The dream of owning a house can seem a daunting task, with the average home price exceeding $4,00,000 in US, but with an FHA construction loan, home buyers can turn their dream into reality. Notably, around 82% of first-time home buyers opted for FHA loans into various categories, including construction loans.

With the higher demand and lucrative financing option, there are various parameters that borrowers need to fulfill to get an FHA construction loan, such as credit scores, debt-to-income ratios, meeting standard borrower profiles, and more, as discussed in the blog further.

Understanding FHA Construction Loan

FHA construction loan is a government-backed loan that allows borrowers to finance a loan for the construction of a new home. The financing is divided into construction financing and permanent mortgage, where once construction is completed, it is converted into a traditional mortgage. Given below are key questions covering aspects of FHA construction loans borrowers look for.

Is an FHA Construction Loan Right for You? Here’s Who Should Consider It

Let’s check ideal borrowers for FHA construction loans:

- First Time Home Buyers

- Borrowers Having Low to Moderate Credit Score

- Homeowners Looking to Build Instead of Buying

- Buyers Looking for Local Loan Limits

- Veterans or Active-Duty Military with FHA Eligibility

What are the Key Benefits the Borrowers Can Gain from an FHA Construction Loan?

Here are the key points borrowers can look at as advantages when opting for an FHA construction loan:

- Low Credit Score Requirements

- Low Down Payment

- Fixed Interest Rate

- Single Loan Covering Construction Phase and Permanent Mortgage

- Supported by FHA (Federal Housing Administration)

