Table of Contents

ToggleSecuring the right type of funding plays a crucial role in materializing profitable opportunities in the real estate market. Hard money rehab loans are a great alternative to traditional financing, as these rehab loans are short-term, asset-based, quicker, faster, and flexible, which motivates investors to capitalize on time-sensitive opportunities, especially when it comes to renovating and rehabilitating distressed properties.

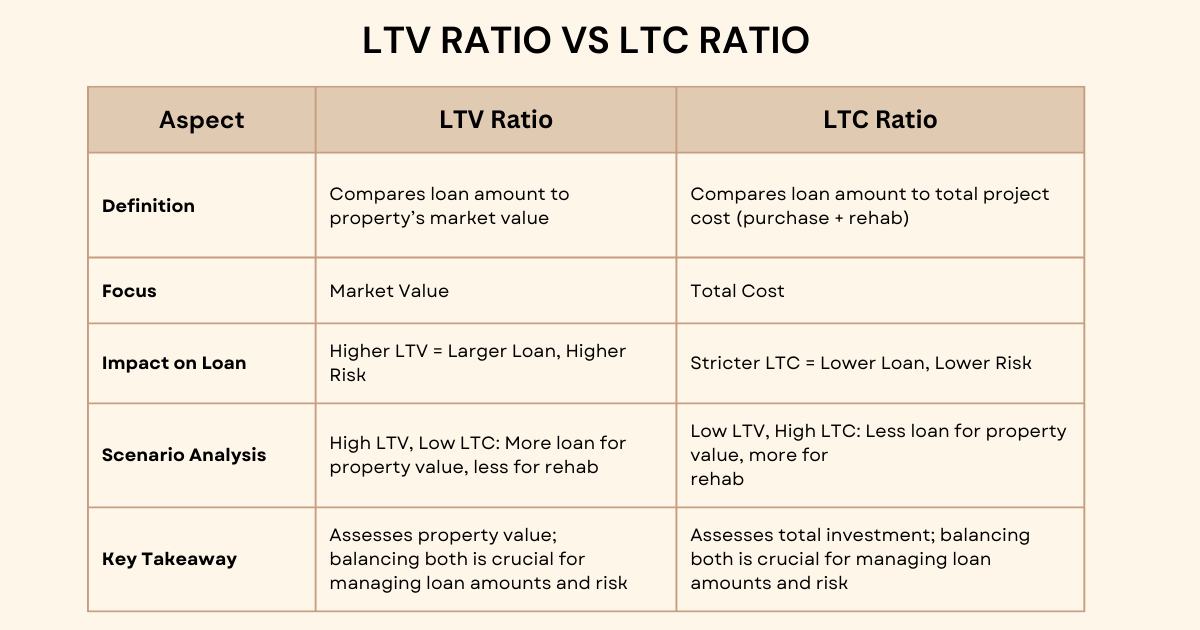

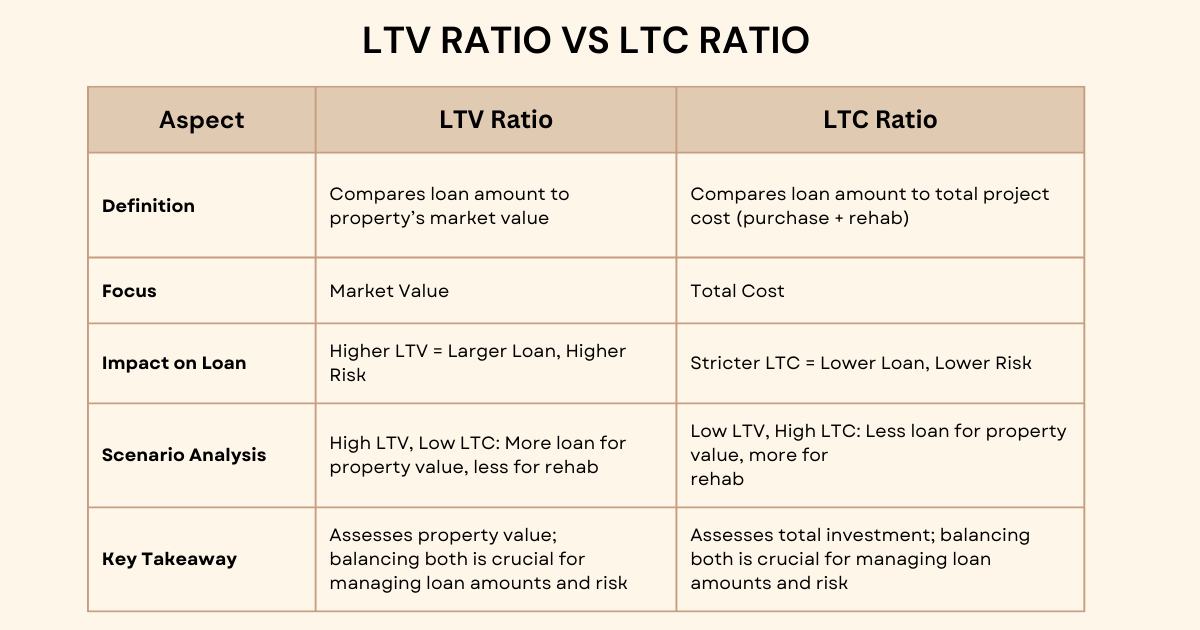

But with the given pros, hard money rehab loans come with certain conditions, which can be a setback for a few investors that lack in qualifying for certain criteria, like hard money rehab lenders demand a loan-to-value ratio of 50% to 80% to reduce risks and a loan-to-cost ratio between 70% to 90%. In this blog, we will understand the pros and cons of hard money rehab loans and strategies to navigate the cons for you to make informed financial decisions.

