Amish's guidance throughout the homebuying process was invaluable. His in-depth knowledge of conventional loans combined with his attentiveness to my financial situation made me feel confident and secure. Amish secured a competitive rate that fit my budget perfectly, and his clear communication ensured I understood every step. He was always available to address any concerns I had, no matter how small. Amish's proactive approach kept the closing process on track and stress-free. Thanks to his expertise, I am now celebrating my housewarming! I highly recommend Amish to anyone seeking a mortgage lender who prioritizes their clients' needs. He goes above and beyond to ensure a smooth homebuying experience.

Real estate manager

Tired of the daily commute and dreaming of financial independence? Amish Munshi's 'Explore Passive Income & Diversification' workshop was the kickstart I needed. The workshop provided clear, actionable steps to build wealth beyond my traditional job. Amish's expertise in various investment strategies helped me identify opportunities that fit my risk tolerance and goals. The best part? It all felt manageable and hassle-free. Thanks to Amish, I'm now actively investing and building a brighter financial future. This workshop is a must for anyone seeking control over their time and finances.

Software Engineer

Tired of feeling stuck in the rat race? Amish Munshi opened my eyes to the power of passive income and diversification. Their 'Explore Passive Income & Diversification - Invest Hassle-Free' workshop was a game-changer. Amish's clear and insightful approach made complex financial concepts easy to understand. He provided a wealth of practical strategies that I could implement right away. Now, I'm actively building a passive income stream, giving me peace of mind and the freedom to pursue my passions. If you're looking to break free from the traditional work model, Amish Munshi is the place to start.

Marketing Executive

Mortgage notes are legally binding documents in which a borrower commits to repaying a loan used to purchase real estate. These notes contain essential details, such as the loan amount, interest rate, repayment schedule, and the consequences of default.

A mortgage note serves as the legal foundation for the loan agreement between a borrower and a lender. When a borrower secures a mortgage to buy a home, they sign a mortgage note agreeing to repay the loan per the specified terms. This note is backed by the property itself, meaning that if the borrower fails to make payments, the lender can repossess the property through foreclosure to recover the outstanding debt.

