Table of Contents

ToggleDo you own a property and want to take advantage of your equity to get more money? If so, you might think about doing an FHA cash-out refinance. This financial instrument can give you the money for a variety of needs, such as home renovations, debt consolidation, or unforeseen costs. To make the best financial option for you, we will weigh the advantages, eligibility criteria, considerations, and other specifics.

What is FHA Cash Out Refinance?

The Federal Housing Administration provides homeowners with a mortgage refinancing option known as FHA cash out refinancing. The refinancing option allows homeowners to refinance the existing mortgage or FHA loan to a new FHA loan by turning a portion of home equity into cash at better loan terms and low interest rates. The cash can be used by homeowners for purposes like debt consolidation, home renovation, and other required financial needs.

Eligibility Criteria for Qualifying for FHA Cash Out Refinance Option

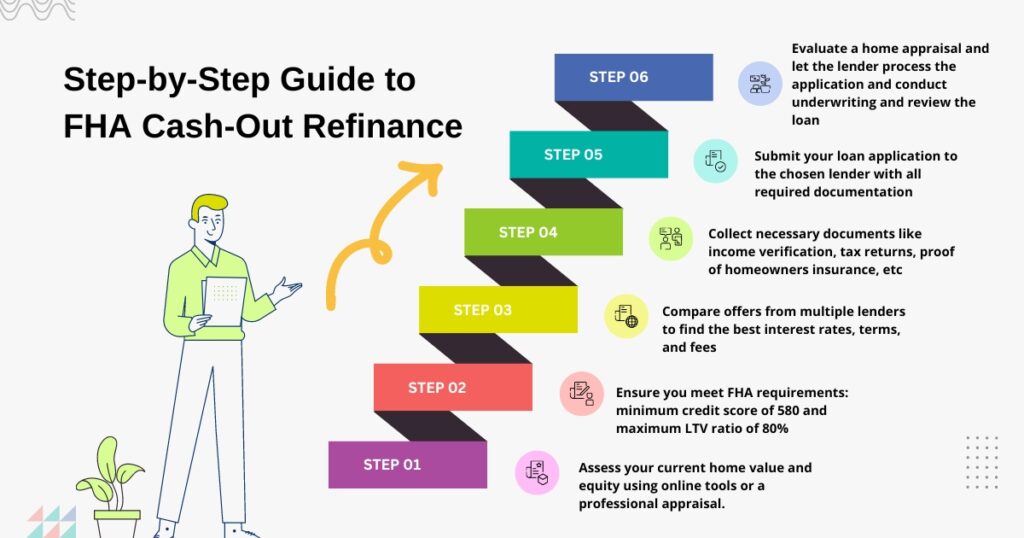

To qualify for an FHA cash out refinance, homeowners must meet a set of eligibility criteria. These include having a minimum credit score, owning property, having a desired loan-to-value ratio, and more. Below is the chart with detailed FHA cash out refinance rules/eligibility criteria:

Benefits of FHA Cash Out Refinancing

Homeowners opting for FHA cash-out refinancing option have potential benefits that help them achieve financial goals and substantially improve their financial position in the long term. Below listed are a few key benefits of FHA cash out refinance:

- FHA cash out refinance option helps in a low monthly payment system due to the modified longer term of repayment which can be up to 30 years.

- When we compare FHA cash out refinance to other loans, the cash-out option is beneficial. This is due to factors like low credit score requirements, access to home equity, low interest, flexible use of funds, and no prepayment penalty.

- With the funds from an FHA cash-out refinance, homeowners can pay down high-interest debt and consolidate it into a single, lower-interest mortgage payment. Rates on mortgages are usually lower than those on credit cards and personal loans, which results in substantial interest savings.

- It also helps increase property value as the money cash out is used for home renovation.

Factors to Consider Before Opting for FHA Cash Out Refinance

It is crucial to understand if the FHA cash out refinance option is right for you and aligns with your financial position and goals. Listed are a few important considerations one should evaluate before opting for FHA cash-out refinance:

- Evaluate the purpose of opting for this option and why you want to access cash from your home equity. Whether it is for education expenses, home improvement, debt consolidation, or other expenses, and how it can help in financial improvement.

- Check the various fees of refinancing, such as appraisal and mortgage insurance premiums. Also, evaluate how long it will take to recover these fees.

- Your monthly payment may go up with a cash-out refinance, particularly if you decide to extend the loan term or go from a fixed-rate mortgage to an adjustable-rate mortgage.

- It is important to assess the risk associated with the option, as you are tapping your home equity, so in the future, due to some economic conditions, there can be a change in property value that can be both positive and negative.

There are various other complex factors, like tax implications, long-term financial strategy, market trends, etc. that homeowners need to evaluate before figuring out if FHA cash-out refinance fits with their financial situation. To ease the process, we at Munshi Capital will help you with tailored advice based on your financial circumstances and assist you with finding the best option.

Conclusion

Opting for the FHA cash-out refinance option in 2024 can be a fruitful strategy due to the low interest rate as compared to historical figures; home value appreciation in areas like the San Francisco Bay Area in California gives more access to home equity and other related factors. FHA cash out refinance is an option for home renovation, debt consolidation, and investing in new ventures. It is better than conventional loans due to low interest rates, which pay off high-interest debt, and flexible credit standards.

Read More: Securing FHA Loan In 2024: What Every Prospective Homeowner Should Know

FAQS

- What is FHA cash-out refinance, and how does it differ from loans for home buyers?

Loans for home buyers are used to initially purchase properties; however, homeowners can access cash by refinancing their current FHA loan through an FHA cash-out refinance option.

- What is the cash-out percentage under FHA cash-out refinance?

You can cash out up to 80% of the value of your home, the amount is derived by subtracting the remaining balance on your FHA loan and any closing expenses.

- Do I need mortgage insurance for FHA cash out refinance?

Yes, even if you have home equity, FHA cash-out refinance does require yearly mortgage insurance costs.

- How can I be eligible for FHA cash out refinance?

For FHA cash out refinance eligibility you need to have an existing FHA loan, the property you are refinancing should be your primary residence, meet a minimum credit score, have an income ratio of less than 43% is preferred by most of the FHA cash out refinance lenders.

- Can FHA cash-out refinance be used for commercial real estate loans?

No, FHA cash out refinance is only used for primary residential properties.