Comprehensive Insight into Pros of Hard Money Rehab Loans

Let us explore the various advantages that hard money loan rehab provides the investor with and the ability to materialize lucrative offers that would not have been available to them otherwise:

- Accessible for Borrowers with a Low Credit Score: Hard money rehab lenders are willing to provide loans to borrowers with a not-so-good credit profile, as these loans mainly focus on the property’s value and profitable returns.

- Best Choice for Short-Term Projects: These loans usually have a shorter duration of 6 months to 3 years, which is perfect for property flipping, resulting in maximization of profits and no long-term financial obligations.

- Quick Funding: The fast funding aspect of hard money rehab loans gives investors a competitive edge in securing desirable deals that may not be available in the real estate market.

- Flexible Terms: The flexible nature of these loans enables the investors to negotiate the loan terms according to their own needs. Also, these loans offer interest-only payments to investors to avoid liquidity crunch during the rehab process.

- Open to New Investors: Flexible lending terms and no income verification in hard money rehab loans attract new and inexperienced investors to invest and build their real estate investment portfolio.

Comprehensive Insight into Cons of Hard Money Rehab Loans

Let us now explore the significant challenges that hard money rehab loan investors deal with during the rehab process:

- Substantial Down Payment: Hard money rehab loan lenders demand a hefty down payment of 20% to 35% to minimize their own risk, which could be a setback for investors with a shortage of liquid funds.

- Higher Interest Rates: Due to the significant risks and costs involved, hard money rehab loans are offered at a higher rate of interest than conventional loans.

- Shorter Repayment Period: These loans involve close deadlines, which puts unwanted pressure on the rehab project to finish within the stipulated time as well as increasing the chances of default, resulting in property loss.

- Overleverage Risk: These loans also attract the risk of depending too much on favorable market conditions that may never occur, which falsely motivates the investors to take on excessive debt without enough cash flow.

- Foreclosure Risk: Any default by the borrowers results in foreclosure of the loan because these loans are asset-backed, which again adds to the high risk of rehabbing a property.

Tips for Successfully Converting Hard Money Rehab Loans Cons to Pros

Hard money rehab loans come with their advantages and disadvantages, such as high costs and short repayment periods. But it is possible to convert hard money rehab loan cons into advantageous prospects with certain guidance and tips and maximize your real investment returns, which are as follows:

- Smart Exit Strategy: As hard money loan rehab attracts higher risks, interest rates, and costs, investors must have a clear exit strategy from the start, whether it is selling or refinancing, to prevent financial mishaps.

- Choosing the Right Lender: Investors should carefully approach the right hard money rehab lender to ensure the establishment of fair loan terms as well as the completion of the rehab project on time.

- Contingency Plan: When engaging in hard money rehab lending, borrowers should also focus on building a contingency plan to face any unforeseen circumstances, safeguarding the timely completion of the project.

- Reducing Interest Rates Through Negotiation: Borrowers can work out lower interest rates by furnishing a clean track record supported by a substantial downpayment and reduced repayment periods.

- Safety Net for Short Loan Terms: It is beneficial for investors to maintain a buffer for shorter durations of loans to safeguard themselves from any potential delays. It also works as a financial cushion to fulfill repayment terms without any chance of default.

Conclusion

Hard money rehab loans are often associated with higher risks, additional fees, and shorter repayment periods, which sometimes serve as major setbacks in attracting potential investors, affecting the projects’ profitable future. These loans serve as a double-edged sword for inexperienced investors by engaging them in substantial risks yet providing them with lucrative opportunities through their quick and flexible nature of funding.

Munshi Captial as a hard money lender helps such new investors navigate whether hard money rehab lending is your best alternative to other options for real estate financing and, if so, enhances your chances of success while reducing the potential risks.

Read More: Types of Hard Money Rehab Loans and Their Specific Uses

Frequently Asked Questions:

- What is property flipping?

It involves maximization of profits by purchasing, renovating, or selling a property as soon as possible in the real estate market.

2. How are the renovations funded in hard money rehab loans?

Lenders provide the borrowers with funds in stages by furnishing invoices and progress reports of the rehab project.

3. Is it allowed to employ hard money loan rehab for commercial projects?

Yes, these loans are available for investors to invest in commercial properties such as retail spaces, office buildings, and multi-family units.

4. Who can obtain hard money residential loans?

Borrowers like real estate investors, property flippers, rental investors, etc., can avail hard money residential loans.

5. How hard it is to get a rehab loan?

The challenge of obtaining a hard money rehab loan depends on various factors such as borrower real estate experience, property value, and having a good financial history so the lender can reduce the interest rate and offer flexible terms. Ticking all the required boxes can ease the process of obtaining a rehab loan.