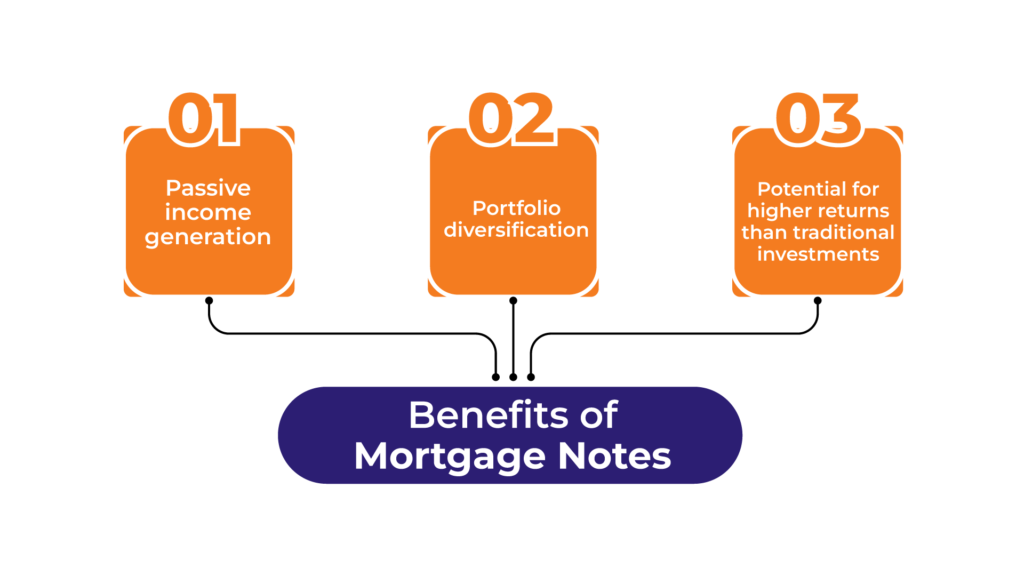

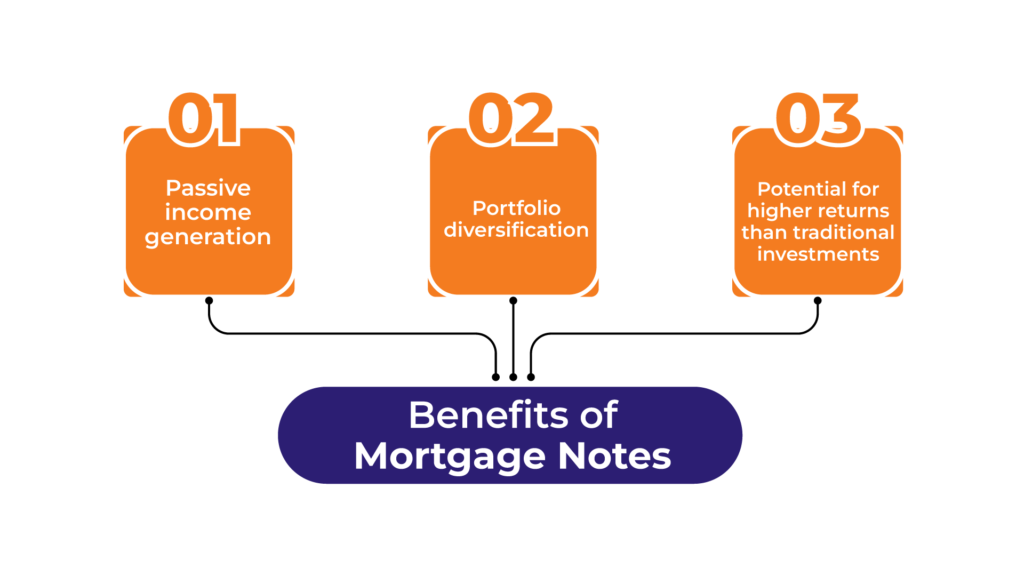

Mortgage notes can be a lucrative addition to your investment strategy, providing several financial benefits. This includes:

Mortgage notes provide a steady source of passive income. As a lender, you receive regular monthly payments from the borrower, which continue until the mortgage is fully repaid or the property is sold. This consistent cash flow is ideal for those looking to supplement their income without active management.

Incorporating mortgage notes into your investment strategy helps diversify your portfolio. By investing in various asset types, including mortgage notes, you spread your risk across different investments. This diversification can protect your portfolio from significant losses if one investment underperforms.

Mortgage notes often offer higher interest rates compared to traditional fixed-income investments like government bonds or CDs. This can lead to higher overall returns, especially with the potential for compounding interest. The returns are primarily influenced by the agreed-upon interest rates and the borrower’s payment reliability.

