VA Streamline Refinance (VA IRRRL) has become a popular choice among veterans, as per the data issued by the Department of Veterans Affairs Office of Inspector General in fiscal year 2020, there was a 598% increase in the number of VA loans opted for.

The exponential jump is because of key factors like reduction in interest rate, lower closing cost, less documentation, and more. So if you are a veteran and looking for VA streamline refinance loans and want to maximize your financial gains, read the detailed insights given in the blog and begin your investment journey now.

Overview of What is a VA Streamline Refinance?

VA streamline refinance, or VA IRRRL (VA Interest Rate Reduction Refinance Loan ) is a refinancing option for veterans given by the U.S. Department of Veterans Affairs as a solution to get low interest rates through a streamlined process without extensive credit checks and documentation processes.

VA Streamline Refinance (VA IRRRL) Key Features

Ease of qualification through no income verification

No credit score requirement

Tangible benefits through interest rate reduction

Loan term flexibility

No out-of-pocket cost

Simplified process through minimal documentation and no appraisal requirementVA Streamline Refinance Requirements: Eligibility Criteria

Listed below are the VA streamline refinance eligibility criteria:

The veteran must have an existing VA loan, also known as a VA-backed mortgage, and the current loan status should not be in default.

To have a good payment history, the borrower should have made at least 6 monthly payments to show credibility.

To be eligible, you are not required to own a home in the current state, but the borrower needs to show a certificate that he/she previously owned a home as a primary residence.

Pros and Cons of VA Streamline Refinance

The VA IRRRL program has various benefits and disadvantages, from a low interest rate to no cash-out option. Listed below are the VA IRRRL program pros and cons in detail:

Pros of VA IRRRL

VA streamline refinance does not require any new appraisal that benefits borrowers whose home value has decreased since the time of purchase. It also makes the process less costly and saves time through no income verification and appraisal.

The key benefit is the low interest rate, which results in lowering the total cost of the loan by a monthly interest reduction.

When going for refinancing of VA loans, the funding fee is low as compared to other VA loans, which makes it affordable as it results in tax savings.

VA streamline refinance loans are known for no out-of-pocket expenses, which means if borrowers do not have funds to pay certain fees, such as closing costs, they can roll out into a new loan and pay then.

Cons of VA IRRRL

The VA IRRRL is not available in a broader concept; only veterans who have existing VA loans can go refinancing.

With its advantage of a low interest rate, the borrower needs to pay the closing costs and other fees like VA funding fee of around 0.5%, recording fee, title search, etc. Rolling them in a new loan is an option but can result in an increased loan balance.

Veterans cannot take equity out of their homes in the form of cash, as it does not allow a cash-out option.

If you are looking for a shorter term period, then VA IRRRL may not be an option for you as it has a term length of 30 years that can delay your time to own a home and extend the repayment mortgage period.

How to Refinance VA IRRRL?

Listed below is the step-by-step guide for how to refinance VA IRRRL for veterans:

Step 1: The first step is to check VA IRRRL eligibility criteria; the loan is available to specific individuals like veterans, National Guard members who already have a VA loan, active-duty service members, etc.

Step 2: Search out for VA lenders and compare different quotations in terms of interest rates, terms, fees, benefits, services, and more.

Step 3: Collect the required documents required for loan approval, like proof of military service, mortgage statement, W-2 form, COE (certificate of eligibility), etc. Even though the loan does not require income verification, it is advised to have it as some lenders may require it.

Step 4: Once the lender is selected, complete the application process and lock the interest rate with the lender to secure it during the closing period.

Step 5: Sign and finalize the loan by carefully looking at new terms, interest rate, fees, etc. Once it is done, the lender pays off the existing VA loan, and then the new payment starts.

Comprehensive Insight on VA Streamline Refinance Program -VA IRRRL Rates and Funding Fee

The current VA IRRRL rates or VA refinance streamline rates are 5.375% and APR is 5.488%; the rates keep on varying. To keep a check on rates, borrowers can consult VA-approved lenders or the financial news.

The other important aspect of the VA funding fee on IRRRL, the standard funding fee is around 0.5% and can go up to 3.6%; the percentage depends on loan type and other related factors. The VA funding fee can be paid in the form of cash or moved to the new loan.