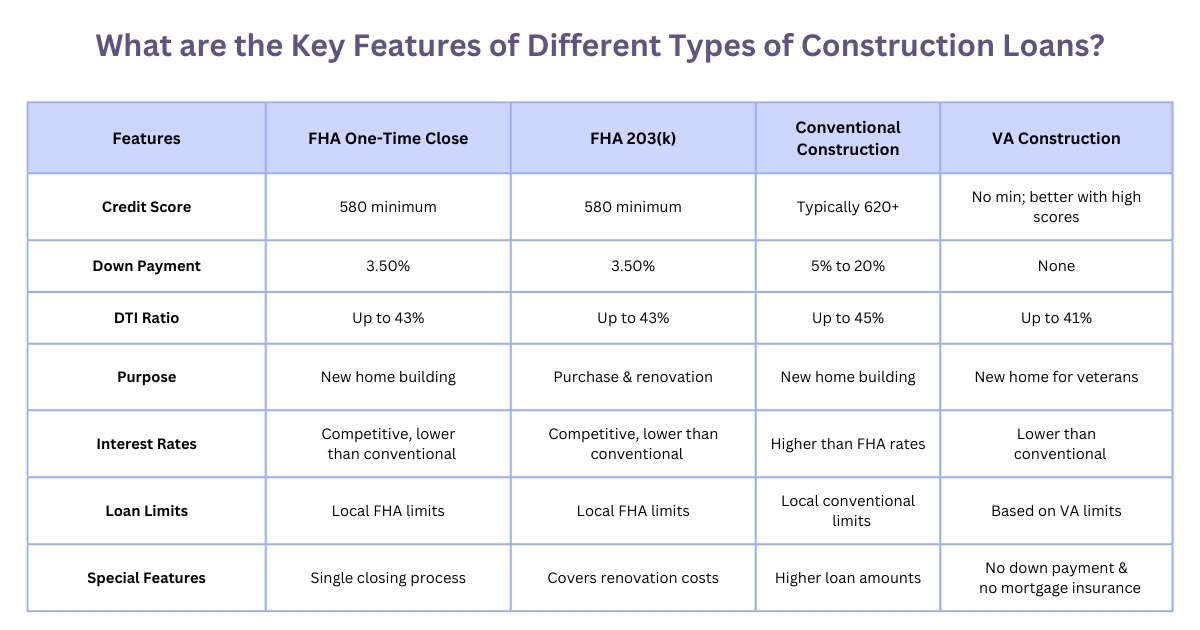

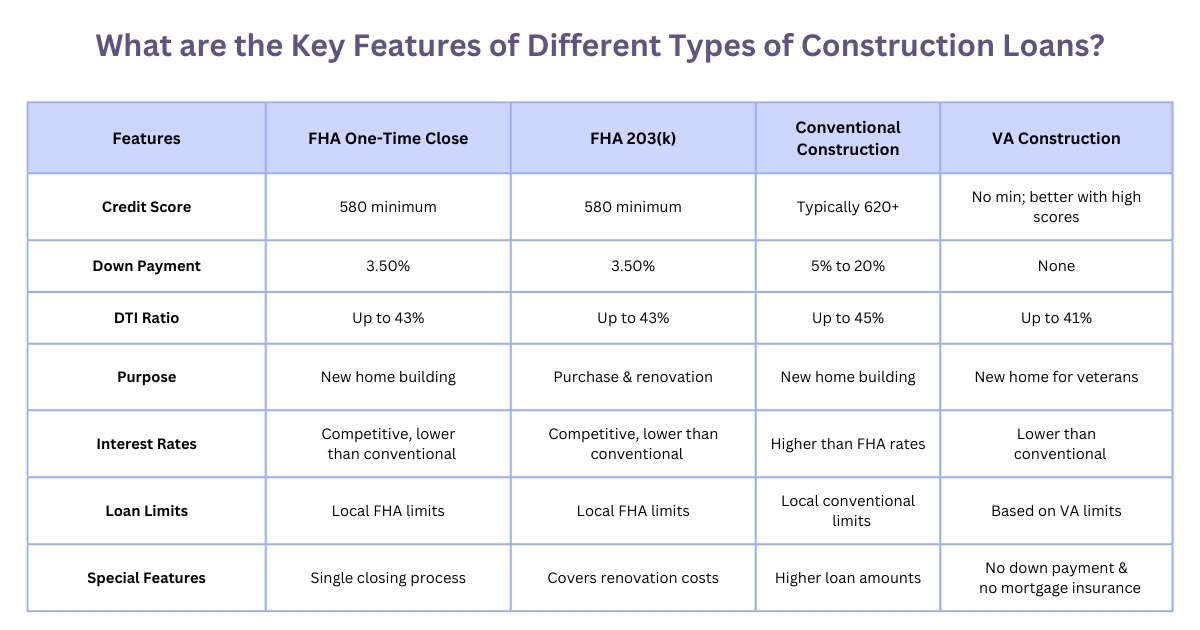

Which Construction Loan Suits Your Needs?

What are the Qualification Criteria for an FHA Construction Loan a Borrower Should Know?

Listed below are eligibility parameters for FHA construction loans with key pointers a borrower can go through before applying for FHA construction loans.

Credit Score and Down Payment Requirements

In order to demonstrate to the lender that the borrower can handle debt, the borrower must have a minimum credit score of 580 and make a down payment of 3.5% of the total cost in order to be eligible for an FHA construction loan. The borrower with a score between 500 and 579 needs to give 10% as a down payment.

Along with minimum credit score requirements, borrowers’ credit history should not include bankruptcies, defaulted loans, foreclosures, etc.

Debt to Income Ratio

The maximum DTI ratio required in FHA construction loan is 43%. The housing ratio, or front-end DTI, is a portion of income spent on housing expenses, and as per FHA guidelines, not more than 31% of gross income should be spent on mortgage payments, property taxes, and homeowner’s insurance.

Lenders can improve the DTI ratio if the borrower has an excellent credit score, substantial savings, and is willing to make higher down payments; then the DTI can go up to 50% depending on the lender.

Primary Residence Requirement

The FHA construction loan primary residence requirements include owner-occupied homes only (FHA construction loans cannot be opted to build investment properties, vacation homes, or second homes).

The borrower also needs to give proof of residency intent to the lender, which can be through a signed occupancy affidavit. This helps the lender get assurance that the borrower will use the home as their primary residence.

FHA Loan Amount Limits

The FHA construction loan limits vary depending on the region and the current real estate value. For example, in a high-cost area, like San Francisco, the loan limit might be 1,089,300, while in a lower-cost region, it might be 472,030. For 2024, FHA loan limits are ranged between $498,257 to $1,149,835. The estimated worth of the finished home, including the price of purchasing the land and building costs, is used to determine the loan amount.

