Introduction

California’s real estate market has always been famous for its luxurious properties, high demand, and steep prices, especially in areas of Los Angeles, Silicon Valley, and San Francisco. To finance such multi-million properties, potential investors most likely resort to jumbo loans.

A standard mortgage is not enough to fund such expensive real estate deals.

This is where super jumbo loans save the day. These loans operate at much higher limits than jumbo loans which are currently greater than $3,000,000 in 2024.

This blog will break down the dynamics of how potential investors can easily qualify for super jumbo loans and navigate their process smoothly with minimum risks involved.

Decoding Super Jumbo Loans

- When certain loans surpass the conforming limits of jumbo loans, they are considered super jumbo loans.

- These loans only cater to luxurious real estate investments and attract stringent requirements due to their magnitude and involvement of higher risks.

What Are The Specific Requirements Faced By Investors Seeking Super Jumbo Loans In California?

Potential investors need to fulfill certain strict credit and financial requirements to qualify for super jumbo loans.

Let us review these key factors:

- Employment History and Income Stability

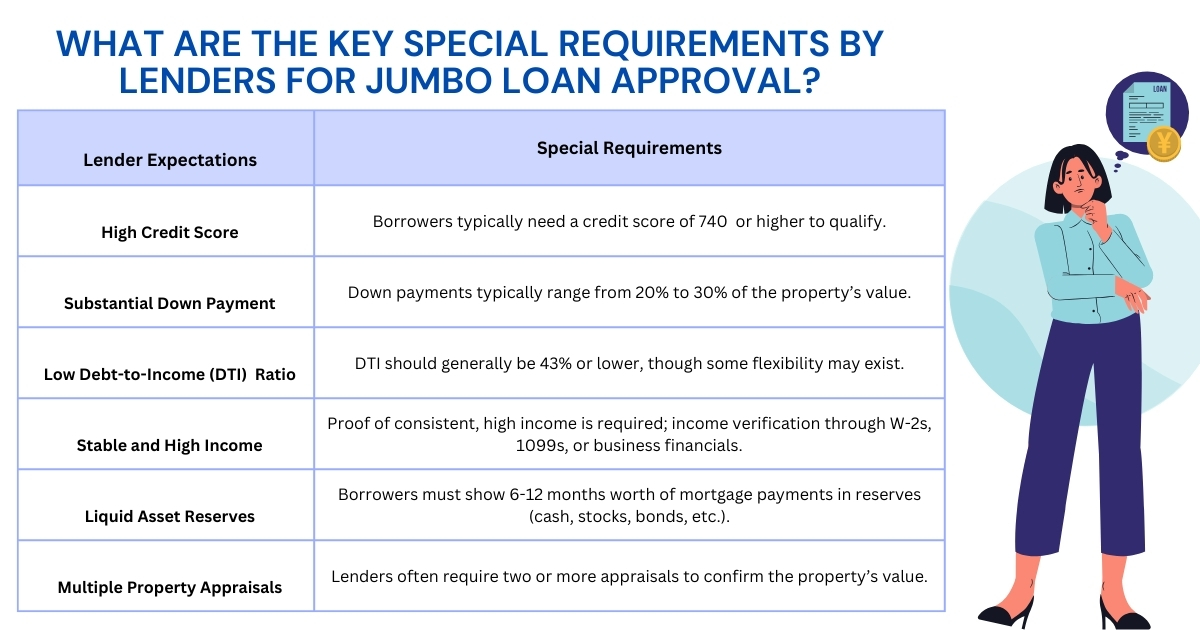

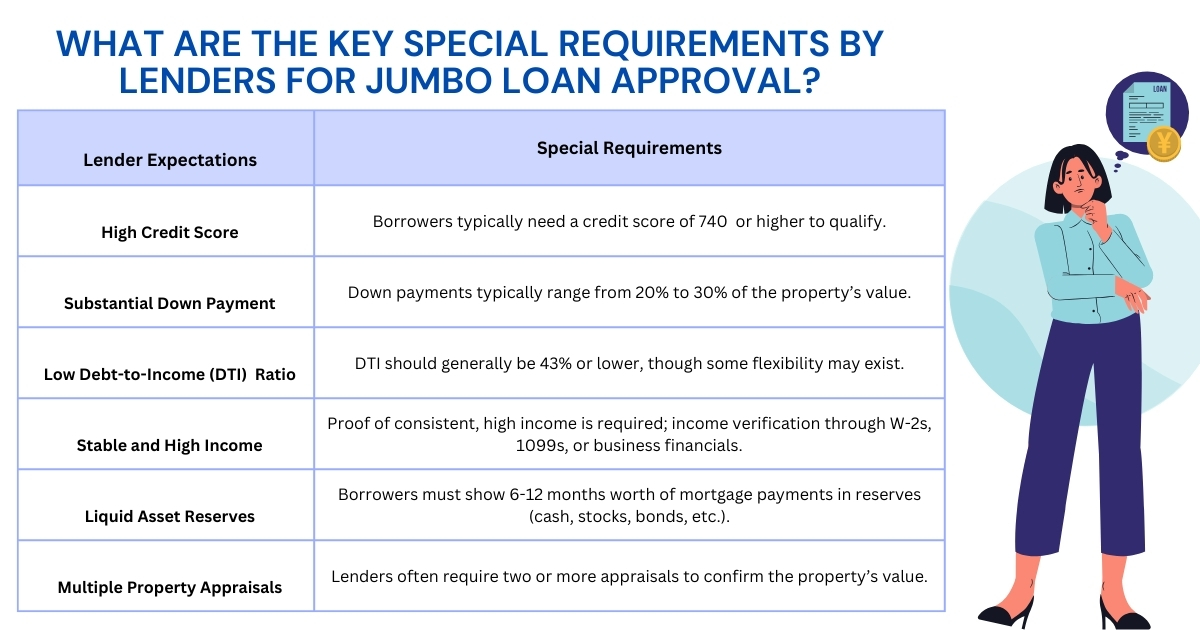

- Borrowers with consistent, stable, and high incomes are mostly considered and favored by lenders for super jumbo loans due to their superior income brackets.

- High-net-worth individuals, business owners, and professionals who are engaged in high-paying markets such as finance, entertainment, etc. are the lender’s first choice for such loans, which solidifies its repayment future.

- Significant Down Payment

- These loans require the investors to make a substantial down payment of 20%–30 % of the total loan amount.

- If the interested borrower struggles with a lower credit score or higher DTI ratio, they may be required to make a down payment exceeding 30% or higher to mitigate the lender’s risk due to hefty loan amounts.

- Higher Credit Score Requirements

- Super jumbo loans adhere to credit scores which are mostly 740 or above, thus reflecting the importance of the borrower’s financial responsibility.

- Investors with a score of less than 740 may also qualify for these loans but will attract higher interest rates and a substantial down payment.

- Emphasis on High Net Worth and Liquid Assets

- Super jumbo loans approve borrowers who have a higher net worth and a significant account of liquid assets.

- Investors may also have to furnish 6 to 12 months of cash reserves to ensure high liquidity in case of any financial setbacks or turmoil to secure the mortgage.

Lenders Expectations from Borrowers Applying for Super Jumbo Loans

What Are The Typical Price Ranges For Investment Properties In California That Qualify For Super Jumbo Loans?