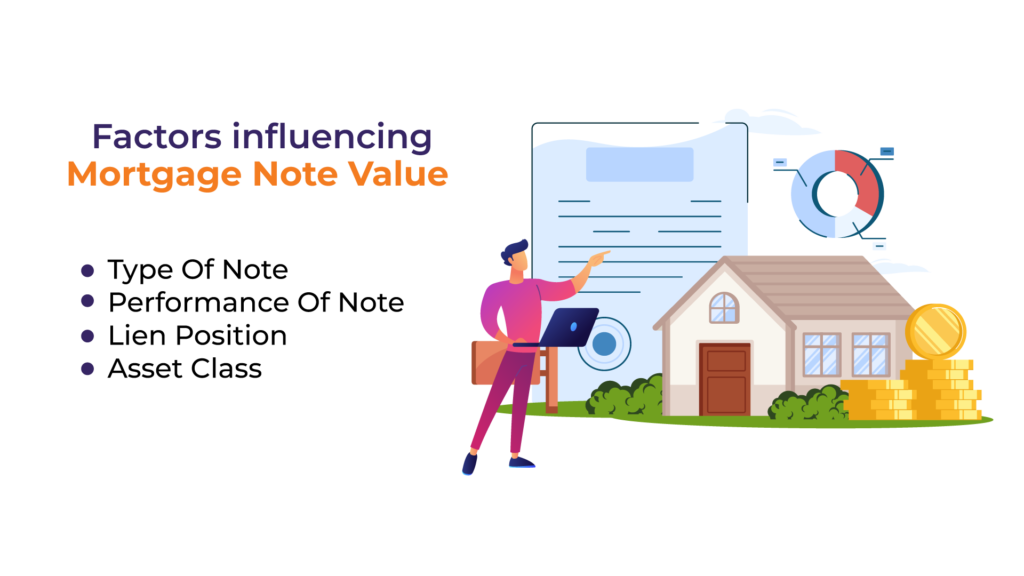

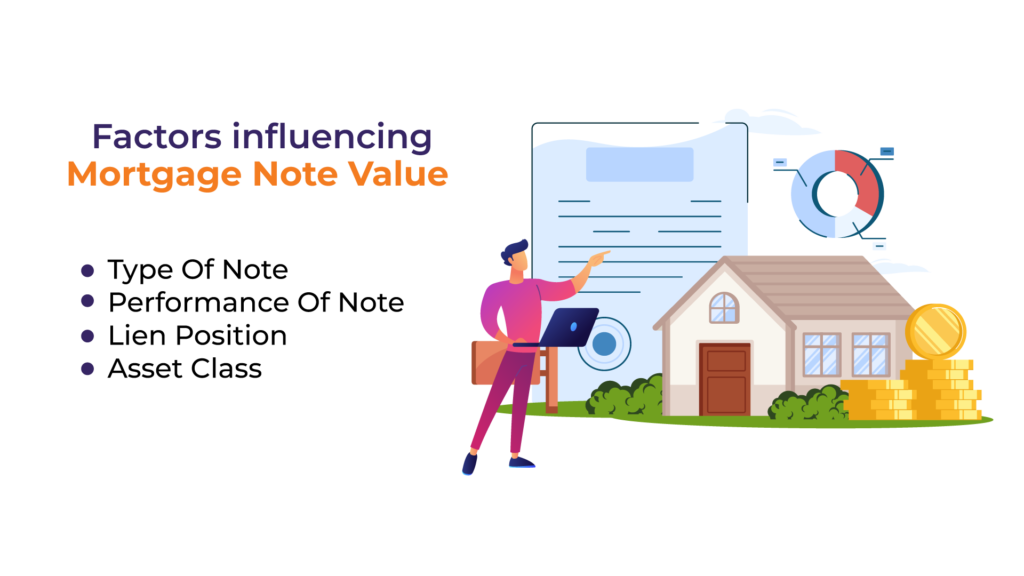

There are several factors that influence the worth of a mortgage note in the market.

Below are some factors that affect its value:

The nature of the mortgage note significantly impacts its value. Fixed-rate notes provide predictable payments, making them attractive during periods of fluctuating interest rates. Conversely, adjustable-rate notes may offer higher returns but come with increased risks due to potential rate hikes.

The borrower’s payment history is crucial in assessing a mortgage note’s value. Consistent, on-time payments enhance the note’s value by indicating a reliable income stream. In contrast, a history of late payments or defaults decreases the note’s value due to the increased risk of non-payment.

The lien position of a mortgage note (whether it is a first or second lien) affects its security and, consequently, its value. First liens are more secure, generally making them more valuable, as they are paid first in the event of a default. Second liens carry more risk since they are subordinate to the first liens.

The value of the note is also affected by the underlying asset, usually the mortgage-secured property. Well-positioned properties and those that are in good condition generally raise a mortgage note’s worth.

On the contrary, if foreclosure becomes necessary, properties situated in less favorable areas or those in bad shape may lower the appeal and value of a note due to potential difficulties when selling such property.

These features are intertwined with wider economic indicators like interest rates and housing market trends which too can have significant bearing on mortgage note values.

For instance, higher rates of interest usually reduce the worthiness of existing notes because new loans at better terms become more attractive. Similarly, stronger housing markets can increase mortgage notes’ value through enhanced property prices.