Builder Approval

Borrowers must look for a builder who is FHA approved with a valid license, adequate insurance and must be registered with the FHA, as lenders will conduct a thorough background check on the builder to track the credibility.

The builder or the contractor should offer construction plans, cost estimates, and timelines to the respective lender and the borrower before any distribution of funds for clear transparency

What are the Minimum Property Requirements by HUD for the FHA Construction Loan the Borrower Should Look For?

Let’s check the MPRs (Minimum Property Requirements) by HUD that the borrower should consider for quick loan approval:

- Safety standards should be met, including structural integrity, electrical, fire safety, plumbing systems, natural lighting, and ventilation.

- The construction site should have durable roofing, windows, exterior finishes, etc. There should be proper drainage, and insulation with structural durability.

- Health and safety hazard parameters should be taken into consideration, focusing on environmental hazards like contaminated soil, toxic waste, flood zones, etc.

- The construction must ensure all local laws are met as per the zone and area.

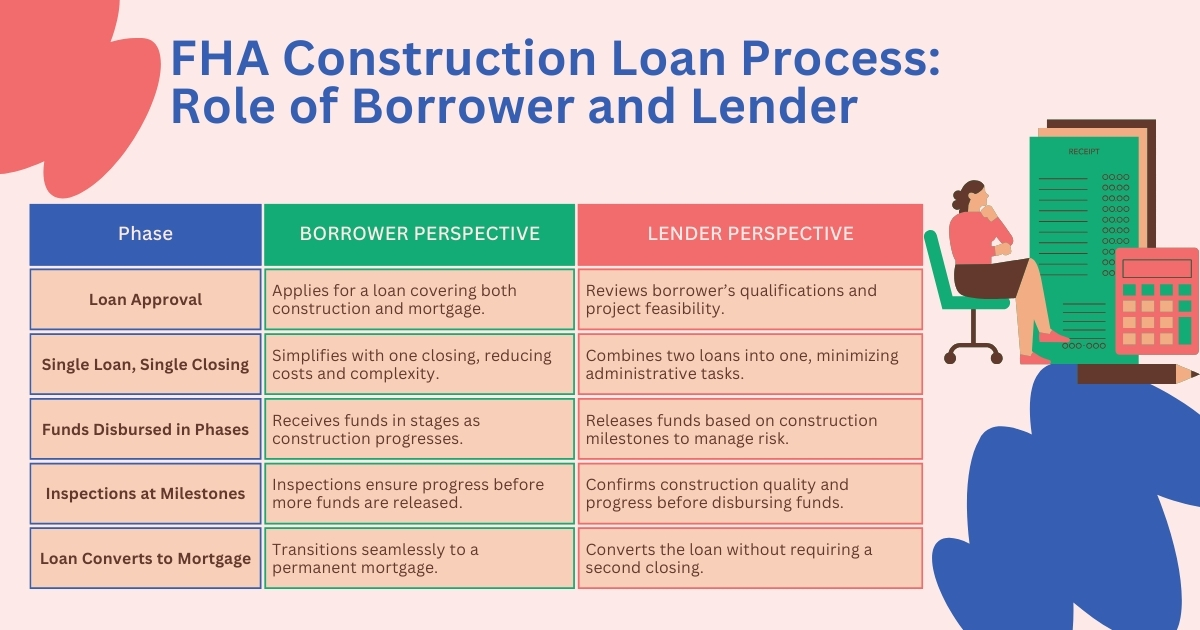

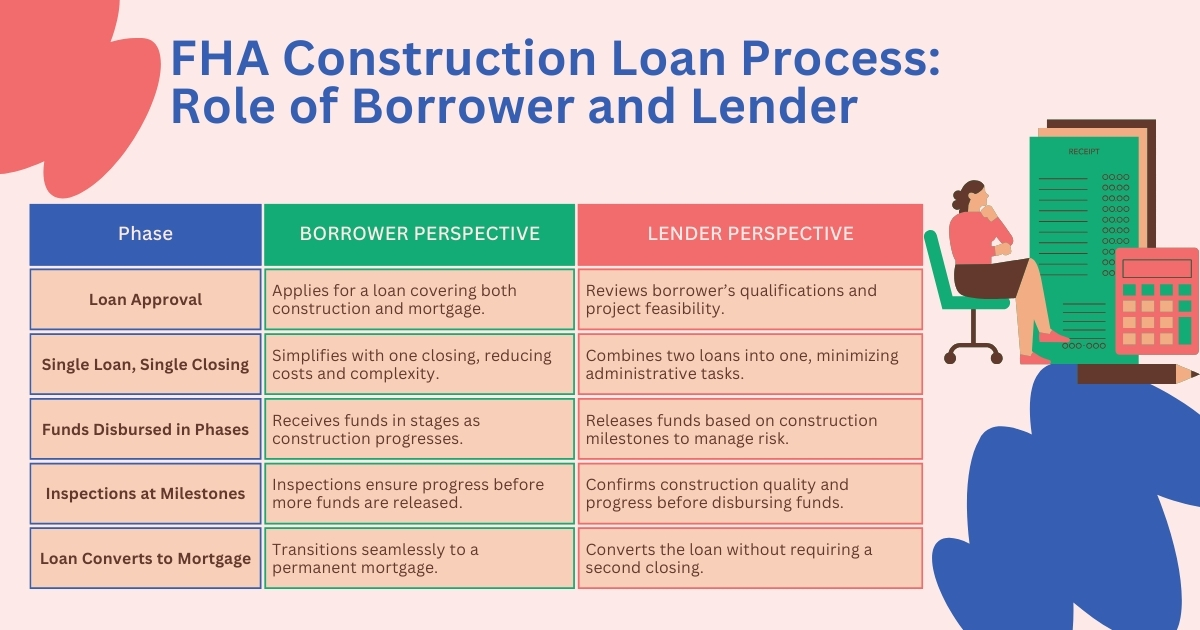

How Does an FHA Construction Loan Process Work for Borrowers and Lenders?

FHA construction loans work in various phases for borrowers and lenders, as given below:

How FHA Construction Loan Process Work for Borrowers and Lenders

Pro Tips for First-Time Home Buyers to Qualify for FHA Construction Loans

- Check the FHA loan limits as per your region so you are aware that you are not looking for properties exceeding the amount that can be borrowed. Borrowers can check through the HUD website or consult lenders.

- Use a gift fund to cover the down payment and closing costs. It is important to show the source of the gift fund to avoid conflict with the lender.