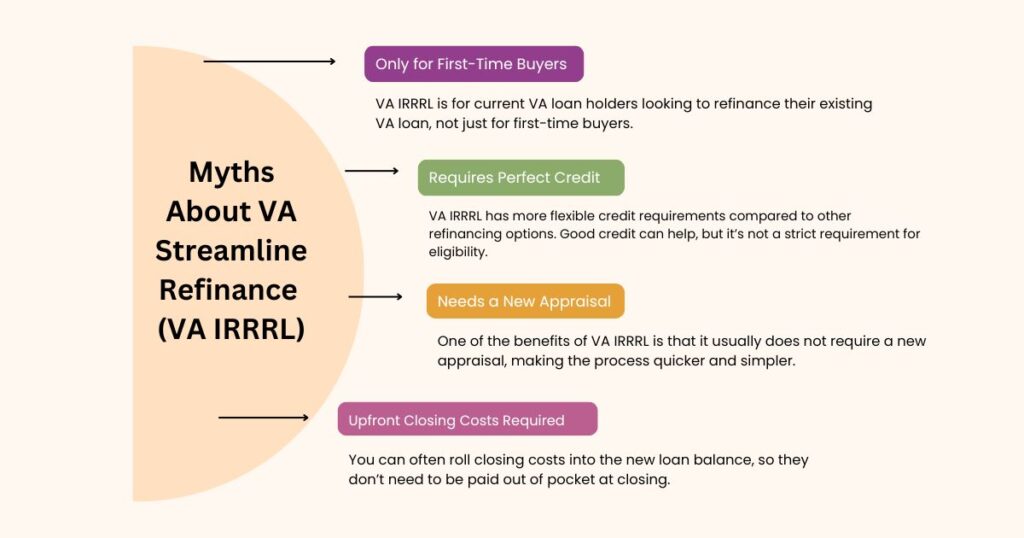

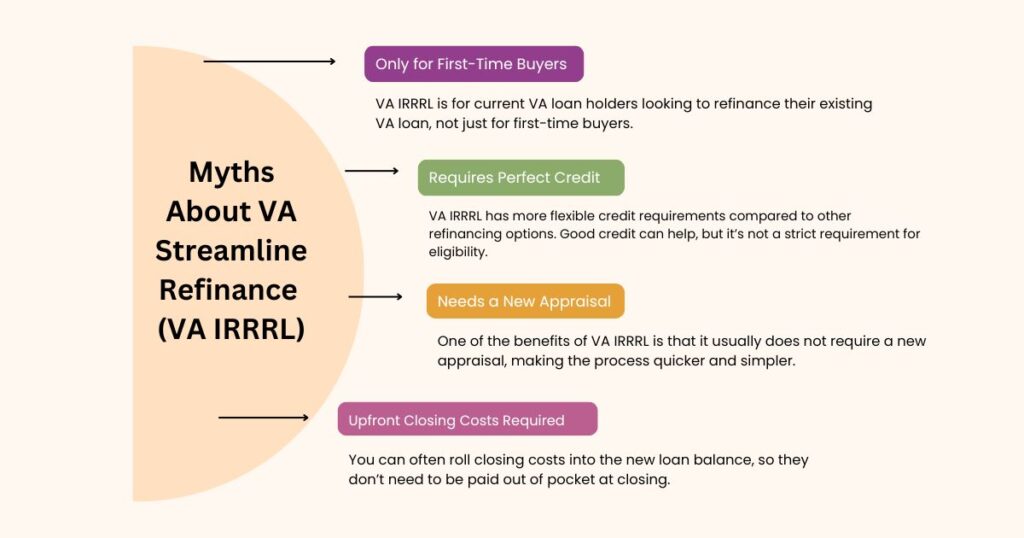

“Myths about VA streamline refinance (VA IRRRL)”

Conclusion

VA streamline refinance (VA IRRRL) is the best opportunity for veterans to optimize their financial goals and situations. With benefits such as reduced interest rates and low monthly payments, VA loans also help in quick debt repayment and adjusting loan terms.

The veterans can also have a safeguard against future interest rate fluctuation by converting from an adjustable-rate mortgage to a fixed-rate mortgage. VA streamline refinance has various added advantages, and to take advantage of maximum potential and have substantial long-term gains, connect with us for tailored expert advice.

Read More: No Money Down: The Continued Advantage Of VA Loans In 2024

Frequently asked questions

1. Does market trend affect VA IRRRL rates?

Yes, VA IRRRL rates are influenced by market trends as per economic conditions and changes in federal rates. Veterans should monitor the changes and refinance when the market rate is low for better financial benefits.

2. What are the key risks involved in choosing a VA IRRRL lender?

Key risks involved are high fees, unfavorable terms, hidden costs, inaccurate rate quotations, poor customer service, slow processing time, and more.

3. In what way do veterans refinance program have an impact on long-term financing?

VA IRRRL can impact long-term financing in terms of reduced monthly payments, lower total interest rates, increased loan balance, and more with strategic long-term financing.

4. What is the process completion timeline for VA streamline refinance?

The average time taken is between 30 to 45 days; it may vary as per the lender and loan complexity.

5. Is VA IRRRL available for vacation homes?

VA IRRL is not available for vacation homes, it is available only for a primary residence.