Let us look at this table to understand an overview of the various types of properties that are eligible for super jumbo loans in California:

| Property Type | Description | Typical Price Range | Common Locations in California |

| Investment Properties | Multi-unit or business homes bought for rentals or resale. | $2 million – $20+ million | San Francisco, Los Angeles, Orange County |

| Vacation Homes | Secondary residences purchased as resorts for leisure. | $1.5 million – $10+ million | Lake Tahoe, Palm Springs, Santa Barbara |

| Luxury Single-Family Homes | High-end homes with modern amenities and prime locations. | $2 million – $10+ million | Beverly Hills, Malibu, Palo Alto, Newport Beach |

| Luxury Estates | Expansive properties with large land areas and private amenities. | $5 million – $50+ million | Napa Valley, Silicon Valley, Montecito, Carmel |

| Ranches and Vineyards | Expensive properties are utilized for residential buildings, vineyards, and agriculture. | $3 million – $50+ million | Napa Valley, Sonoma, Santa Ynez Valley |

What Are Some Potential Challenges Investors Might Face When Seeking A Super Jumbo Loan?

Securing a super jumbo loan can be quite challenging, and the borrowers must be prior aware of all the obstacles that they might encounter while considering these loans for their investment goals.

Let us understand the various challenges that investors may face in obtaining a super jumbo loan and how they can improve their chances of approval significantly:

Higher Risk of Market Volatility

- Super jumbo loans often finance luxury properties, which are more susceptible to market volatility. But on a larger note, California’s luxury market has historically proven resilient due to global demand, tech wealth, and foreign investments, particularly in regions like Silicon Valley and Los Angeles.

- Demand fluctuations, economic downturns, etc., may cause a negative impact on the property’s value, which can further complicate the refinance or selling of the property, making it vulnerable to price swings.

Longer Processing Times

- Since super jumbo loans involve a lengthy underwriting process, their approval takes a substantial amount of time.

- During the entire process, lenders may follow up with multiple appraisals to ensure the exact price of the property as well as regular review of the financial situation of the investors.

Higher Interest Rates

- Super jumbo loans attract a higher rate of interest than other loans to mitigate the high level of the lender’s risk.

- For borrowers, they must understand and carefully compare the cost of borrowing and long-term return on investment.

Stringent Underwriting Standards

- These loans follow stricter underwriting standards, which include extensive documentation, credit history, income and assets, employment history, etc., to ensure the solid financial health of the investor.

- This is done to protect the lender’s interest and curb their risks due to the involvement of large sums of money.

Potential for Multiple Appraisals and Property Inspections

- Lenders might undertake multiple appraisals to verify the property’s value, which may result in additional costs for the borrowers and delayed approval of the loan.

- Lenders may also request a specialized property inspection in case the property is unique or located in a high-risk area.

Conclusion

Securing a super jumbo loan in California can be a complex and time-consuming process, but with the right planning, financial wisdom, and professional help, it’s entirely manageable. At Munshi Capital, we help investors by providing expert and honest advice to make your journey smoother and more efficient.

Our deep understanding of the Californian real estate market ensures that you can navigate the complexities of such high-investment deals with confidence. These loans are exclusively designed for high net-worth individuals who are interested in the luxury real estate landscape of California.

Whether you are dealing in a multimillion-dollar estate or investment property, Munshi Capital is your trusted partner dedicated to supporting you to achieve your unique financial goals.

Frequently Asked Questions

- Who decides the conforming loan limits in the USA?

The conforming loan limits are set by the Federal Housing and Finance Agency (FHFA) and they change every year according to the market dynamics.

- Can non-U.S. residents qualify for super jumbo loans?

Yes, they can qualify for super jumbo loans, but with additional requirements of larger down payments and higher interest rates. Non-U.S. residents may need to provide U.S.-based credit history, proof of residency status (e.g., visa or green card), and often need to make a larger down payment, potentially 30-40%.

- What is a jumbo loan refinance?

A jumbo loan refinance replaces the existing jumbo loan with a new loan that involves lower interest rates, better terms, or home equity.

- Can investors obtain a fixed-rate super jumbo mortgage in California?

Yes, certain lenders offer super jumbo mortgages with both fixed and adjustable rates. While adjustable-rate mortgages offer introductory lower rates that change based on market conditions, fixed-rate loans give consistent payments over the loan term.