- Borrowers can lock in an interest rate for the entire construction period and the mortgage period under the FHA construction loan, which is an added advantage borrowers are unaware of.

- HUD’s minimum property requirements must be fulfilled to qualify for an FHA construction loan. It is preferable to have a pre-inspection for a better understanding of the area to be worked upon.

Conclusion

Getting an FHA construction loan can be tough with a complex understanding of fluctuating economic dynamics, interest rate trends, market conditions, documentation, etc. To ease the process, Munshi.capital helps borrowers navigate complex challenges and understand the eligibility of FHA construction loans so they can secure the best possible financing options to turn their dream homes into reality.

Read More: FHA vs HUD Loans: Understanding the Key Differences

Frequently Asked Questions

- What types of properties can I finance through FHA construction loan?

FHA construction loans can finance properties like single-family homes, multi-family units (up to four units), and manufactured homes.

- What additional documentation do I need to provide for an FHA construction loan compared to a standard FHA loan?

The FHA construction lender may require additional documents, such as detailed construction plans, builder contracts, building permits, proof of the builder’s qualifications, and more, compared to a standard FHA loan.

- What are the advantages of refinancing an FHA construction loan in California’s real estate market?

Refinancing FHA construction loan in California’s real estate market can help secure lower interest rates, reduce monthly payments, or eliminate mortgage insurance premiums (MIP).

- What should I consider when refinancing an FHA construction loan online?

When considering a refinance FHA loan online, consider offers from various lenders and evaluate fees, closing costs, and whether the refinance will help reduce your mortgage insurance costs. Also, comparing offers from the best online mortgage lenders is essential when refinancing to secure lower rates and save costs.