, hard money lenders specializing in no credit checks act as a bridge to ease out the process. But there are a few myths associated with hard money lenders that don’t check credit scores. Let’s bust those myths and understand the facts for a clear understanding of the process.

Myth 1: “No Credit Check”: Hard Money Lenders Avoid Background Verification

Reality: The first question is do hard money lenders check credit scores? The lender focuses more on assessing the property’s current appraisal value and estimating ROI, along with checking the borrower’s current and income assets, which helps evaluate the ability to pay monthly payments. Background verification also includes a criminal background check, insurance verification, and past real estate investment experience, especially in the case of large loans, so lenders can assess the risk involved. Do you know? As per the American Association of Private Lenders (AAPL), borrowers’ past experience is considered a major factor among 70% of hard money lenders.Myth 2: All Lenders Have the Same Policies for No Credit Check Lending

Reality: As traditional lenders have their own set of lending practices, no check credit hard money lenders have different requirements for parameters such as:- As per the lender, the collateral type accepted may differ as per the expertise they have, such as residential, commercial, high-value asset properties, etc.

- The interest rate and fees may differ from lender to lender. Lenders looking for borrowers who have high-risk capacity may charge a higher interest rate and fees, but on the other hand, some lenders also offer competitive rates as per market trends and the borrower’s specific situations.

- Lenders can offer both flexible repayment terms, such as balloon payments, interest-only payments, or strict monthly repayments.

- Even borrower qualification plays a key role in determining the acceptance criteria. Few lenders may place a strong emphasis on past history of successful investment, employment stability, income level, etc.

Myth 3: Lenders are Not Concerned with Exit Strategy Plan

Reality: Exit strategy plans are important for no credit check hard money lenders because they help them assess borrowers’ financial stability and predict their capability to pay the associated costs on time. If the borrower is in default, lenders have a way of mitigating losses by selling the mortgages mentioned by the borrower in their existing strategy plan. Do you know? As per Bigger Pockets reports investors who have a clear exit strategy plan get success in the projects associated with real estate with a favorable percentage of 35% or more.Myth 4: “No Credit Check” Hard Money Lenders Don’t Offer Flexibility on Loan Terms

Reality: Borrowers who need quick access to funds go for hard money lending, and it is assumed that the flexibility of the loan term is stringent for all types of borrowers, but the flexibility may differ from borrower to borrower. The no credit check hard money lender benefits savvy investors due to their overall financial profile and offers a customized financing structure with flexible repayment terms that help both parties improve cash flow.Myth 5: Hard Money Lenders with No Credit Check Option Operate Without License

Reality: This is the biggest misconception about no credit check hard money lenders, as they are often considered as private money lenders in states like the USA where they need to comply with the rules and regulations with license issued by respective state authorities. Lenders who offer no credit check hard money loans don’t imply that no license is needed by them; they run a thorough check on the borrower’s property and financial documentation.Myth 6: No Credit Check Hard Money Lenders Offer Loans to Borrowers with Unlimited Amount

Reality: Hard money lenders provide loans with flexibility and less complexity as compared with traditional loans, but that does not imply that the borrower can obtain an unlimited amount of loan. The lender assesses the property value and conducts document verification, which becomes the basis for assessing the loan amount. The loan amount is assessed by ARV percentage, i.e., the After Repair Value, as it helps to determine the future value of the property. The percentage range is between 60% to 80%. Example: If the property’s current value is $2,00,000, the estimated repair cost is $60,000, the estimated ARV is $3,00,000, and the maximum LTV ratio percentage is 70%. Maxim Loan Amount Formula= ARV * LTV Ratio $3,00,000*0.70=$210,000 So in this case, the maximum loan amount that a borrower can obtain is $210,000.How Do You Choose the Right No Credit Check Hard Money Lender?

- Research various parameters about lenders, such as interest rate, fees, online review testimonials, star ratings, and tailored project experience such as residential, commercial, fix and flip, etc.

- Evaluate the loan-to-value ratio policy of the lender. If the lender is offering a substantially lower LTV ratio, that means you need a higher equity percentage, so choose the lender as per your long-term financial prediction.

- Look for lenders that are willing to offer customized loan terms that are aligned with your financial situation and goals.

- It is good to ask the lender about the past loan performance history and default rate, if any, so you can evaluate the lending practices used by the lender.

- It is best to consult the right advisor when choosing the right hard-money lender. You can schedule a call with us to get expert advice tailored to your needs.

Conclusion

As per industry reports, a conclusion was made that around 75% of borrowers have a credit score below 620 in the USA, making no credit check hard money lenders act as an alternate financing option for borrowers in the complex real estate market and changing dynamics of obtaining funds. The option is suitable for borrowers who find it tough to get a traditional loan due to a poor credit score. But borrowers must understand that all lenders do not follow an umbrella policy in terms of fees, interest rates, repayment terms, collateral requirements, etc. The nuances of myths associated with no credit check hard money lending need to be assessed by the borrower, which can be done through market research and the comparison of different lenders to get the best possible financing option. Read More: Choosing the Perfect Partner: Your Guide to Hard Money LendersFrequently Asked Questions:

- What types of properties can I finance through no-credit-check hard money lenders?