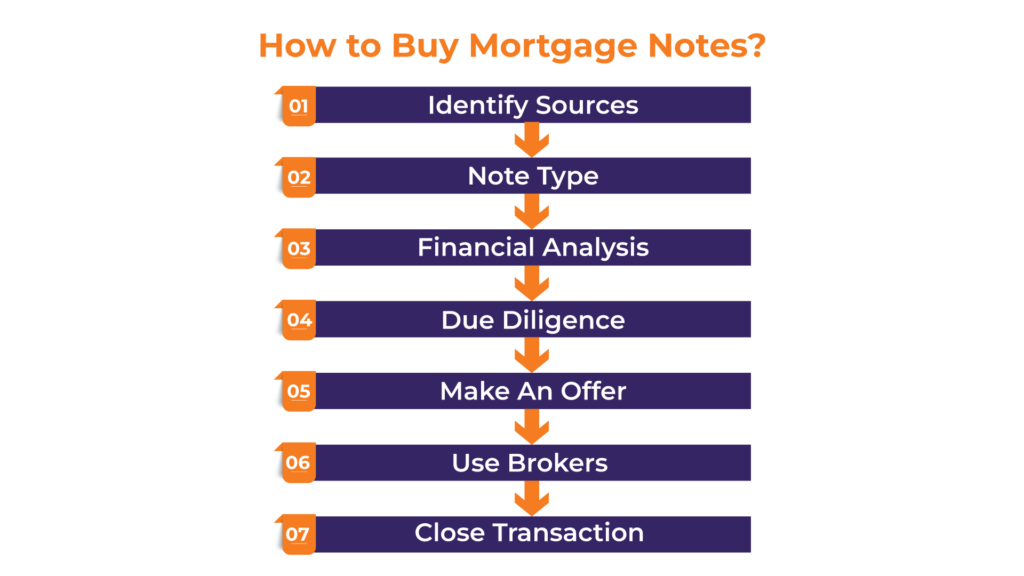

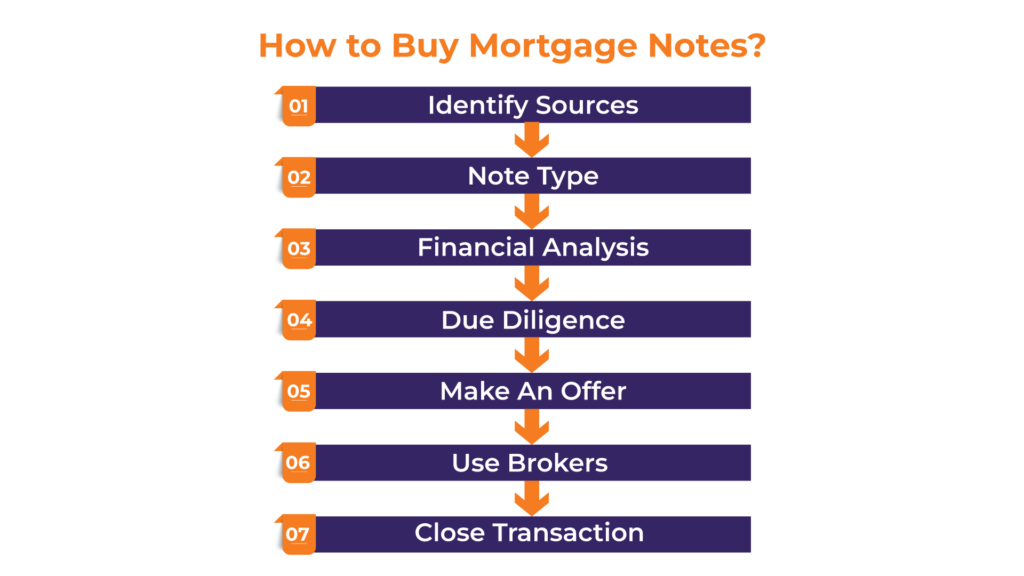

Purchasing mortgage notes is one clever approach to turn real estate assets into passive income.

Here are key steps to guide you through the process:

You can buy mortgage notes through banks, private sellers, online marketplaces, or note brokers who specialize in these transactions.

Investing in mortgage notes can offer passive income, potential for high returns, and diversification away from traditional stock and bond investments.

Performing mortgage notes are loans where the borrower is making timely payments, while non-performing notes are loans where the borrower has stopped making payments.

Assess the value of a mortgage note by examining the borrower’s creditworthiness, the property’s value, the note’s interest rate, and the payment history.

Disclaimer: This information is for educational purposes only and should not be considered financial or tax advice. Always consult with a qualified financial advisor and tax professional before making any investment decisions related to Mortgage Notes.